Disclaimer: This is not a sponsored post, but this article contains referral links that allow me to earn referral rewards at no cost to you if you choose to signup with my links, which helps me maintain the blog.

Whenever I come across a good deal/promotion, I feel a sense of joy and satisfaction.

And promotions don’t get any better than ones that give free money.

Singlife’s Grow promotion is exactly that – where you can earn $30 in cash and possibly hundreds more in rewards for free.

I know this sounds too good to be true, but take a step back and go through the post – I’ll only share things that are legit.

In this post, I’ll share with you the mechanics of this promotion and how you can take advantage of it to earn hundreds of dollars for free.

Singlife Referral Campaign

Let’s start with the Singlife referral campaign.

The promotion itself awards up to $35 for both referrers and referees and is split into 2 awards of $5 and $30.

$5 Reward – New Singlife Account + Activate Visa Debit Card

Ironically, the $5 award is harder to earn.

This is because it’s only awarded to new customers who open a Singlife account and activate the Singlife Visa debit card.

So it’s not available to current Singlife customers.

New customers need to signup via a referral link or enter a referral code (KLkjyHY5) during the signup process.

After the Singlife account is opened and the Singlife Visa card is activated, $5 will be awarded to both the referee and referrer.

Also, given how mediocre the Singlife Visa card is, probably not many people would want to go through the hassle of getting another card just for $5.

If you’re wondering, the Singlife Visa card’s perks include 0 FX fees for foreign currency transactions – nothing else.

$30 Reward – Activate First Grow Portfolio

Next, the $30 reward is awarded when Singlife customers fund and activate their first Singlife Grow portfolio.

This is available to both new customers and existing customers, as long as they have not used Singlife Grow before.

To receive the reward, customers will need to enter a referral code (KLkjyHY5) during the Singlife Grow signup process.

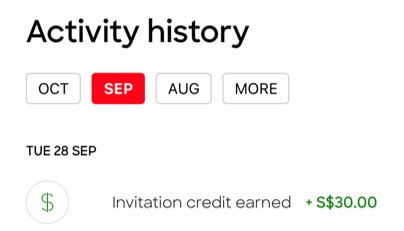

Upon activation of the Grow portfolio, the $30 reward will be awarded to both the referee and referrer.

Step-by-step Guide

To begin, you can click this link on your mobile phone or launch the Singlife app, log in to your account and tap on “Grow” on the homepage.

A pop-up should appear where you can either swipe across different screens or tap “Skip” at the top righthand corner.

Do not press “Skip”.

Instead, swipe to the last screen where you have the options “Choose your portfolio” and “Continue with invite code”.

Tap “Continue with invite code” and enter the code KLkjyHY5.

Then, you’ll be prompted to begin the signup process.

After filling in all the information accordingly, your Grow application will be pending.

Wait for an email from Singlife that says your Grow application is approved. This may take about an hour or up to a few days.

After receiving the approval email, open the Singlife app again.

Under “Grow”, tap “Pay initial premium”.

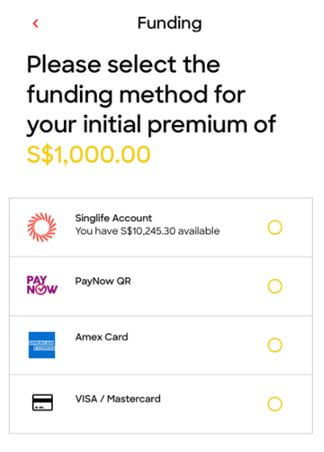

If you’re taking advantage of credit card promotions and rewards, choose “Amex Card” and proceed with your payment.

Otherwise, choose your preferred mode of payment.

After Singlife receives your payment, you will receive $30 credited into your Singlife account.

What Is Singlife Grow?

Singlife Grow is an investment-linked policy (ILP), which is a life insurance policy that provides a combination of both investments and insurance protection.

Insurance

To my knowledge, the basic insurance provided by Singlife is pretty barebones, covering only death and terminal illness.

The payout amount is dictated by the higher of 101% of your net Grow premiums or the value of your Grow portfolios.

For example, if you invested a net amount of $30k in Grow and since then, your account value has grown to $45k, the payout amount will be $45k.

Conversely, if your account value has decreased since then to $25k, the payout amount will be $30.3k (101% of $30k).

Investment

Singlife’s Grow portfolios are managed by Aberdeen Standard Investments, an asset management company.

You don’t get to choose what exactly you invest in, but instead, have to choose between 3 risk levels – Conservative, Balanced, and Dynamic.

