You’ve probably heard of treasury bills (T-bills).

Recently, people have been raving over them as a great place to park your savings due to the high interest rates they offer at little to no risk.

But if you haven’t paid much attention to T-bills outside of your economics lectures, this might be a foreign topic to you.

Today, I’ve written a beginner-friendly guide about T-bills to explain what you need to know and how to buy them.

What Are Treasury Bills?

Treasury bills are short-term government bonds that are fully backed by the Singapore Government.

In other words, you can think of T-bills as loans that you can make to the Singapore Government which will generate returns in the form of interest.

Usually, T-bills are issued with a tenor period of either 6 months or 1 year.

Are Treasury Bills Safe?

The Singapore Government has been accorded a credit rating of “AAA” by several international credit rating agencies – the highest rating that can be attained.

This means that the Singapore Government is an extremely reliable institution in that it has strong creditworthiness and a minimal probability of defaulting on payments.

For investors, this is good news because it means that any money you lend to them is most likely to be safe.

It is for this reason that Singapore Government Securities (SGS) like T-bills, Singapore Savings Bonds (SSBs), and SGS Bonds are commonly thought of as safe investments that are almost risk-free.

Of course, it doesn’t mean that there is absolutely no risk.

There is still a chance that the Singapore Government may default on payments, however low that chance might be.

Nevertheless, the likelihood of that happening is low enough that if it were to ever happen, we’d probably have bigger things to worry about.

How Do Treasury Bills Generate Returns?

The way that bonds generate returns differs from equities.

Unlike equities, where returns are not guaranteed and fluctuate according to market movements, bonds generate fixed returns based on interest rates.

In the case of T-bills, returns are earned by buying T-bills at a discounted price based on its interest rate, and having the full sum of money returned to you upon maturity.

For example, the BS23100Z 6-month T-bill that was auctioned on 5 Jan 2023 has a yield of 4.2%.

I successfully invested S$5,000 into this issue of T-bills, but I only paid S$4895.30.

When this issue of T-bills matures on 11 Jul 2023, I will receive the full sum of S$5,000 that I initially invested, meaning that I will earn the difference of S$104.70 as interest.

But the tricky thing about T-bills is that interest rates for each issue of T-bills are not known beforehand.

They are only determined after you decide whether you want to invest in it or not through an auction process.

Treasury Bills Auction Process

Before T-bills are issued, there will be an auction process to allow institutional and retail investors to decide whether they want to invest in this issue of T-bills and how much to invest.

After the auction closes, the interest rate for this issue of T-bills will be computed, and T-bills will be allotted to successful investors.

It’s not guaranteed that you will receive an allotment of T-bills because there is a total amount that can be allotted to all investors for each auction.

If the total amount applied by investors exceeds the total amount available for allotment, naturally, some investors will experience partial or no allotment.

So, how is allotment determined?

Non-Competitive Bids VS Competitive Bids

If you try to invest in T-bills during the auction process, you will be asked if you want to submit a non-competitive bid or a competitive bid.

A non-competitive bid means that you want to buy this issue of T-bills regardless of the final interest rate that is yielded – you only need to decide how much you want to buy, in multiples of S$1,000.

A competitive bid means that you only want to buy this issue of T-bills if the final interest rate meets a minimum value specified by you.

In this case, you will need to decide what this cut-off value is and how much you want to buy, again in multiples of S$1,000.

During the allotment process, non-competitive bids are allotted first, and up to 40% of the total amount available for allotment will be allotted.

The balance will then be allotted to competitive bids, starting from the lowest bid to the highest bid.

However, competitive bids will only be allotted if your specified yield is equal to or lower than the actual yield of the T-bills.

For example, if the actual yield is 4.2%, you will only be allotted if you bid for a yield that is 4.2% or lower. A bid of 4.3% will not be allotted.

Since allotment for competitive bids starts from the lowest bid, it’s possible to receive only partial allotment even if your competitive bid is successful.

The amount that you are actually allotted will depend on the number of bids that were lower than yours.

You are allowed to submit multiple bids of each type during a single auction period.

That is to say, you’re free to submit a mixture of non-competitive and competitive bids, and you can even submit competitive bids with different cut-off yields.

