In the past, you were able to get credit card rewards when you used your credit card to top up your GrabPay wallet.

This allowed you to double-dip on rewards – once from your credit card when you top up your GrabPay wallet, and another when you pay with GrabPay to earn GrabRewards points.

But one day, Visa and Mastercard decided to reclassify Grab top-ups under a different Merchant Category Code (MCC), thereby excluding Grab top-ups from their credit card rewards.

MCC is a 4 digit number that classifies the type of service a business provides and is used by credit card companies to determine whether or not a transaction is eligible for rewards.

Similarly, AMEX excluded Grab top-ups as an eligible transaction for rewards for almost all of their cards.

This basically killed the scene for stacking credit card rewards with Grab top-ups, and you can no longer enjoy double rewards – you have to choose either credit card rewards or GrabRewards points.

But this isn’t all that true.

In this post, I will share with you how you can continue to earn rewards for your GrabPay top-ups and when you should take advantage of them.

PSA: Grab will be revising its GrabRewards program from 22 Mar 2021 – paying with GrabPay will earn up to 6 points (1.2% cashback) / $1 spent. This update has not been reflected in this post to avoid confusion.

1: Top Up With Selected Cards

While the vast majority of cards exclude GrabPay top-ups from their rewards system, there are a few survivors.

AMEX True Cashback Card

You may have noticed earlier that I mentioned AMEX excluded rewards for Grab top-ups for most of its credit cards, but not all.

The AMEX True Cashback card is an exception, and the first card on this list.

If you use this card to top up your GrabPay wallet, you will earn a flat 1.5% cashback on the amount.

This is not a loophole or a limited offer.

Instead, it seems to be a unique selling point of this card where it rewards cashback for transactions that other cards typically wouldn’t earn rewards for, aptly living up to its name of “True Cashback”.

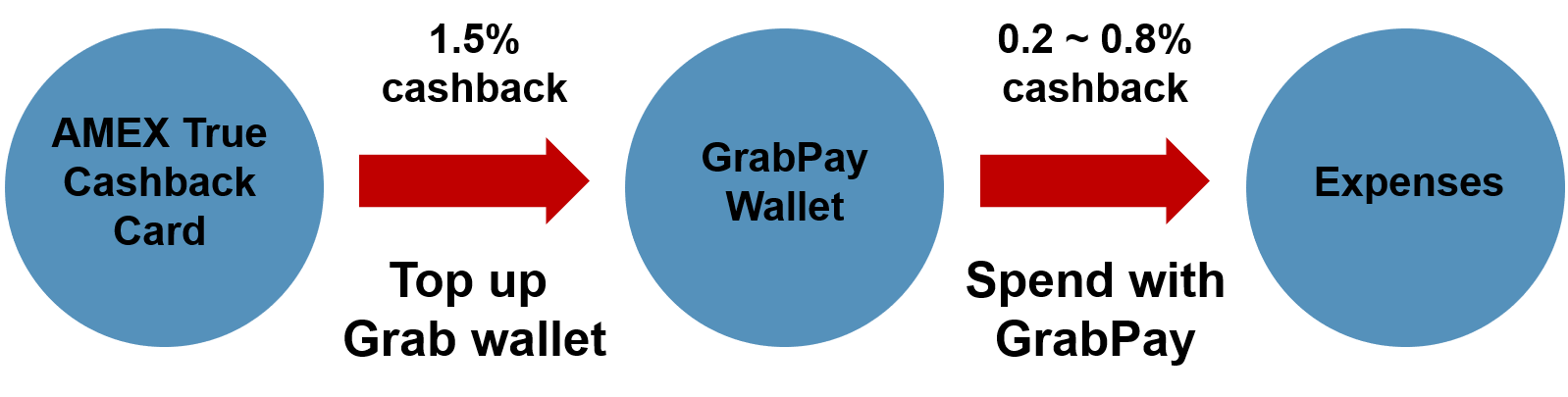

Using this card to top up your GrabPay wallet and then spending with GrabPay will allow you to earn up to 2.3% cashback (1.5% cash + up to 0.8% in GrabRewards points).

