Disclaimer: This is not a sponsored post, but this post contains affiliate links. If you sign up for a product through one of these links, I’ll earn a commission to help sustain this blog at no cost to you. For more information, read our affiliate disclosure.

Shopee is no stranger to us here in Singapore, and if you’ve ever used it, you’ve probably heard of ShopeePay – Shopee’s mobile wallet feature.

Choosing ShopeePay as your payment method allows you to earn Shopee Coins, a type of currency that you can use to offset purchases made on Shopee.

But is this enough to make ShopeePay worth using?

How does ShopeePay compare against other payment methods when it comes to earning rewards?

Read on to find out!

What Is ShopeePay?

As mentioned earlier, ShopeePay is Shopee’s version of a mobile wallet, similar to DBS PayLah!, GrabPay or Singtel Dash.

Here are some features that are available with the ShopeePay wallet:

- Top up funds

- Make payments

- Transfer funds to other users

- Withdraw funds

These are quite generic features that almost all mobile wallets have, so there’s nothing that stands out.

How To Use ShopeePay

Let’s briefly go over how you can use the various features of ShopeePay.

1: Top-Up Funds

Before you can use your ShopeePay wallet to make payments or transfer funds, you need to make sure you have loaded it with cash.

As of writing this post, there are 3 ways you can top up your ShopeePay wallet:

- PayNow

- Bank transfer

- Credit/Debit card

PayNow Top-up

When you select PayNow as the top-up method for your ShopeePay wallet, you will see a QR code generated in the app.

Save the QR code, open your preferred banking application, and make a PayNow transfer via QR by uploading the saved QR code.

There are no fees involved for PayNow top-ups.

Bank Transfer Top-up

To top up your ShopeePay wallet via bank transfer, you first need to link a bank account.

Currently, only the following banks are supported for bank transfer top-ups:

- DBS

- OCBC

- BOC

- HSBC

- Maybank

Once you have successfully linked a bank account, you can top up your ShopeePay wallet from that bank account.

There are no fees involved for bank transfer top-ups.

Credit/Debit Card Top-up

To top up your ShopeePay wallet via a credit/debit card, you need to have a credit/debit card linked to your Shopee account.

If you have added any cards as a payment method, they will automatically be displayed here as well.

Currently, the following card networks are supported:

- Visa

- MasterCard

- American Express

- JCB

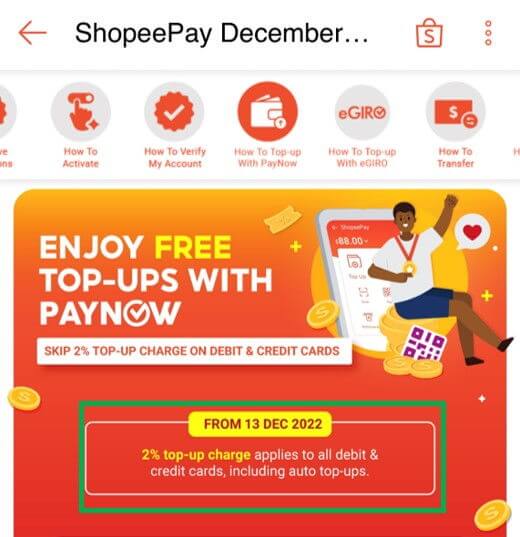

All credit/debit card top-ups are subjected to a S$1 top-up fee, which will be revised to a 2% fee effective from 13 December 2022.

2: Make Online Or Offline Payments

After you have topped up your ShopeePay wallet, you can now use it to make payments.

Most people probably use ShopeePay only for online payments when shopping on Shopee, but it can also be used for offline payments at selected merchants.

Online Payments (Shopee)

To pay via ShopeePay while shopping on Shopee, simply select ShopeePay as your payment method at the checkout screen before placing your order.

Offline Payments

You can’t use ShopeePay for all offline transactions – only when you make payments at merchants that support ShopeePay.

You’ll know that they support ShopeePay if you see a ShopeePay QR code at the cashier, or you can simply ask them if they accept ShopeePay.

