National Service (NS) might not be the favourite aspect of many Singaporeans’ lives, but at least it comes with benefits once in a while… right?

One such benefit is NS credits, and in this post, I’ll tell you how to get them and how to withdraw them with zero fees.

What Are NS Credits?

NS credits are monetary rewards/benefits awarded to Singaporeans for their NS contributions.

NS credits are essentially cash and can be accessed via the LifeSG app.

From there, you can use your NS credits at any merchant that accepts payment via PayNow SGQR.

How To Get NS Credits?

There are several ways to receive NS credits:

- NS55 Credits

- NS Excellence Award

- NS HOME Awards

- NS Celebratory Gifts

Firstly, there was a payout to all NS men and NSFs as a part of the NS55 Recognition Package in 2022.

Next, the NS Excellence Award is awarded to selected high-performing NS men in appreciation for their efforts during their reservists.

This award comes in 2 tiers and is typically awarded to the top 5% and 10% of servicemen in every reservist cycle.

NS credits are also paid out as milestone benefits under the NS HOME Awards scheme at different times during the NS journey, which are notably:

| Milestone | Reached upon |

|---|---|

| 1st milestone | Completion of full-time NS |

| 2nd milestone | Completion of 3 High Key (HK) In-Camp Training (ICT) or Completion of 5 ORNS years of which 2 are HK ICTs, whichever is earlier |

| 3rd milestone | Completion of your ORNS training cycle – when you have fulfilled 10 ORNS years of which 7 are High Key ICTs |

Finally, NS men who solemnise their marriage or enter fatherhood will also receive $100 worth of NS credits.

How To Withdraw NS Credits?

In the past, there were many ways to withdraw the NS credits for free.

Many methods no longer work, and some of the remaining methods still work now but come with a fee.

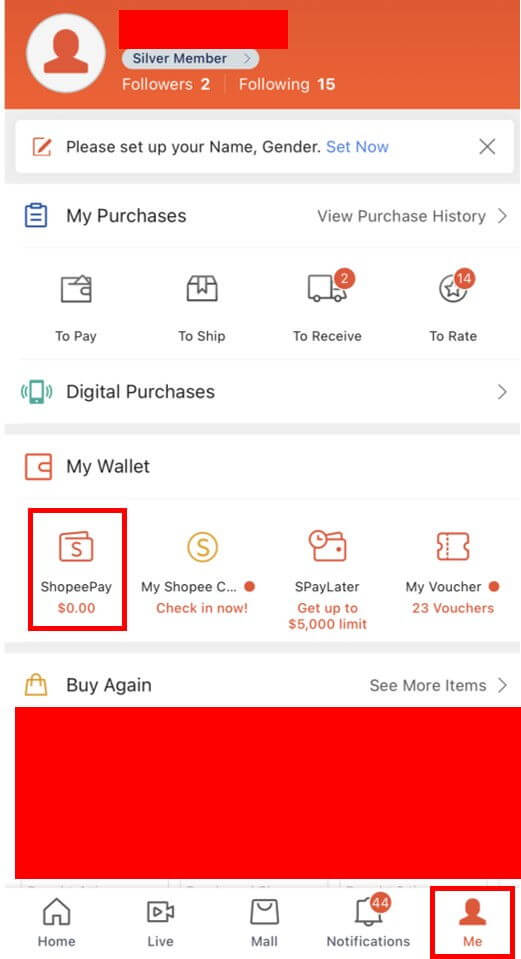

Here’s the easiest way to withdraw your NS credits with no fees – all you need is a Shopee account with ShopeePay activated.

Generally, the idea is to top up your ShopeePay wallet with your NS credits, and then withdraw the money from your ShopeePay wallet to your bank account.

This works because LifeSG recognizes ShopeePay as a valid merchant for utilizing NS credits, and ShopeePay wallet top-ups via PayNow can be withdrawn.

Withdrawals from ShopeePay wallet normally have a $0.20 admin fee, but users are entitled to 1 free withdrawal every week, so this fee can be avoided.