Cashback from GrabRewards points are calculated assuming 1) Platinum membership, ie 4 points/$1 spent and 2) $5 vouchers are redeemed using 2500 GrabRewards points.

To illustrate, this is how you should be utilising the AMEX True Cashback card + GrabPay to maximise your rewards.

Standard Chartered Cashback Card

The next card on the list is the Standard Chartered (SC) Cashback card – the debit card accompanying the SC Jumpstart account.

Using this card to top up your GrabPay wallet will earn you 1% cashback, as per any Mastercard transaction made with this card.

This is based on personal experience and reports from other users,so test it out for yourself first.

Using a similar approach to before will allow you to earn up to 1.8% cashback (1% cash + up to 0.8% in GrabRewards points).

Singtel Dash Visa Card

The final card on this list is the Singtel Dash Visa card – the Singtel Dash equivalent of the GrabPay Mastercard.

As ironic as it may be, you can earn Dash Rewards points for GrabPay top-ups using this card.

Similar to GrabRewards, the number of Dash Rewards points earned per $1 spent is dependent on your Dash Rewards membership status.

This translates into an equivalent cashback of up to 0.6%.

Cashback from Dash Rewards points are calculated assuming 1) Platinum membership, ie 3 points/$1 spent and 2) $5 vouchers are redeemed using 2500 Dash Rewards points.

Currently, Dash is running a 2x Dash Rewards points promotion on all transactions – upsizing the cashback earned to up to 1.2%.

Now, here is where things get interesting.

It turns out that the SC Cashback card earns 1% cashback not only on GrabPay wallet top-ups, but also on Singtel Dash wallet top-ups.

Again, this is based on personal experience – so do test it out for yourself first.

This means that it is possible to triple-dip on rewards by:

- using the SC Cashback card to top up Singtel Dash wallet;

- using the Singtel Dash Visa card to top up GrabPay wallet;

- spending with GrabPay

This effectively allows you to earn up to 2.4% cashback, or 3% with the ongoing 2x Dash Rewards points promotion (1% cash+ 0.6%/1.2% Dash Rewards+ 0.8% GrabRewards).

This effectively allows you to earn up to 2.4% cashback, or 3% with the ongoing 2x Dash Rewards points promotion (1% cash+ 0.6%/1.2% Dash Rewards+ 0.8% GrabRewards).

This is a sizable amount of cashback to earn, especially considering the fact that there is no minimum spending requirement and is not limited to a specific category of spending.

However, there is a monthly cap of $999 for card top-ups to the Singtel Dash wallet – so take note if you’re planning for big-ticket expenses.

Also note that triple-dipping via this method is not possible with the AMEX True Cashback card as Singtel Dash currently does not accept AMEX cards for top-ups.

2: Credit Card Promotions

Banks and credit card companies occasionally launch promotions to allow customers to earn credit card rewards on their GrabPay top-ups.

For example, AMEX recently launched a promotion to allow cardholders to earn miles and rewards points on their cards as they top up their GrabPay wallets.

This is the promotion for the AMEX CapitaCard, and other AMEX cards have similar promotions ongoing.

This is a limited promotion that requires customers to register for the promotion through the AMEX app or website.

However, there is a cap on the amount of rewards that can be earned throughout the promotion period, as well as the number of AMEX cards that can be registered for the promotion.

So it’s fastest fingers first.

While such restrictions are not ideal, there’s certainly nothing to complain about when you are given the chance to stack rewards.

When To Use Them

Obviously, you should use these cards to top up your GrabPay wallet whenever you need to use GrabPay – because using any other method will not earn you rewards.

But here are 2 specific use cases for maximising rewards.

1: Unable To Hit Min Spending On Better Cards

Whether you’re a student looking at the DBS Visa debit card for its 3% cashback or a working adult looking at high cashback credit cards like DBS Live Fresh, you may be facing the same problem.

