With all the savings accounts that are available to choose from, it can be hard to decide which ones you should use.

Today, I’m going to solve this problem by telling you which, in my opinion, are the 2 best savings accounts to use.

These accounts are tailored specifically for students and young adults so they can seamlessly fit into your lifestyle.

Note: Insurance savings plans such as Singlife were not considered as this article focuses only on bank accounts.

Without further ado, let’s take a look at the 2 savings accounts.

1: Standard Chartered Jumpstart

I recently wrote an article about why I won’t be closing my Jumpstart account despite the fact that its interest rate has dropped by 80% – from 2% to a measly 0.4%.

While its interest rate is nothing to get excited about, the Jumpstart account fulfills its role as a savings account exceptionally well.

No Fees

For one, there are 0 fees associated with the account.

This means that you won’t have to worry about paying for any hidden costs like a fall-below fee, inactivity fee, or overdraft fee, and there are 0 costs involved with having this account even if you don’t use it.

Free Interest

Next, it rewards you with decent interest for doing nothing.

| Account Balance | Interest Rate |

| First $20k | 0.4% p.a. |

| >$20k | 0.1% p.a. |

In the current low-interest rate climate, a rate of 0.4% is actually fairly decent.

Even though other high-interest savings accounts advertise interest rates of 2%+, they are extremely unrealistic to achieve, especially for students and young adults.

Furthermore, those interest rates are only applicable on a portion of the total account balance and not the total balance, so the effective interest rate (EIR) of such accounts tends to be much lower than advertised.

For most students and young adults, the EIR they can realistically achieve from high-interest accounts is more likely around 0.4% ~ 0.5%, which is barely higher than that offered by Jumpstart.

The biggest difference, in this case, is that to enjoy the same interest rate from other high-interest accounts, you’ll need to fulfill several criteria like credit card spending or salary crediting while for the Jumpstart account, you don’t have to do anything.

Easy Cashback

Finally, the Jumpstart account comes with the Cashback debit card, which awards 1% cashback on all eligible Mastercard transactions.

There are no minimum spending requirements and few category restrictions to earning this cashback, so you can easily earn cashback as long as you pay via Mastercard.

This is a good alternative to other debit cards like the DBS Visa that require minimum monthly spending if you don’t foresee yourself being able to meet that requirement.

2: DBS Multiplier

The DBS Multiplier account has seen many revisions to its interest rate over the past 1-2 years.

Even though its interest rate structure isn’t as attractive as it used to be, the Multiplier account is still one of the best accounts to have.

Flexible Criteria

Among the various high-interest savings accounts, DBS Multiplier has the most flexible criteria requirements.

Specifically, the Multiplier account has been tweaked to allow students to enjoy bonus interest – something that isn’t quite possible for other accounts like OCBC 360 or UOB One.