During allotment, each bid will be evaluated individually, so it’s possible for multiple bids to be successful (or unsuccessful).

Auction Timeline

To bid for T-bills during an auction, you need to be familiar with the timeline of a typical auction.

There are 4 key dates you need to be aware of when auctioning for T-bills.

- Announcement date – this is when you can start submitting bids for the ongoing auction

- Auction date – this is when the actual auction happens, ie the cut-off date for bids for this round of T-bills

- Issue date – this is when T-bills will be issued into your account and is the start of the tenor period

- Maturity date – this is when the T-bill will mature and your money will be returned to you

In order to invest in T-bills, you need to submit a bid for an ongoing auction between its announcement date and its auction date.

However, the cut-off time to submit bids is usually the night before the auction date – so it’s safer to submit a bid sooner rather than later if you intend to do so.

The auction results will be released on the auction date, upon which you will find out if your bid was successful or not.

If it was successful, you should receive the T-bills in your investment account on the issue date, and you will receive your returns on the maturity date.

Step-by-step Guide To Buying Treasury Bills

Step 0: Open CDP And Bank Accounts

Before you can make your first investment in T-bills, you’ll need to have the following accounts opened:

- Central Depository (CDP) account

- DBS/OCBC/UOB bank account (for cash investments)

- Supplementary Retirement Scheme (SRS) account (for SRS investments)

- DBS/OCBC/UOB Central Provident Fund (CPF) investment account (for CPF Ordinary Account investments)

A CDP account is a holding account where you can keep your Singapore-based investments.

It can hold equities that are traded on the Singapore Exchange (SGX) as well as SGS products like T-bills.

You can open an account via the SGX website using MyInfo to easily retrieve your personal details.

You’ll be asked to provide your banking details for something called “Direct Crediting Service”.

Here, you should choose the bank account that you wish to use as the main source of funds for your SGX and SGS investments.

For example, if you want to use your DBS Multiplier account, you should select “DBS Bank” and enter your account number accordingly.

After you have signed up, you’ll need to wait for your account to be approved.

This normally takes up to 10 working days but may be slower depending on the volume of applications.

If your account is successfully opened, you’ll be notified via mail and/or email.

I’m going to assume that you already have a DBS/OCBC/UOB account opened, so I won’t go into details here.

You can simply apply to open an SRS and CPF investment account with DBS/OCBC/UOB if you wish to make SRS or CPF investments.

Now that your CDP account is opened, you’re ready to buy some T-bills!

Step 1: Search For Auctions

You can only buy new T-bills whenever there is an ongoing auction.

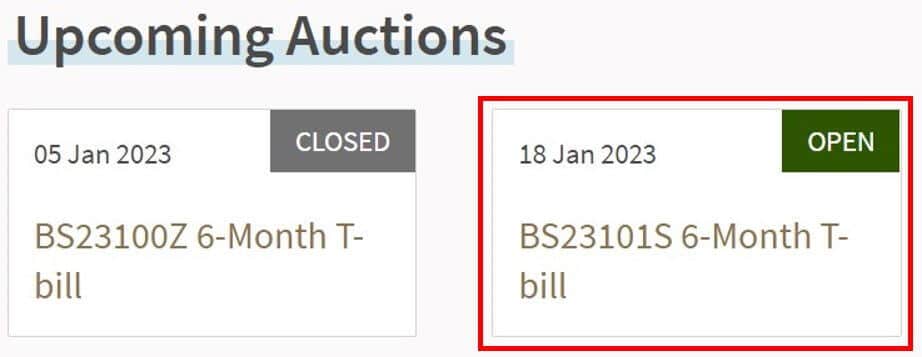

To check this, visit the MAS website and scroll down to “Upcoming Auctions”.

If there is an ongoing auction, it will be indicated as “Open”.

In this case, there is an ongoing auction for the BS23101S 6-month T-bill.

Don’t worry about the name BS23101S – it simply acts like a ticker symbol for stocks and ETFs to identify the T-bill.

You can also check the issuance schedule for future T-bill auctions later in the year.

Step 2: Submit A Bid Via Your CDP-Linked Bank

Since there is an ongoing auction, you can go ahead and submit a bid for the T-bill.