That is, hitting the monthly minimum spending to be eligible for cashback.

If you’re trying to save money, trying to achieve the $500/$600 monthly spending requirements may put you over your budget.

And if that’s the case, these cards are probably not right for you.

This is when you can consider double-dipping or triple-dipping on rewards using GrabPay + the cards mentioned earlier.

None of these cards have minimum spending requirements, so this will be a fuss-free way to earn up to 2.4% cashback on expenses.

If you want to maximise the ways you can use GrabPay and thus earn rewards, you can also get the GrabPay Mastercard.

This will allow you to pay with GrabPay wherever card or Grab QR payments are accepted – which should cover most daily expenses.

Note: GrabPay is not supported by Apple Pay/Google Pay, so you will require the physical card to make offline purchases.

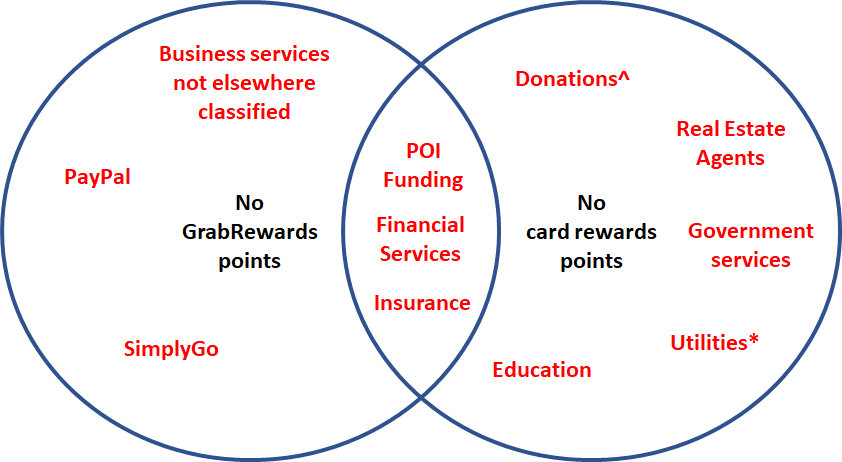

2: Credit Card Reward Exclusions

GrabPay is useful because the range of transactions that you can earn GrabRewards points on is wider than that of a typical credit or debit card.

Payments for things like school fees or medical bills at governement hospitals and facilities are often excluded from card rewards, but you can earn GrabRewards points from them.

See more examples of such scenarios below:

You can also earn rewards on payments that earn neither GrabRewards points nor credit card rewards (ie insurance).

You just need to top up your GrabPay wallet via the AMEX True Cashback card or SC Cashback + Singtel Dash card, so you earn rewards for the top up process but not the payment.

To summarise,

You can still earn rewards on GrabPay top-ups via the folllowing:

- AMEX True Cashback card

- Standard Chartered Cashback card

- Singtel Dash Visa card

- Bank/credit card promotions

The total rewards earned are as follows:

| AMEX True Cashback + GrabPay |

SC Cashback + GrabPay |

Dash Visa + GrabPay |

SC Cashback + Dash Visa + GrabPay |

|

| Total Cashback |

2.3% | 1.8% | 1.6% | 2.4% |

| Total Cashback from 22 Mar |

2.7% | 2.2% | 2% | 2.8% |

If you’re an avid Grab user who constantly needs to top up your GrabPay wallet, you should definitely consider using one of the cards mentioned in this post.

To maximise rewards, get the GrabPay card so you can pay with GrabPay at as many merchants as possible.

If you enjoyed this post, share it with someone who always uses Grab so that they can get the most out of their GrabPay top-ups!

And if you know of more ways to earn rewards for GrabPay top-ups, I’d love to hear it – leave a comment below!

2 replies on “How To Earn Rewards For GrabPay Top-Ups”

Any more reasons to keep this card in 2024?

Hey Nerf,

Thanks for checking out my blog and for leaving a comment!

Given that Grab is planning to cease the services of the GrabPay card later this year, I’m going to say no 🙂