Disclaimer: All information in this post is correct as of 22 Apr 2021.

Disclaimer: This is not a sponsored post, but this article contains referral links that allow me to earn referral rewards at no cost to you if you choose to signup with my links, which helps me maintain the blog.

The online brokerage space in Singapore has grown extremely competitive over the past 1 year or so.

This has sparked enticing sign-up rewards being offered by various brokers in hopes to gain market share.

Not only that, but these brokers also offer extremely competitive fees, making them even more attractive to retail investors.

As consumers, this is definitely a good thing for us.

In fact, it is for these 2 reasons alone that I believe it’s worth opening both a Moomoo and Tiger Brokers account if you haven’t already done so.

Signup Rewards

Let’s talk about the more interesting thing first – the freebies.

Moomoo

Moomoo’s signup promotion has been ongoing for a while now, but it’s not too late yet to jump on board.

Promotion Period

To be eligible for the signup rewards, you need to successfully open a Moomoo account by 30 April 2021, 3 pm, and deposit the required funds within 45 days of account opening.

Rewards

- 1 free share of Apple (AAPL)

- 30 SGD

- 3 months of commission-free trading

Given that the trading price of AAPL is ~133 USD (as of 22/4/21), Moomoo’s signup rewards amount to ~200 SGD – which looks like a good reward if I’ve ever seen one.

Criteria

- Successfully open a Moomoo account

- Deposit 2000 USD/2700 SGD/16000 HKD within 45 days of account opening

These criteria are extremely simple to fulfill, and it doesn’t require you to spend any money or perform any trades.

The cash that is deposited into the account can be withdrawn subsequently and does not have to be invested.

Eligibility

- New Moomoo customer

- Singaporean/PR/Singapore Resident

- 18 years old or older

- Have a Singapore bank account in your own name

Again, these are pretty basic eligibility criteria, and almost anyone would be eligible for this promotion.

Signup & Funding Process

This is a fairly straightforward process.

1: Sign Up

First, you’ll need to sign up for an account by entering your email and creating a password. You can do so via their website, or you can use a referral link.

Note that using a referral allows you to receive the signup rewards too!

2: Open Account

Next, you’ll need to open your account.

This is where they’ll ask for your personal particulars. You can signup using MyInfo, which will make the process a lot quicker.

Moomoo will take some time to verify your account details before approving it, typically within hours, so wait patiently for an email.

Be sure to check your junk/spam mail too as that’s where my confirmation email went.

3: Fund Account

Once your account has been successfully opened, you’ll need to fund your account.

This can be done either via Direct Debit Authorisation (DDA) through DBS/POSB or via bank transfer. The former is more advisable as the funds will be deposited faster and it’s simple to set up.

To set up a DDA, you will be prompted to log in to your iBanking account to approve the request.

After that, simply make a deposit from your DBS/POSB bank account of at least 2700 SGD to be eligible for the free Apple share and $30 rewards.

4: Claim Rewards

You do not need to do anything after completing all the above steps in order to receive your rewards.

The $30 will be credited directly into your SG account, while the Apple share will be credited to your US account.

Note that it takes up to 5 business days for the Apple share to become available in your account, and will be seen as “Pending Gift Stock” until then.

Tiger Brokers

Tiger has had a flurry of various signup rewards recently, with a 10% off Tesla stock voucher and free Disney share.

Promotion Period

There is currently no stipulated end date for this campaign, but it has been stated that there are only 5000 free shares available.

Rewards

- 500 Tiger coins

- 60 commission-free trades for 180 days for US, HK, SG stocks, and Futures

- 1 free share of Starbucks (SBUX)

Tiger coins can be used to redeem rewards in their app, including commission-free trades, stock vouchers, and more.

At Starbucks’ share price of ~116 USD (as of 22/4/21), Tiger’s signup reward amounts to ~ 150 SGD.

Note that there are only 5000 shares of SBUX available for this campaign and will be awarded on a first-come-first-serve basis.