You can choose to buy T-bills using:

- Cash,

- SRS account, or

- CPF OA / Special Account (SA)

For CPF investments, you will only be allowed to invest the balance above S$20,000 for OA and S$40,000 for SA.

Remember that you’re allowed to submit multiple bids if you wish.

Each of these payment methods has a different application process.

I will be showing the steps using DBS as an example.

Note: the cut-off time to submit bids is usually 1 night before the auction date, so make sure to submit your bid in time!

Cash

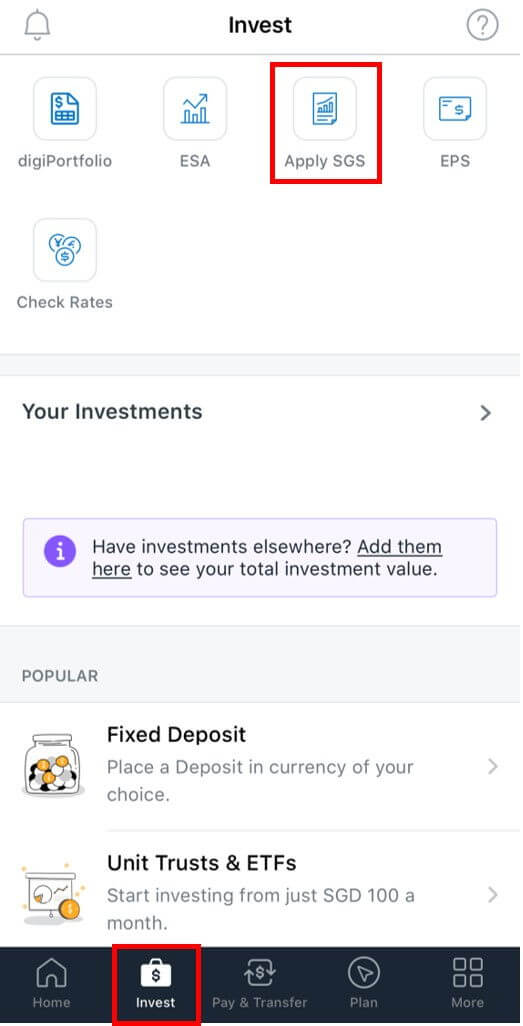

Log in to the internet banking portal or mobile app.

Navigate to the “Invest” tab, then select “Apply SGS”.

Select “Treasury Bill” and choose the T-bill issuance code you want to apply for.

Select your nationality and enter your CDP account number – make sure you enter this correctly!

Select the bank account you wish to make payment from – this should be the same account that you entered under the direct crediting service when applying for the CDP account.

Enter the amount you wish to bid for (in S$1,000s only) and indicate whether you wish to make a competitive or non-competitive bid.

Click “Next”, review the payment details, and then click “Confirm”.

SRS

The steps to bid for T-bills via SRS are almost the same as with cash, but for DBS, you’ll need to log in to the internet banking portal – it’s currently not possible on the mobile app.

The only difference here is that on the screen where you’re asked to provide your personal details and CDP account number, you’ll also see an option to select your payment mode.

Select “SRS” and continue with the process as per the steps for cash applications.

CPF

It’s more troublesome to submit a bid using CPF monies.

You’ll need to personally head down to a branch of the bank that your CPF investment account is opened under.

I haven’t done this myself, so I’m afraid I can’t share any insights or tips regarding this process.

Congratulations! You have successfully submitted your bid for this round of T-bills.

Step 3: Wait For Auction Results

After bidding, there’s nothing else to do besides waiting for the results.

The auction results will be released on the auction date, usually in the late afternoon or evening.

In particular, you’ll be interested in finding out the yield (interest rate) and your allotment rate.

You can check the results of the auction on the MAS website, and you can see the implications this has on your bid when you log in to your internet banking portal.

If your bid is fully allotted, you should receive the equivalent interest earned based on the yield.

If your bid is partially allotted, you should receive a full refund of the amount that was not allotted and the equivalent interest earned on your successful allotment.

If your bid is not allotted, you will receive a full refund of your bid.

Step 4: Verify T-Bill Issuance

If your bid was successfully allotted, the T-bills will be issued to your CDP account (for cash investments) on the issue date.