Neither returns nor capital is guaranteed.

- Conservative (low-risk) – 20% Equity, 80% Fixed Income

- Balanced (medium-risk) – 50% Equity, 50% Fixed Income

- Dynamic (high-risk) – 80% Equity, 20% Fixed Income

Things To Know

The minimum amount to get started with Grow is $1000 and subsequent top-ups can be made in multiples of $100.

There is a management fee of 0.25% per quarter charged by Singlife which will be deducted on a calendar quarter basis.

There is no lock-in period for Grow, which means you’re free to withdraw your funds at any time with no charges.

This is the main reason why this promotion is attractive – because once you’ve received the reward, you’re free to surrender your Grow policy.

In other words, after earning the $30 referral reward, you can withdraw your money from your Grow portfolio and call it a day.

The thing to take note of is that you need to have a minimum balance of $1000 in order to make a withdrawal.

This may not seem like an issue since the minimum funding amount required is $1000.

But since the $1000 that you initially fund your account with is getting invested, due to volatility, your portfolio value may be lower than $1000 when you want to make a withdrawal.

In this case, you’ll need to top-up your portfolio with another $100 so that your account value will now exceed $1000 and be eligible for withdrawal.

Earn More Rewards With Credit Cards

The initial funding of the Grow portfolio can be made via a credit card if the amount is $1000.

If the amount is higher than that, these options will not be available, and you’ll be prompted to fund your Grow account via PayNow.

So if you’re keen to explore these bonus rewards, be sure to take note of this.

This is an insurance transaction that typically doesn’t earn any credit card rewards.

But for the AMEX True Cashback and UOB Absolute cards, this is not the case.

They will earn 1.5% and 1.7% cashback respectively on this transaction, which comes up to $15 and $17.

This is true if you already have these credit cards.

However, if you don’t have any AMEX or UOB credit cards yet, then you’ll be considered a new-to-bank customer and will be eligible for certain promotions.

For example, AMEX is currently awarding a bonus of 1.5% cashback on the first $5k spending to new customers.

This means that cashback will be credited at a rate of 3%, which comes up to $30 if used to fund the Grow portfolio of $1000.

In conjunction with SingSaver’s current promotion, you stand to receive either an ErgoTune Classic chair, AirPods Pro, or $160 cash.

Thus, this is an easy way to earn a whole lot of rewards on top of the free cash awarded by Singlife’s referral campaign.

UOB is also running a promotion to award $300 in cash when new UOB customers spend $1500 within 30 days of card approval.

Using the UOB Absolute to fund your Grow portfolio will put you much closer to hitting the $1500 spending requirement while earning $17 in the process.

Bonus Interest

If you’re thinking about whether there’s any point in keeping your Grow portfolio, this one’s for you.

Having an active Grow portfolio will boost the interest earned on your Singlife account from 1% to 1.5% per annum.

Note that this is only applicable on the first $10k balance, and will be credited into your account on the monthly crediting date.

The bonus interest will only be credited if your Grow portfolio is active for at least 30 days prior to the monthly crediting date.

For example, if you activated a Grow portfolio on 1 June and your monthly crediting date is the 15th of every month, you will not be eligible for the bonus interest during June’s interest crediting.

So the interest rate earned during June’s interest crediting will only be at 1%.

But if you maintain the Grow portfolio until July’s monthly crediting date, you will earn 1.5% interest for July’s interest payout.

It’s actually fairly reasonable to keep a Grow portfolio of $1000 for the extra 0.5% interest.

On a balance of $10k, a bonus of 0.5% interest/year adds up to $50.

Given that this was earned from an initial sum of $1000, this is a 5% guaranteed return.

However, this bonus interest campaign is only valid until 31 Dec 2021.

This means that there are only 2 months left where bonus interest can be earned.

The returns you stand to gain are significantly less than $50 ($8.33), which is a 0.83% return.

This isn’t the best return, though it’s at least better than the interest rate from a typical savings account.

Of course, there’s also a possibility that this bonus interest campaign will be extended, in which case keeping your Grow portfolio will allow you to earn bonus interest sooner.

Closing Thoughts

The Singlife Grow referral campaign is great because it’s an easy way to earn $30 for free with no fine print.

If coupled together with a proper credit card, you could earn even more in the form of cashback and other rewards.

Remember – there’s no lock-in period or fee, so you’re free to ditch your Grow portfolio after receiving the $30 reward.

It’s a high reward for little effort. What’s not to love?

Will you take part in this promotion? Let me know in the comments below!