Criteria

- Successfully register for and open a Tiger Brokers account

- Make an initial deposit of more than 2000 SGD or equivalent

As with Mooomoo, these criteria are easy to fulfill, and the initial deposit can be withdrawn after confirming eligibility for the reward.

The important thing to take note of is that the initial deposit, ie the very first deposit made into the account, must be more than 2000 SGD in order to receive the free Starbucks share.

Signup & Funding Process

1: Register

The first thing you need to do is to register for an account.

You can do this via their website or via a referral link.

Again, signing up with a referral link still qualifies you for the signup rewards.

Alternatively, you can register directly via their app. To enter a referral code, you’ll have to check the “Enter Invitation Code” box. If you need one, you can enter “MNRWMR”.

2: Open Account

2: Open Account

After that, you’ll have to open your account.

Again, this is where they’ll ask for your personal particulars. If you fill-up the information using MyInfo, this process will be a breeze.

Wait for a confirmation email from Tiger for your account to be approved. This typically takes no more than an hour.

3: Fund Account

After your account is successfully opened, you’ll need to fund your account.

As with Moomoo, it is advisable to do so via DDA.

After setting up DDA, you can proceed to make your initial deposit.

In order to qualify for the free SBUX share, your first, initial deposit must be more than 2000 SGD or equivalent currency.

So you need to deposit a minimum of 2001 SGD.

4: Claim Rewards

After your funds have been successfully deposited, you need to log in to your Tiger account via their app, navigate to the rewards centre, and claim your rewards.

Rewards will only be available for a stipulated time and must be claimed before they expire!