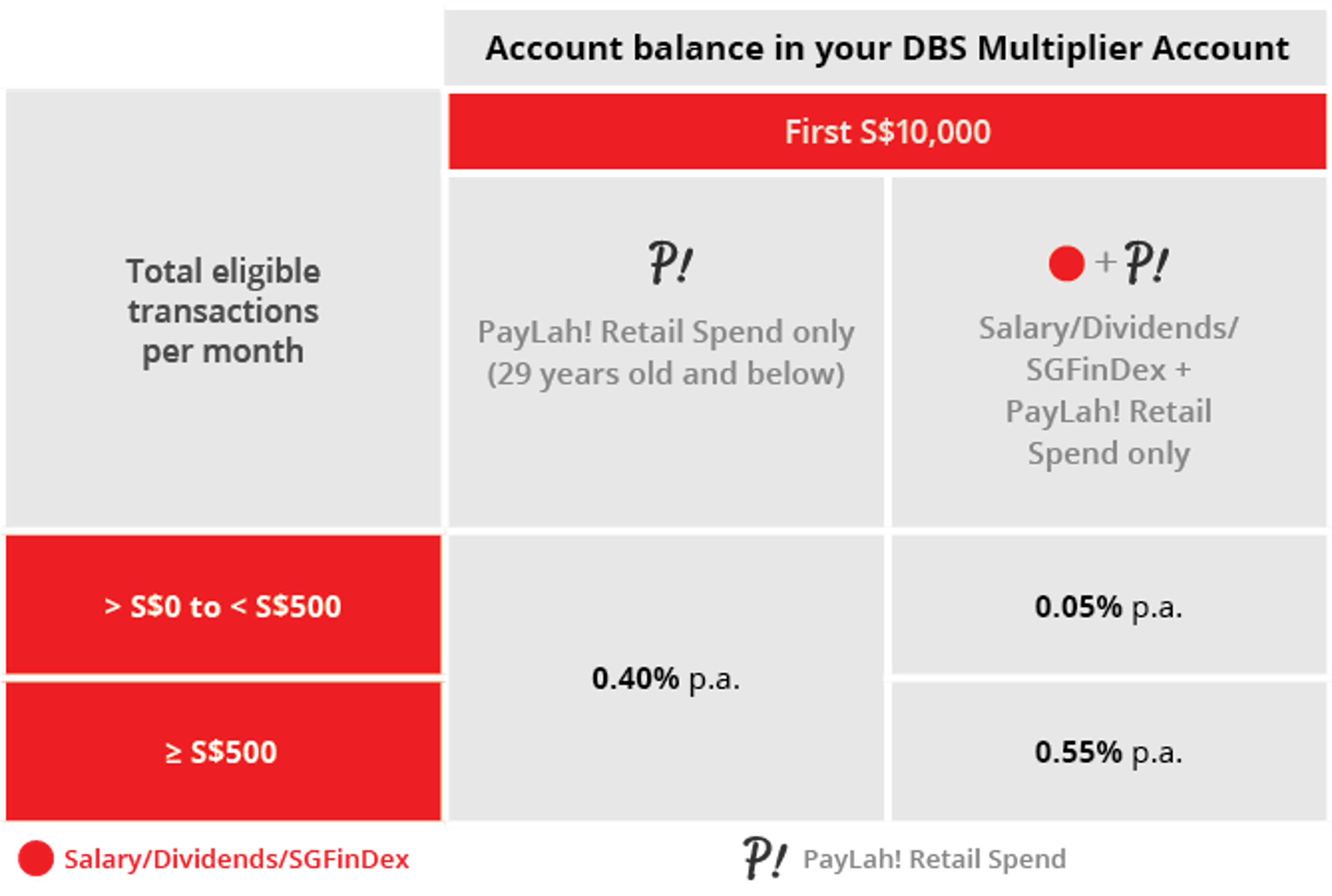

Even if you don’t earn a salary, you can earn 0.3% interest on the Multiplier account by making qualifying transactions as little as $1 with PayLah!, if you’re 29 years old or below.

Or, if you’re earning a small salary, you can earn 0.4% interest when coupled with PayLah! spending amounting to $500 or more in total.

|

Also, the Multiplier account’s interest rates are arguably higher than those offered by its competitors for fulfilling similar criteria.

So after you’ve graduated and started working full-time, you can continue to use the Multiplier account as your savings account and earn higher bonus interests.

You don’t have to worry about finding another savings account to switch to because you’re already using the best option.

Multi-currency Account

The Multiplier account doubles up as a multi-currency account, which means that it’s able to store and process transactions in various currencies at no extra cost.

This is an extremely useful function to have for a savings account.

For one, it allows you to save money on currency conversion fees when you pay for transactions that are denominated in foreign currencies via card.

This is a fee that you would normally incur on an SGD-denominated account.

If you enjoy traveling or online shopping, this is a function you need to make use of.

There are alternatives in multi-currency wallets such as YouTrip and Revolut, but with such wallets, your money is often locked up in the wallet and cannot be transferred out.

With a multi-currency savings account like DBS Multiplier, any unused foreign currency can be converted back to SGD and transferred out for other uses like savings or investments.

The multi-currency functionality is also useful because it allows you to fund your investment brokerage accounts in foreign currencies.

During your investment journey, you’ll almost definitely buy investments that are denominated in foreign currencies like USD, GBP, or etc.

If you fund your brokerage account in SGD, you’ll often be charged a fee by the broker for converting the SGD to the relevant currency.

By funding your account with the necessary currency directly, you will be able to bypass this fee and save money on your investment, boosting your overall returns.

Convenient

The Jumpstart account is great and offers similar interest rates to the Multiplier account, but it may not be very convenient due to the scarcity of Standard Chartered ATMs.

If you need to withdraw money often, having a DBS/POSB bank account will make it extremely convenient because Singapore is littered with DBS/POSB ATMs.

Almost No Fees

Unlike the Jumpstart account that charges absolutely 0 fees, the Multiplier account actually charges a $5 service fee if your account’s daily average balance falls below S$3k or equivalent.

However, this fee is waived for all customers until you turn 29.

Also, assuming that you will be keeping some savings in this account, chances are that you will have an account balance of S$3k or more.

Or, if you’ve never had a DBS bank account, open the Multiplier account as your first DBS account and the daily average balance requirement will be waived perpetually.

Save & Spend

With both the Jumpstart and Multiplier accounts, the former can be used for daily expenses while the latter, for savings.

This is because the Jumpstart account has no fall-below fees or overdraft fees, so if you’re spending directly via the Cashback debit card, you won’t have to worry about paying any fees.

Keeping your savings in the Multiplier account helps to ensure that you will have sufficient balance in the account to meet the daily average balance requirement and avoid paying the $5 service fee.

Closing Thoughts

If you’re a student or young adult who has been struggling with deciding which savings accounts to use, I’d strongly recommend opening both the Jumpstart and Multiplier accounts.

The Jumpstart account is a no-frills savings account that does its job well – it requires almost no effort to use or maintain and comes with a decent debit card.

The Multiplier account complements the Jumpstart account well in that it provides multi-currency functionalities and convenient access to ATMs – 2 things that the Jumpstart account doesn’t have.

Top them off with decent interest rates, and you have 2 great savings accounts.

What are your favourite savings accounts? Let me know in the comments below!