Disclaimer: This is not a sponsored post, but this post contains affiliate links. If you signup for a product through one of these links, I’ll earn some commission to help sustain this blog at no cost to you. For more information, read our affiliate disclosure.

Credit cards open up a whole new world of rewards as compared to debit cards.

If you know how to take advantage of them, credit cards can be a great financial asset that helps you save money.

But if you’re new to credit cards and don’t know much about credit card rewards and how they work, it can seem like a daunting challenge trying to understand them.

In this post, I’ll explain the basics of credit card rewards so you can start taking advantage of them.

Types Of Rewards

There are 3 different types of rewards you can earn with credit cards – miles, reward points, and cashback.

Miles

Miles refers to air miles and can be thought of as travel reward points.

The miles you earn can be redeemed for a plethora of things, but the most common usage of miles is redeeming flights.

With miles, it’s possible to redeem flights and only have to pay for the taxes and fees involved in the booking.

This includes tickets for all flight classes – Economy, Premium Economy, Business, and First/Suite.

Reward Points

Similar to miles, points can also be redeemed for a wide variety of rewards.

One of the most common rewards are vouchers – mall vouchers (ie CapitaMall), dining vouchers, shopping vouchers, etc.

Points can also be redeemed for miles or cash rebates off your credit card statement.

Cashback

The final and most straightforward reward you can earn with credit cards is cashback.

Depending on the card you use, you will earn a % of cashback on your eligible expenses.

This cashback is usually automatically used to offset your credit card statement, which makes cashback the most immediate and convenient type of reward you can earn.

Types Of Cards

There are different types of credit cards to earn each type of reward.

In general, there are 5 types of credit cards:

- General Miles Cards

- Specialised Miles/Rewards Cards

- General Rewards Cards

- Unlimited Cashback Cards

- High Cashback Cards

Let’s take a closer look at each of these types of cards.

1: General Miles Cards

These are cards that allow you to earn miles on your expenses without needing to fulfill specific criteria.

The earn rate is typically 1.2~1.4 miles per dollar (mpd) with no monthly minimum spending requirement and no cap on the number of miles you can earn.

There is usually a preferential earn rate on expenses with selected travel/hotel merchants to allow you to earn more miles when you pay for holidays with these cards.

These cards also tend to come with free lounge access in a variety of airports every year to elevate your travel experience.

These cards are a great fuss-free way to earn miles for your expenses, especially if your expenses exceed $1k/month (more on this later).

Some examples of general miles cards include Citi PremierMiles, UOB PRIVI Miles, and DBS Altitude.

2: Specialised Miles/Rewards Cards

Strictly speaking, these are rewards cards that earn reward points.

However, as mentioned earlier, it is possible for reward points to be redeemed in exchange for miles. So this creates some form of overlap between miles cards and rewards cards.

These cards are commonly used as specialised miles cards because as long as your expenses on these cards meet certain criteria, you will earn reward points at an accelerated rate.

This, in turn, can allow you to convert reward points into miles at an accelerated rate – better than the rate you would get with a general miles card.

Such criteria may include contactless payments or specific categories of expenses like shopping and online spending.

For meeting these criteria, instead of earning 1 point/dollar, some cards will reward you with up to 10 points/dollar.

In general, the conversion rate for reward points to miles is 1 point = 0.4 miles. So these cards allow you to earn up to 4 mpd, which is significantly higher than 1.2 mpd with a general miles card.

It’s not hard to see why many people would choose to use these cards to earn miles instead of a general miles card.

Although, since these cards earn points and not miles, they can also be used with the intention of redeeming vouchers.

Another good thing about these cards is that there is usually no monthly minimum spending requirement.

However, the caveat is that there is a cap on the number of bonus points you can earn with these cards.

This cap is usually at a spending of $1k/month, after which you will only earn points at the regular rate of 1 point/dollar. This is why general miles cards are better if you’re spending >$1k/month.

These cards are a great way to rack up miles and points quickly for expenses below $1k/month and if you are able to meet the bonus points criteria.

Some examples of such cards include HSBC Revolution, Citi Rewards, and OCBC Titanium.

3: General Rewards Cards

These are cards that also earn reward points, but at a lower rate than specialised rewards cards.

Even though these cards also have ways to boost their points earning rate, the boosted rates aren’t as high.

The good thing about these cards is that there is also no monthly minimum spending requirement.

In general, I think these cards are severely inferior as compared to specialised rewards cards, and I don’t see much reason to use them.

Examples of such cards include DBS Black.

4: Unlimited Cashback Cards

As its name suggests, these are cards that allow you to earn unlimited amounts of cashback on your expenses, ie there is no cap.

There is also no monthly minimum spending requirement or specific criteria to meet to earn cashback for these cards.

The downside to these cards is that the cashback rate is generally low – ranging from 1.5% to 1.7%.

These cards are a great way to collect cashback if your monthly spending is low or if you have big-ticket expenses.

Examples of these cards include UOB Absolute, Citi Cashback+, and AMEX True Cashback.

5: High Cashback Cards

These are cards that also award cashback on your expenses, but at significantly higher rates than unlimited cashback cards – usually upwards of 5%.

Naturally, these cards come with more restrictions and requirements.