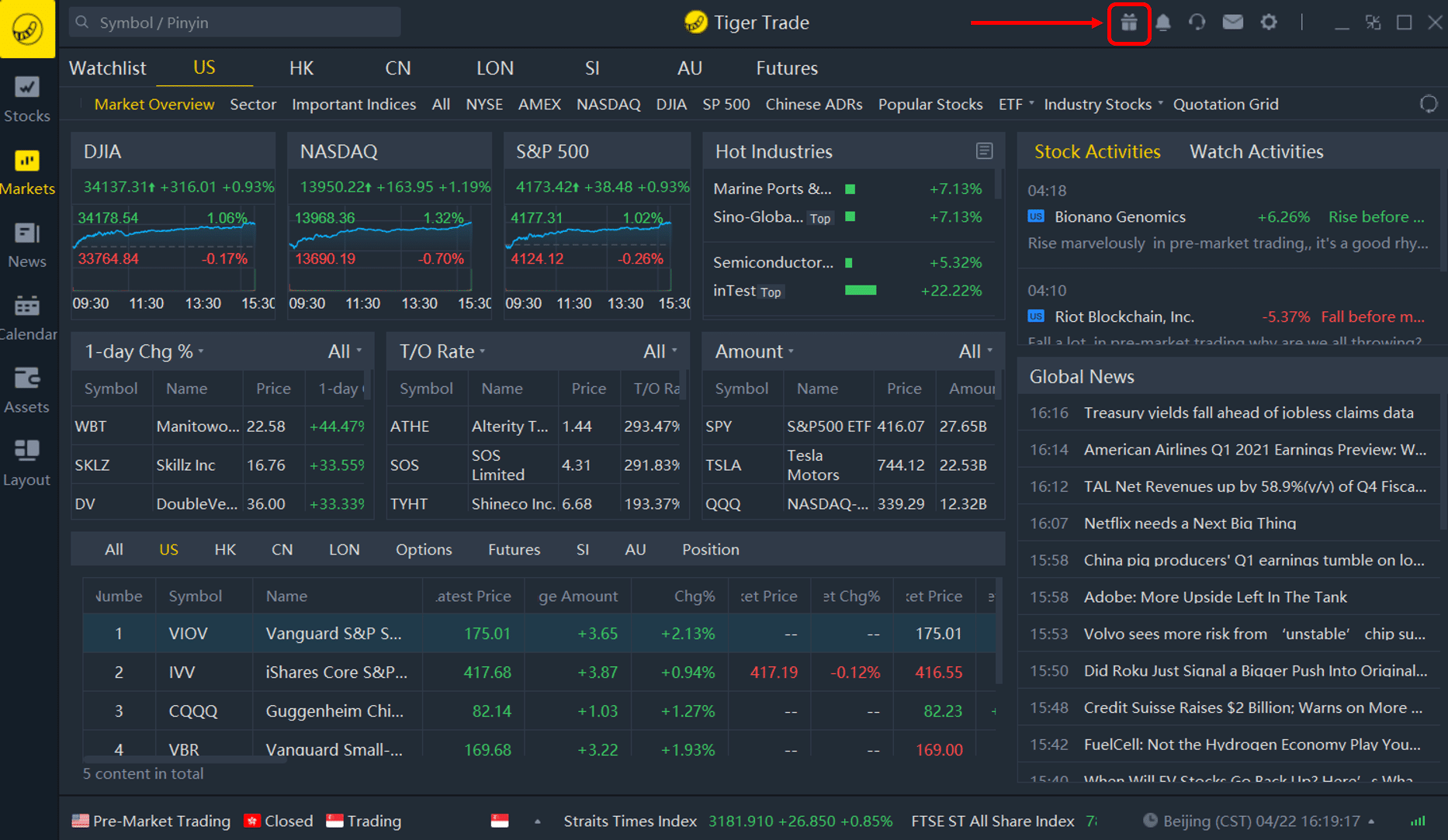

If you’re using the desktop app, click the present icon at the top right.

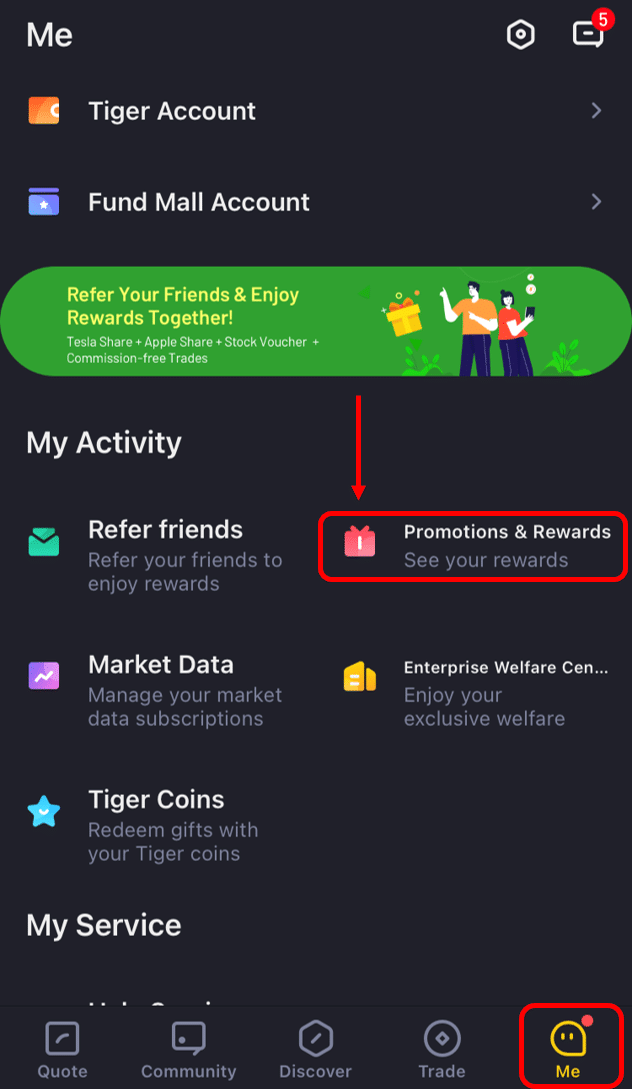

If you’re using the mobile app, go to Me > Promotions & Rewards.