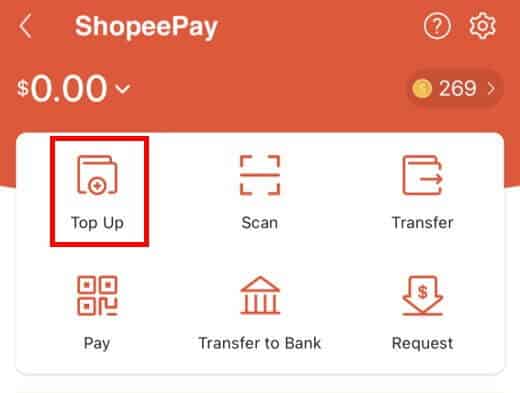

1: Top up ShopeePay Wallet With NS Credits

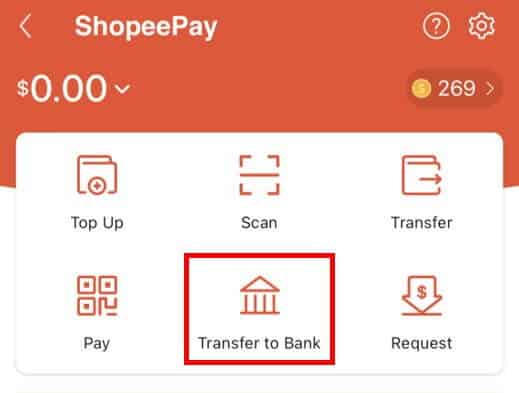

Open the Shopee app and navigate to Me > ShopeePay.

Select “Top Up” and enter the amount you wish to top up.

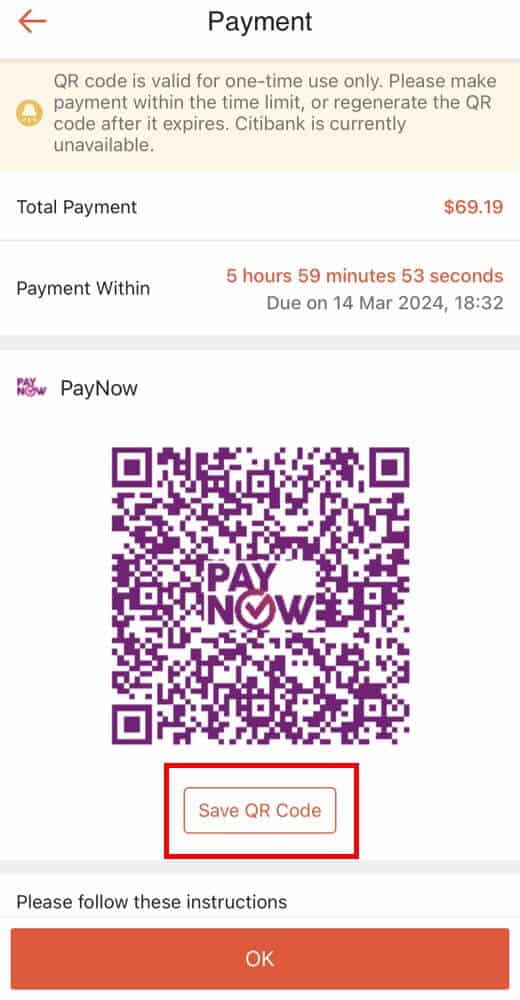

You should then see a PayNow QR code. Save this QR code.

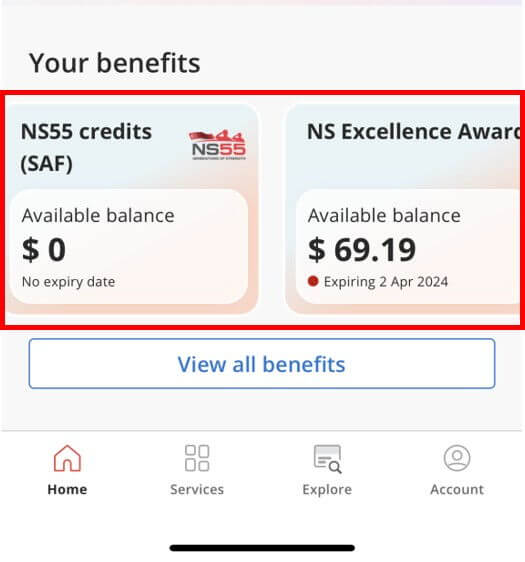

Next, open your LifeSG app, scroll down to “Your benefits” and select the NS credits you wish to use.