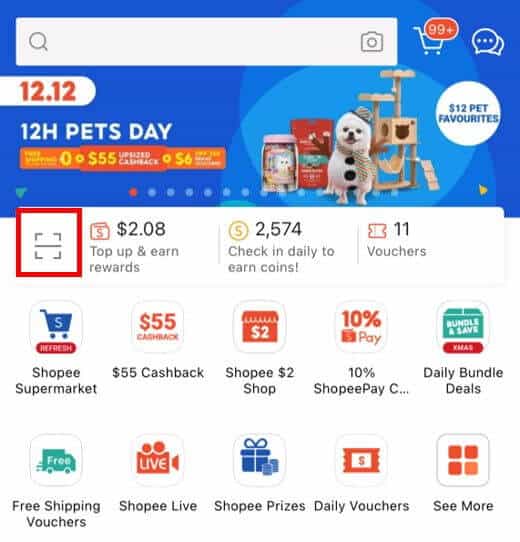

To make offline payments via ShopeePay, open your Shopee app and tap on the scanning icon near the top of the home page.

Scan the merchant’s ShopeePay QR code, enter the amount to be paid, and complete the transaction to make the payment.

3: Transfer Funds To Other Users

You can transfer funds from your ShopeePay wallet to another user who is also using ShopeePay.

You can send funds via any of the 3 ways below:

- Phone number/username

- Link

- QR code

Transfer Via Phone Number/Username

This option is called ‘Send to Contacts’ as shown in the Shopee app.

After selecting this option, you can either sync the contacts from your phone into your Shopee app, or you can manually enter a user’s phone number or Shopee username.

Transfer Via Unique Link

This option is called ‘Send Ang Bao’ as shown in the Shopee app.

You have the option to choose how much you want to send and how many recipients you want to send funds to.

The total amount you send will be split among the recipients, so if you only add 1 recipient, they will receive the full amount of the ang bao.

Once you have completed the steps, you will be given a unique link that you can share with the intended recipient(s) of the ang bao.

Note that the link will only be valid for 24 hours – any uncollected balance from the ang bao will be returned to your ShopeePay wallet.

Transfer Via Shopee QR Code

Finally, you can send funds from your ShopeePay wallet by scanning another user’s ShopeePay QR code.

To do this, you need to have the intended recipient’s ShopeePay QR code.

They can find their QR code by selecting ‘Request’ on the ShopeePay page in the Shopee app.

4: Withdraw Funds

It’s possible to withdraw funds from your ShopeePay wallet directly into your bank account, but there’s a catch.

You can only withdraw amounts that were credited into your ShopeePay wallet as a result of a refund.

This means that funds you willingly added to your ShopeePay wallet via top-ups cannot be withdrawn.

To withdraw funds, simply add your bank account details and confirm the withdrawal.

Many banks are supported for fund withdrawal, including all major banks operating in Singapore and some overseas banks.

Why Use ShopeePay?

With so many payment methods available today, why would someone choose to use ShopeePay?

Use Shopee Platform Vouchers

The main reason why anyone would want to use ShopeePay is to use Shopee’s platform vouchers.

This may include discount vouchers or cashback vouchers that award shoppers with Shopee Coins.

Shopee is known for its cashback program that awards shoppers with Shopee Coins, a currency that has monetary value and can be used to offset future purchases.

In the past, Shopee Coins could be easily earned by applying Shopee vouchers when you shop on the app, regardless of your payment method.

But recently, Shopee has imposed stricter terms and conditions on such cashback vouchers.

Now, many cashback vouchers are only eligible if you choose ShopeePay as your payment method.

You can occasionally come across vouchers that do earn Shopee Coins with other payment methods, but the most common ones require you to use ShopeePay.

The cashback awarded from such vouchers is often upwards of 8%, which is quite generous.

Redeem Shopee Coins On Offline Payments

Shopee Coins can be used to offset online payments on the Shopee app regardless of your payment method.

But using ShopeePay for offline payments allows you to also use Shopee Coins to offset part of your transaction, giving you another way to utilise them.

So if you somehow find yourself with a surplus of Shopee Coins and can’t use them up with online purchases, you can also use them via offline ShopeePay transactions.

How Much Rewards Can You Earn With ShopeePay?

As I mentioned earlier, the main reason for using ShopeePay is to take advantage of Shopee vouchers, which either let you enjoy a discount or earn cashback rewards in the form of Shopee Coins.

The question, then, is how much rewards does using ShopeePay actually earn you?

We know that in order to use ShopeePay, you must first top it up with cash and then make a payment.

So, there are 2 opportunities to earn rewards here – 1 when you top up your ShopeePay wallet and 1 when you actually make a payment.

Let’s take a look at both of them.

