So you want to start investing because you want to build wealth.

And you’ve read my post about the 5 things you need to understand before investing.

If you thought you were ready to start your investing journey, back up for a while – until you’re done with this post.

In this post, I’m going to share with you 3 things that you need to consider before making your first investment, because they will have a large impact on your investment journey and experience.

1: STRATEGY

Before you actually start investing, you need to decide what type of investor you want to be – an active investor or a passive investor.

An active investor is one who actively trades securities and tries to time the market to buy low and sell high in an effort to achieve returns that are higher than the market average.

A passive investor is one who simply buys and holds securities, often owns a portfolio identical to that of the market and seldom worries about prices. They usually end up with the market average return.

Naturally, everyone wants to have the highest returns possible and may consider active investing. The caveat here is that no one knows with certainty which stocks will perform better than the market average.

Even financial experts and fund managers cannot guarantee that they will be able to outperform the market consistently over many years.

I don’t know about you, but I don’t think that I’ll be able to do a better job at stockpicking as compared to the experts at Wall Street and Goldman Sachs. If they can’t do it well, what makes me think I can?

Thus, I made the logical decision to be a passive investor.

In fact, I wouldn’t recommend anyone to be an active investor. It’s like betting against the odds, and that’s not wise – to me.

2: APPROACH

Now that you’ve decided what type of investor you want to be, the next thing to decide is how you’re going to start investing.

There are many different ways to start investing.

While the variety of options are supposed to make it easier to start investing, it undoubtedly gets overwhelming when you’re trying to choose the best option for yourself but you don’t really know what they are in the first place.

Ironically, this may cause you to not invest at all because you don’t understand the different options and don’t want to make a mistake.

Don’t worry, I’ve got you covered.

The first point to consider when deciding how to start investing is your investment strategy from earlier.

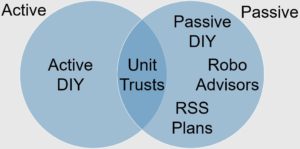

If I were to classify the various investment methods into active or passive investments, it would look something like this:

Next, you can zoom in on the various methods to find out what each of them entail and whether or not they are suitable for you.

The different ways to start investing are listed below, along with a brief description of what they entail.

| DIY DIY stands for Do-It-Yourself. In other words, you decide for yourself exactly what you want in your portfolio. This entails choosing which ETFs, stocks, bonds or commodities to invest in. PROS:

CONS:

Suitable for you if:

|

| Robo Advisors Robo Advisors are like a fully automated fund manager. When you sign up, you have to answer questions regarding your risk appetite, how much you have to invest, your investing goals and etc. Based on this information, a fancy computer algorithm is used to calculate an appropriate risk level for you, wihch comes with a fixed, customised portfolio. If you’re not satisfied with the portfolio, you can choose a different risk level to get a different portfolio. However, you cannot alter the portfolio to your liking. PROS:

CONS:

Suitable for you if:

|

| Regular Shares Savings Plans A Regular Shares Savings (RSS) Plan or Regular Savings Plan (RSP) are basically the same thing. They allow you to invest a specified amount of money every month into a variety of financial products. Different brokerages offer access to different varieties of financial products, charge different fees and have different criteria with regards to the minimum monthly sum to be invested. Some also require an initial lump-sum investment. PROS:

CONS:

Suitable for you if:

|

| Unit Trusts/Mutual Funds In Singapore, Unit Trust (UT) and Mutual Fund refers to the same thing. They pool money from various investors to form a large fund and use it to invest in a wide variety of investment products. This allows investors to own a diversified portfolio which they may otherwise not be able to own due to the amount of capital required. Funds are actively managed by professional fund managers in order to try and obtain returns that exceed the market average return. PROS:

CONS:

Suitable for you if:

|

3: BROKERAGE

The final thing you need to consider is which brokerage you want to invest with.

A brokerage is a financial entity – the middleman that you go through to buy/sell your investments.

This can be an investment firm such as Saxo Capital Markets, or a bank like DBS or UOB.

There are 2 factors to help you decide which brokerage you should use: fees and ownership type.

Fees

In investing, what matters is not how much returns your investments generate. Instead, it is how much returns you get to keep for yourself.

This means minimising the amount of fees you pay.

Investing comes with a lot of fees: trading fees, commission fees, conversion fees, custodian fees, clearing fees, handling fees…

You get the point.

The deceiving thing about fees is that they often appear to be very low (1% or less) and it seems fair.

Then you realise that it’s not inclusive of other applicable fees, and you lose track of how much you end up paying in fees.

It’s probably not a coincidence that banks and investment firms don’t display all the chargable fees in a nice table for you – they want you to pay the fees. After all, that’s how they earn money.

To save you from paying any unknown fees, here is my attempt at compiling various types of fees.

| Fees | Imposed By |

| Clearing Fee | CDP |

| Trading Fee | SGX |

| Commission Fee + Tax | Broker |

| Currency Conversion Fee | Broker |

| Annual / Management Fee | Broker |

| Custodian Fee | Broker |

| Sales Fee | Broker |

| Platform Fee | Broker |

| Expense Ratio | Fund Manager (for ETFs / UTs) |

At first glance, the number of fees that you can be charged with seem ridiculous. Fortunately, you will (hopefully) never be charged with all these fees at once.