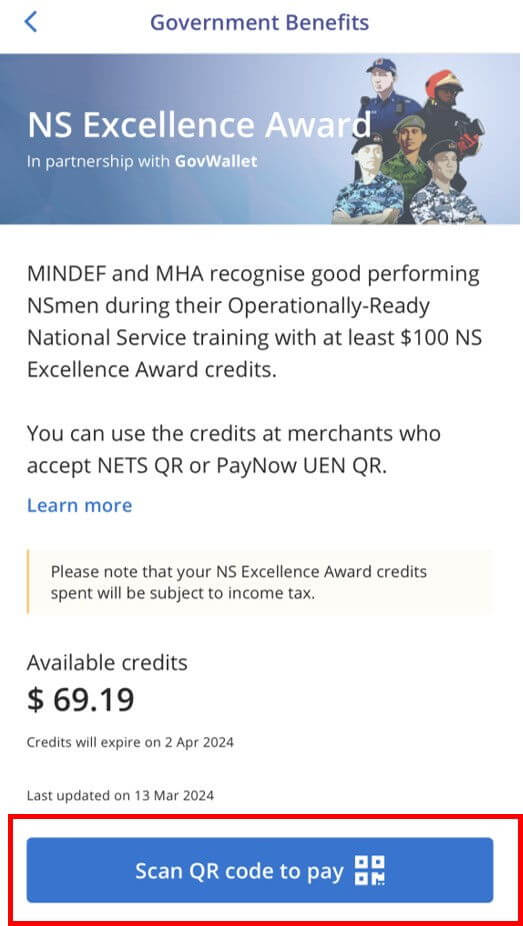

Select “Scan QR code to pay”, upload the PayNow QR code you saved earlier, and confirm the transaction.

Go back to your ShopeePay wallet to confirm that your top-up was successful.

2: Add Bank Account For ShopeePay Withdrawal

From ShopeePay, select “Transfer to Bank“, then “Add New Bank Account“.

Enter your bank account details and click “Next“.

3: Withdraw ShopeePay Balance To Bank Account

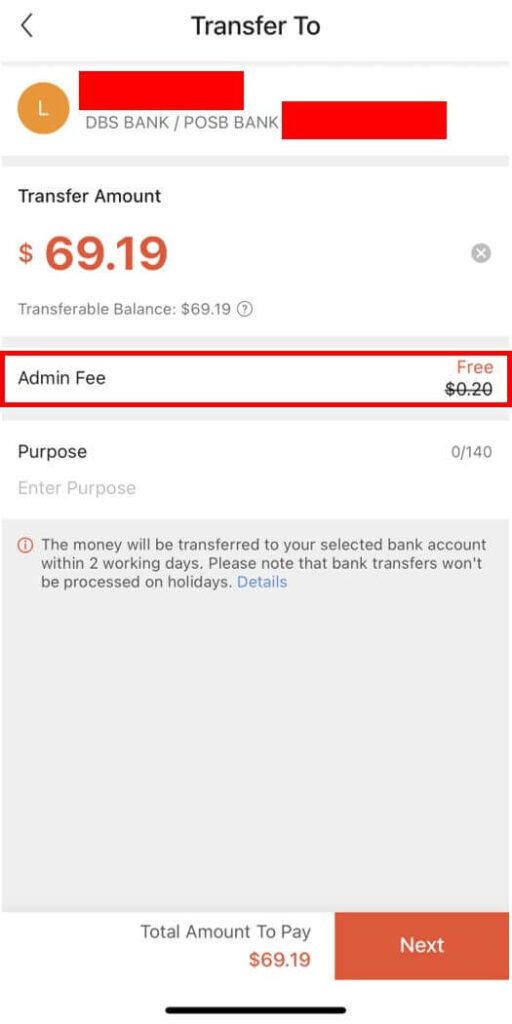

Enter the amount you want to transfer and check that the admin fee of $0.20 is waived.

Click “Next“, review the transaction details, and then click “Transfer Now“.

The withdrawal should be completed and sent to your bank account within 2 working days.

NS Credits – Spend or Withdraw?

Given that NS credits can be used at any merchant that accepts SGQR PayNow, why should we bother finding ways to withdraw it instead?

To be clear, there’s nothing wrong with spending the NS credits directly via PayNow.

However, if we want to optimize the rewards we earn from our expenses, withdrawing the NS credits is more beneficial than spending them via PayNow.

Whenever we make a payment via PayNow, we don’t earn any rewards – the credits are used up immediately without earning any value.

If, instead, we withdraw the NS credits as cash and make payment with an eligible credit card, we can earn miles up to a rate of 4 miles per dollar (mpd) or cashback of up to 18%.

Furthermore, if we set up GIRO payments for our credit card bill from an HSBC Everyday Global Account, we can earn a further 1% cashback on the bill payment.

Finally, since the credit card bill is typically due ~1 month after the transaction is made, it means that the cash we withdrew and didn’t spend via PayNow is earning interest in the bank account for an extra month.

When we put everything together, we can triple-dip on rewards when we spend via credit card instead of PayNow.

But what if you’re an NSF or a student without access to credit cards yet?

Generally, it remains true that withdrawing the NS credits to use as cash is better, though the difference isn’t nearly as huge.

The only better payment method than PayNow that NSFs or students have access to is via debit cards, which generally don’t earn many rewards (~1% cashback).

It’s better than nothing, though it might not be worth the extra steps to some people.