If you’re using the mobile app, go to Me > Promotions & Rewards.

After you have claimed the SBUX share, it will take up to 10 working days to credit it to your account.

**Note that the terms and conditions of this promotion stipulate that in order to sell the SBUX share, you will first need to complete 10 trades with a trade value of at least 1 USD each.**

This means that liquidating the SBUX share will not be as simple as compared to the AAPL share from Moomoo, but it’s still free money.

Cheapest Way To Liquidate Free SBUX Share

The cheapest way to perform 10 trades to liquidate your free SBUX share is by trading in the SG market.

The reason for this is that Tiger Brokers is currently waiving the minimum fees for SG market trades.

With the commission-free trades you receive upon signing up, the only fee Tiger will charge you for is 0.04% of your transaction value as a platform fee.

Disclaimer: you will also be charged 0.04% in trading/clearing fees by SGX, plus 7% GST on all applicable fees.

As long as you keep the transactions small (min requirement is 1 USD), these fees will be peanuts compared to the profits you stand to earn from the SBUX share.

In my opinion, it’s still a great signup reward!

Low Fees

Moomoo and Tiger Brokers have pretty similar fee structures and the fees are both low in general.

For one, neither of these brokers charges a custodian fee or a currency conversion fee, which other brokers like Saxo do.

The trading fees for these brokers are also low.

Here are the broker-related fees for stocks and ETFs.

|

||

| SG | Commission: 0.03%, min 0.99 SGD

Platform: 0.03%, min 1.50 SGD |

Commission: 0.04%

Platform: 0.04% Total min: |

| HK | Commission: 0.03%, min 3 HKD

Platform: 15 HKD |

Commission: 0.03%, min 7 HKD

Platform: 0.03%, min 8 HKD |

| US | Commission: 0.0049 USD/share, min 0.99 USD, capped at 0.5% of transaction amount

Platform: 0.005 USD/share, min 1 USD |

Commission: 0.005 USD/share, min 0.99 USD, capped at 1% of transaction amount

Platform: 0.005 USD/share, min 1 USD |

| China | N/A | Commission: 0.03%, min 7.50 CNH

Platform: 0.03%, min 7.50 CNH |

| AU | N/A | Commission: 0.05%, min 4 AUD

Platform: 0.05%, min 4 AUD |

*: The minimum fee for SG market trades for Tiger Brokers is currently waived until 31 Dec 2021.

Since this isn’t meant to be a broker comparison post, I have not included the fee structure of other brokers.

However, a simple search should help you find that the only other brokers that have cheaper fees than Moomoo/Tiger are TD Ameritrade (TDA) and Interactive Brokers (IBKR).

TDA has drawbacks in that it only has access to US markets and has an extremely long waiting time for account opening (I’ve been waiting for more than a month).

Meanwhile, IBKR charges a monthly inactivity fee on accounts with total assets worth less than 100k USD of either 3 USD or 10 USD depending on your age.

I believe most students and young adults reading this wouldn’t have 100k USD worth of assets any time soon, and thus the inactivity fee ends up outweighing the cheaper trading fees.

To summarise,

Moomoo and Tiger Brokers are low-cost brokers that allow investors to invest in various markets including the US.

Their cheap pricing structure makes them suitable for students and young adults with small amounts of assets who want to start investing.

The ongoing signup promotions that award free shares of Apple and Starbucks make it extremely worth it to sign up for an account with them now if you haven’t already done so.

The monetary value of rewards amounts to ~ 200 SGD for Moomoo and ~ 140 SGD for Tiger Brokers, so it’s an excellent time to open accounts with them now especially if you’re looking to start investing!

If you want to help me out, you can use my referral links when you signup for Moomoo and Tiger Brokers – I’ll earn a bit of cash at no extra cost to you, and you’ll still be eligible for the signup rewards!

Will you be opening a Moomoo/Tiger account? If yes, will you continue using them? If not, why not? Let me know in the comments below!