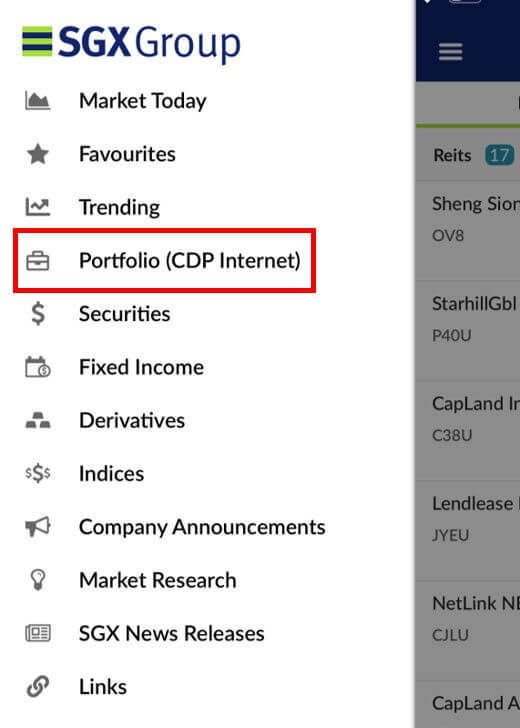

You can verify this by logging into your CDP account 1 working day after the issue date.

To access your CDP account, log in via the SGX website or open the SGX mobile app and navigate to “Portfolio (CDP Internet)”.

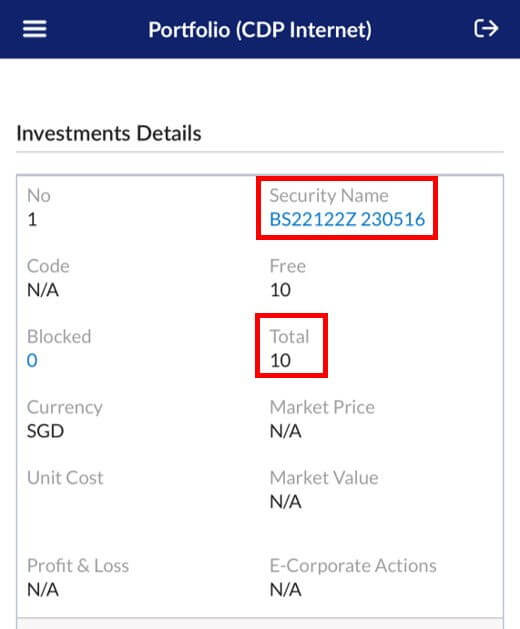

Under “Investments Details”, you will see your successfully allotted T-bills.

Note that each unit holds a value of S$100, so if you have 10 units available, it means you have S$1,000 worth of T-bills.

For SRS and CPF OA investments, this should be reflected in the account statements sent by your issuing bank.

For CPF SA investments, this should be reflected in your CPF statement.

Step 5: Wait For T-Bills To Mature

After you’ve confirmed that your T-bills were issued accurately, all that’s left to do is to wait for them to mature.

Upon reaching its maturity date, the money you invested in the T-bill will be returned to your linked bank account, SRS, or CPF accounts.

What’s Good About T-Bills?

Now that we better understand how T-bills work, what exactly makes T-bills an attractive place to park your savings?

Little Risk, High Yield

The allure of T-bills is that it is a low-risk investment that has been generating reasonably high yields in recent months.

As mentioned earlier, T-bills are backed by the Singapore Government, which has the highest credit rating of AAA accorded by several international credit institutions.

This makes the risk of losing your money in T-bills extremely low, which is a key factor that many people look for when deciding where to stash their cash.

But having low risk isn’t enough – after all, locking your cash up in a safe is reasonably low-risk as well.

The other half of the equation is returns.

In an environment where inflation is on the rise, cash is quickly eroding in value if it’s not generating returns in some way.

Other than being one of the safest investments, T-bills have been generating returns at a rate of ~4% and as high as 4.4% since November 2022.

This is definitely impressive, beating the rates offered by SSBs and banks for their fixed deposits (FDs) and some high-interest savings accounts.

What’s Bad About T-Bills?