Earn 1.7% Cashback Or 1.8 Miles/$1 For ShopeePay Top-Ups

You can top up your ShopeePay wallet via PayNow, bank transfer, or card.

Bank transfer top-ups don’t earn any rewards.

There is a limited-time promotion that awards 1% cashback on PayNow top-ups of a minimum of S$100 to ShopeePay, capped at S$1.

To do this, you’ll need to:

- Register for the promotion,

- Make a PayNow top-up of S$100 or more in December, and

- Complete 4 offline ShopeePay transactions or more in December.

The S$1 cashback reward will be credited to your ShopeePay wallet on 2 January 2023.

However, this promotion is limited to the first 5,000 users who successfully register and complete all the listed criteria, so it’s the fastest fingers first.

When it comes to credit cards, most of them don’t award rewards for mobile wallet top-up transactions.

But some cards operating under the American Express (AMEX) network are known to be exceptions to this rule – such as the UOB Absolute and AMEX HighFlyer Business credit cards.

They earn 1.7% cashback and 1.8 miles per dollar (mpd) respectively on all eligible transactions, which does include mobile wallet top-ups.

Note that the AMEX HighFlyer card is a business credit card, so you can only apply for it if you are a business owner.

But remember that Shopee charges a fee for ShopeePay top-ups done via cards.

This fee stands at S$1 from now until 12 December, and 2% from 13 December onwards.

Before 13 December 2022

Your effective rewards rate for card top-ups would be 1.7% cashback – S$1 or 1.8 mpd – S$1.

This means that you should only choose card top-ups if you would earn >S$1 in rewards – otherwise, you’d be losing money.

So, the minimum amount required for it to be worth it to top up your ShopeePay wallet with either of these cards should be:

- UOB Absolute: $1 / 1.7% = $59

- AMEX HighFlyer: $1 / (1.8 * $0.015) = $38

The calculation for the AMEX HighFlyer card assumes that the value of 1 airline mile is ~1.5 cents, which is a conservative estimate based on The MileLion’s valuation of miles.

From 13 December 2022

After the fee schedule is updated, it will no longer make sense to use the UOB Absolute card for ShopeePay wallet top-ups because the fee of 2% is more than the cashback reward of 1.7%.

So, the only card to consider is the AMEX HighFlyer card.

Interestingly enough, since the fee is now changed from a fixed rate of S$1 to a variable rate of 2%, it is now always worth using the AMEX HighFlyer card to top up your ShopeePay wallet.

Based on the assumed value of an airline mile of 1.5 cents, the effective cashback rate of the AMEX HighFlyer card is 1.8 * 0.015 = 0.027 = 2.7%.

This means that the rewards rate is always higher than the fee of 2%, so you should always use your AMEX HighFlyer card to top up your ShopeePay wallet – if you have it, of course.

Earn 10% Cashback Or Enjoy 10% Off For ShopeePay Payments

Let me start by saying that it’s difficult to quantify how much cashback or discount you can receive by paying with ShopeePay because there are so many different vouchers that are available.

Depending on the sale campaign, the minimum spending requirement, the category restrictions, or other criteria, you may enjoy a different rate of cashback or discount.

But I’ve decided to use 10% as a baseline because you can quite reasonably find vouchers that equate to a 10% rewards rate, whether it’s in the form of cashback or a discount.

It’s also important to note that simply paying with ShopeePay on Shopee will not earn you any cashback or discount.

You need to claim vouchers within the app and apply them at the checkout page in order to receive cashback or discounts.

How Does ShopeePay Compare To Other Payment Methods?

Having the opportunity to earn upwards of 10% in rewards with ShopeePay is pretty good, but how does it compare with other possible payment methods?

After all, choosing to pay with ShopeePay means we’re choosing not to pay with other payment methods, so we’ll only want to choose ShopeePay if we’re sure that it’s better than the other options.

Other than ShopeePay, the following payment methods are available when shopping on Shopee:

- PayNow

- DBS PayLah!

- Credit/Debit Card

- SPayLater (Shopee PayLater)

- Credit Card Installment

We want to identify the payment method from the list above that has the highest rewards earning potential and compare it against that of ShopeePay – which we have found to be >10% on average.

When using any of these payment methods, there are 2 ways in which we can earn rewards:

- Shopee platform voucher

- Payment method reward (ie credit/debit card rewards)

Shopee vouchers can be applied regardless of your payment method, though some vouchers may require you to use specific payment methods.