These cards have monthly minimum spending requirements, only award cashback on specific categories of spending, and impose a cap on the amount of cashback you can earn.

These cards are a good way to earn high cashback rates if you’re able to fulfil the requirements.

Some examples of high cashback cards include DBS Live Fresh, UOB EVOL, and Citi Cashback.

Spending Exclusions

Credit cards can be used to pay for just about anything these days, but don’t be mistaken – just because you can pay with a credit card doesn’t mean that you’ll earn rewards for it.

In fact, there’s a whole list of different types of transactions that typically will not earn rewards across all credit cards.

This includes things like payments for financial services, mobile wallet/account top-ups, education expenses, and fine/tax payments, just to name a few.

These spending exclusions will be stated in the terms and conditions of the credit card, so it’s best to familiarise yourself with them for the credit cards that you own.

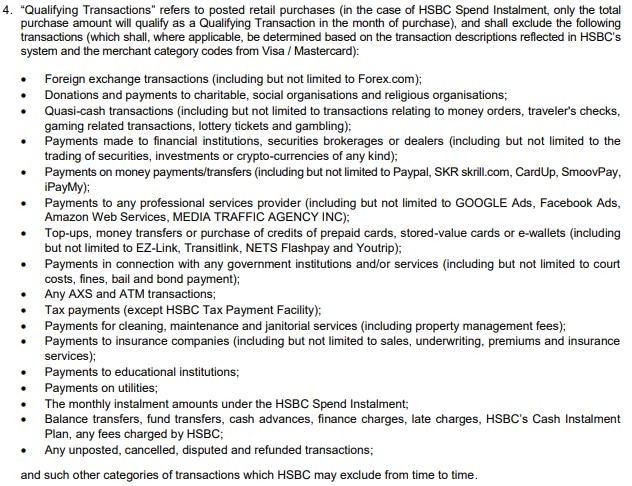

For example, here are the spending exclusions for the HSBC Revolution card.

Tip: If you don’t like spending exclusions, the AMEX True Cashback and UOB Absolute cards have very few spending exclusions – they offer cashback on almost all transactions!

Ambiguous Categories

Aside from these spending exclusions, you should be pretty set to earn those credit card rewards right?

Well, not quite.

There is another problem in the world of credit card rewards, which is the ambiguity of the categories for certain transactions.

For example, say your credit card awards cashback for dining expenses.

Naturally, you’d expect that wherever you are, as long as you’re paying for food, it counts as ‘dining expenses’.

But what if you’re dining in a restaurant at a hotel? Does it count as dining or hospitality?

Or, if you’re dining in a bar? Does that count as a restaurant or a bar? (Note: They are considered different types of businesses.)

This ambiguity makes it hard to know for sure whether or not a transaction qualifies for the rewards that you’d expect it to.

Merchant Category Codes

So, how do you know which transactions will qualify to earn rewards, and at the rate that was stated?

This is where merchant category codes (MCCs) come into the picture.

An MCC is a code that dictates the type of service that a business operates as.

The list of MCCs that are generally eligible to earn rewards from a credit card can be found in the card’s terms and conditions.

Using HSBC Revolution as an example again, here is the list.

But this will only help you if you’re able to predetermine the MCC of a store – then you’ll be able to check it against the list of eligible MCCs to find out if you’ll earn the due rewards.

Thankfully, there is a way to do this.

WhatCard

WhatCard is a website that has crowd-sourced information on MCCs of various merchants so that you can find out, well, what card to use for each merchant.

The site also tells you which are the best cashback/miles cards to use at each of those merchants, which makes it even more convenient.

But do note that since it is a crowd-sourced website, not all information is necessarily updated and/or accurate, so it wouldn’t hurt to do your own due diligence as well.

For example, they have yet to update the points calculation for the revamped HSBC Revolution card, so it appears to be a less useful card than it actually is.

Signup Rewards

Finally, when it comes to credit cards, you should also take advantage of signup rewards.

Banks and financial partners (eg SingSaver) may offer exclusive promotions where customers can receive rewards for signing up for a credit card, provided that they fulfil some other criteria.

Such criteria may include being new-to-bank customers, spending $X amount on the card within Y number of days, being the first Z customers to sign up for the card, and so on.

The specific criteria and steps to receive the rewards vary between promotions, so it’s best to check all the terms & conditions carefully to ensure that you will be eligible for these rewards.

The rewards have been pretty attractive as of late, including Apple iPads, Apple AirPods Pro, Nintendo Switch Lites, and cash of up to $350, depending on the card you apply for.

So if you’re planning to apply for a credit card soon, be sure to look out for these promotions!

To summarise,

Credit cards offer 3 types of rewards – miles, points, and cashback.

Depending on the type of reward you want to earn, you will need to use different types of credit cards, each with different reward criteria and restrictions.

Familiarising yourself with the spending exclusions and eligible MCCs for earning rewards with your card will help to maximise the rewards you stand to earn.

Finally, taking advantage of credit card signup rewards can allow you to squeeze even more rewards out of your credit card, as long as you can fulfil the criteria.

What credit card reward do you prefer collecting and why? Which credit card do you use for this? Let me know in the comments below!