Unknown Interest Rates

For one, the interest rate for T-bills is not known until the auction is over.

In other words, you need to decide whether you want to invest in it or not without knowing what the yield is going to be.

You can mitigate this to some extent via competitive bids to make sure you only invest above a specified yield, but this isn’t an ideal solution.

If you bid too high and fail to secure any allotment, the result is that your cash remains in your bank account, probably generating lower interest.

If you bid too low, you risk securing allotment even if the interest rate is low.

And if you bid close to the actual yield, you might only get partial allotment due to the priority of non-competitive bids and competitive bids that are lower than your own bid.

No Early Redemption

Unlike long-term bonds, T-bills cannot be redeemed before the maturity date along with their interest earned to date, which makes them a rather illiquid investment.

They can be sold on the secondary market via your agent bank, but the market volume is generally low.

Also, the price of T-bills on secondary markets will depend on current interest rate environments versus that which the T-bill offers, so it’s possible that you will suffer a loss if you choose to sell it.

Short Tenor Period

To be fair, this isn’t so much of a con as it is a point to consider before deciding whether to invest in T-bills or not.

As I mentioned earlier, T-bills have been yielding rates of ~4% and higher for about 2 months now, which is higher than SSBs and some FD rates offered by banks.

This might make T-bills seem like the obvious choice of investment over SSBs and FDs, but that’s not the case because of the tenor period of each investment.

Since T-bills are usually issued with tenor periods of 6 months, this means you can only earn 6 months’ worth of interest, no matter how high the interest rate might be.

Once these 6 months are up, if interest rates have gone down and you’re not able to find a product that offers high interest rates to park your cash, then your effective interest rate over a period of years will remain low.

On the other hand, FDs can have tenor periods of up to 18 months, and SSBs up to 10 years.

Longer tenor periods mean you’re able to lock in a good interest rate for a longer period of time and allow you to earn more interest.

In the long run, high-yielding T-bills may underperform compared to lower-yielding SSBs and FDs if you’re not able to consistently get high yields for T-bills.

Are Treasury Bills A Suitable Investment For You?

T-bills make for a decent investment, but does this mean it’s the right investment for you?

To determine whether or not a particular asset is a good investment for you, here are some factors you can consider:

- Investment goal: why do you want to invest in this product?

- Risk appetite: how much drawdown are you able to tolerate for this investment?

- Time horizon: for how long are you planning to invest your money?

- Liquidity: how easily can this investment be converted to cash / do you foresee a need to do so?

Given the nature of T-bills, they might be a good investment for you if you fit the following profile:

- Investment goal: wealth preservation

- Risk appetite: low

- Time horizon: short (<= 1 year)

- Liquidity: none

In other words, you’re looking for a place to park some money for a short period of time, from 6 months up to 1 year.

You might need the cash for an upcoming planned expense, or just want to hold cash while observing how the market moves in the short term.

Either way, you don’t want to risk losing your capital.

This is cash you don’t intend to use for the time being and you can afford to have it locked up for a while.

If the profile I described above sounds like you, then T-bills are probably a good option for you.

Otherwise, there might be other types of investments that are better suited to your needs.

For example, equities are a better option if your goal is wealth generation, and you can consider longer-term bonds if you have a longer time horizon.

To summarise,

T-bills are one of the safest investments around and they have been yielding high interest rates over the past few months, making them an ideal asset to store your cash in.

While it has its downsides, it’s still a generally good investment if you’re looking for ways to make your savings work while having the peace of mind that it’s in good hands.

Will you invest in T-bills? Why or why not?

Let me know in the comments below!

3 replies on “Beginner’s Guide: How To Buy Singapore Treasury Bills (T-Bills)”

Great post! I found the step-by-step guide really helpful, especially the tips on understanding the auction process. I’m excited to start investing in T-Bills and appreciate the clarity you’ve provided. Looking forward to more posts like this!

Hey there,

Thanks for checking out my blog and for leaving a comment!

I’m glad you’ve found my blog helpful, hope to see you around! 🙂

Great guide! I really appreciate the step-by-step breakdown on how to buy T-Bills in Singapore. It makes the process seem much less daunting for beginners like me. Looking forward to trying it out!