Depending on your preferred method of investing, different fees will be applicable.

#frugaltip: Contact the brokerage firm to clarify the applicable fees. Ask for a hypothetical scenario and all the instances in which you may need to pay fees. Note down this info and save a record of the conversation (staff’s name, date, time) so you can raise an issue if there are discrepancies in the future.

There are many, many brokers available out there. To save you the time of going through every single option, I’ve compiled the brokers that offer the lowest fees for you to consider. You’re welcome!

| Broker | DBS Vickers |

Saxo | Interactive Brokers |

Syfe | Kristal.AI |

| Best for |

DIY (SGX securities) | DIY (Global securities) | DIY (Global securities) | Robo, RSP | Robo, RSP |

| Fees

|

Commission fee:

Higher of S$10 / 0.12% (Cash Upfront) Custodian fee: N.A. (CDP owned) |

Commission fee:

Higher of $4 USD / 0.06% Custodian fee: 0.12% p.a. |

Commission fee:

Higher of $1 USD / $0.005 USD per share Custodian fee: $10 USD / month less monthly commission, |

Annual fee:

<S$20k: 0.65% S$20k ~ S$100k: >S$100k: 0.4% |

Annual fee:

<$50k USD: >$50k USD: |

*Info is accurate as of 6 July 2020.

As you can see, all the brokers in the above table charge very low fees (way below 1%).

While the difference in fees between the various brokers are small, with compounding this difference adds up over the years.

How big this difference grows to become ultimately depends on the annual returns and total value of investments.

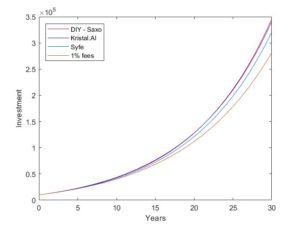

Check out this graph to get an idea of how your investments will grow over a 30 year period compared between investing with Saxo, Kristal.AI, Syfe and some broker that charges 1% in annual fees.

Calculations were done assuming a principal investment amount of $10k, an annual return of 10% and an annual investment of $1k.

While there is only very slight difference between Saxo ($345k) and Kristal.AI ($340k), there is an obvious difference when compared with Syfe ($320k).

This contrast is magnified when compared with a broker charging 1% in fees – which returns only $281k.

This goes to show how much difference fees can make on your investments – even if they appear seemingly low.

It’s also worth noting that Kristal.AI, despite being a Robo Advisor, actually allows you to pick specific ETFs to invest in from their list of available ETFs, allowing you to cuztomise your portfolio to a greater extent compared to other Robo Advisors.

Ownership type: CDP VS Custodian

You can either own investments under your name in your Central Depository (CDP) Account or have a financial entity (e.g. a bank) own them for you by means of a Custodian Account.

A CDP Account is like a bank account. But instead of storing money, it stores investments.

Having investments in your CDP means that you own the shares directly and will have access to any Annual General Meetings (AGMs) or shareholder information that may be disclosed.

Having investments in a Custodian Account, say with UOB, means that the shares are not owned directly under your name. Instead, it is UOB that owns them on behalf of you.

This means that you will not be able to attend AGMs and may not receive any information intended for shareholders only.

This also means that if UOB somehow goes bankrupt, there is a risk that you lose your investments.

Based on this, owning investments in your CDP Account seems like the safer and wiser option.

However, there is a very good reason to use a Custodian Account – to hold foreign investments.

This is because you can only hold securities that are listed on the Singapore Exchange (SGX) in your CDP Account.

If you want to hold more global securities such as US/EU based investments, you have to do it through a Custodian Account from a brokerage of your choice.

To summarise,

- Decide whether you’re going to be a passive or active investor

- Choose your investment approach (DIY/Robo/RSP/UT)

- Choose a broker that suits your approach

| TFS Pick

As mentioned earlier, I am a passive investor because I don’t believe that the time and effort that goes into active investing is worth it – especially since active investing does not guarantee superior results. Personally, I chose to be a DIY investor because I want to minimise the amount of fees I pay in my investing journey in the long-term. Although Kristal.AI charges no fees up to $50k USD of assets, after exceeding that threshold, DIY investing becomes cheaper. While it may take years before my portfolio exceeds that amount, I know that it will eventually, and I’m investing with that long-term goal in mind. I have a DBS Vickers account to hold REITs which are listed on SGX and a Saxo account to hold global equity ETFs. |

Regardless of whether you choose to start with DIY investing, Robo Advisors, RSPs or UTs, what matters most is that you start.

Choose an investment approach that you’re comfortable with and start. Even if you pay slightly higher fees when you first start investing, it’s better than not investing at all.

Investing as early as possible results in more compounding of your investments, which means more money in the future.

Now you’re finally ready to start your investing journey.

You will need to open the relevant accounts, fund the accounts and proceed to make your very first investment.

I’ll have a step-by-step guide on how to do this in an upcoming post, so stay tuned!