In fact, it’s possible that the Shopee vouchers that do not require you to use ShopeePay as a payment method are just as good as the vouchers that do require you to use ShopeePay as a payment method.

This means that the main differentiating factor is which payment method has the best inherent rewards program, and how that compares to the rewards that can be earned on ShopeePay wallet top-ups.

PayNow and DBS PayLah! don’t typically award rewards for making transactions.

SPayLater bills can ultimately be paid off via PayNow, ShopeePay, or credit/debit card, so this is simply an extension of the analysis we’re trying to do now.

Credit card instalments are either the same as using a credit card to pay or worse – because some cards might not earn rewards for instalment payments.

This leaves us with credit/debit cards, and we all know that credit cards are much better than debit cards in terms of rewards.

It’s complex to determine exactly how much rewards you could earn with a credit card because it ultimately depends on the actual card that you use to make payments.

But the baseline rewards rate that I’d choose for credit cards is 5%.

This is because several cashback cards like DBS Live Fresh and UOB EVOL can earn 5% cashback or higher.

Also, several miles cards like HSBC Revolution, UOB Preferred Platinum Visa, and Citi Rewards can earn 4 mpd which is equivalent to a cashback rate of 6% using a conservative valuation.

Thus, it is quite easy to achieve a rewards rate of 5% or higher with a credit card, so I feel like it’s a fair baseline.

Comparing the rewards rate of 5% for credit card transactions to the rewards rate for ShopeePay top-ups, it’s clear that the rewards rate is better for the former.

This means that if we assume that there are equally good vouchers available for both ShopeePay and credit card payments, then using a credit card will likely yield better rewards.

Is ShopeePay Worth Using?

This post has gone on for a lot longer than I expected it to, so it’s finally time to tackle the question: is ShopeePay worth using?

The short answer is yes.

ShopeePay is worth using because most of the time, you can probably find a decent voucher to use that will earn you cashback or give you a discount.

But this doesn’t mean that ShopeePay should always be the preferred payment method to maximise rewards when shopping on Shopee.

As I mentioned earlier, it’s entirely possible for vouchers that don’t require you to pay with ShopeePay to be as good as the vouchers that do.

In these cases, it might be and probably is better to use a credit card that has a decent rewards rate instead of ShopeePay.

This is because using ShopeePay as a payment method has a poor rewards rate in itself – it does not directly earn rewards and topping up your ShopeePay wallet earns rewards but at a low rate.

Granted, there are a lot of things to consider when trying to identify the best payment method for your purchase like voucher minimum spending requirements, cashback cap, etc.

So if you really want to maximise your rewards whenever you shop on Shopee, you’ll have to approach it on a case-by-case basis depending on the vouchers you have available, their minimum spending requirements, cashback cap, etc.

Would I Use ShopeePay?

I personally do use ShopeePay, but only selectively.

I usually prefer to pay with my miles credit card on Shopee because it has the potential to earn more rewards than ShopeePay.

But I will use ShopeePay if there aren’t any good vouchers to use for credit card payments and there are good vouchers to use with ShopeePay.

In my experience, this is usually the case for cheaper transactions of about $30 or less.

Would you use ShopeePay? Why or why not?

Let me know in the comments below!

2 replies on “What You Need To Know About ShopeePay: Is It Worth Using?”

Hi, if I use shoppee pay day to buy $17 worth of stuff; the $17 will be deducted from my credit card automatically? If so, what is the difference if I use normal process (still paying via credit card) vs using shoppee pay ? Both are one-time payment ? Thanks

Hi Sean,

Thanks for checking out my blog and leaving a comment!

ShopeePay does not deduct an amount from your credit card automatically; you need to top up your ShopeePay wallet before you can make payment with ShopeePay. You can choose to top up your ShopeePay wallet via a credit card, though this might incur a fee. You can also choose to top up your account via bank transfer or PayNow.

The difference between choosing ShopeePay and a credit card as the payment method is where the source of funds is deducted from when you perform the transaction.

If you choose ShopeePay, then the transaction will be deducted from your ShopeePay wallet – you must ensure you have sufficient balance in your wallet before you can choose this option.

If you choose a credit card, the transaction will be charged to your credit card. Depending on which card you use, you might be eligible to earn credit card rewards on this transaction (ie cashback, miles, points).

There is also an implication on the vouchers you can use when checking out:

– ShopeePay-only cashback vouchers. Many cashback vouchers on Shopee can only be used if ShopeePay is selected as the payment method.

– Bank card-exclusive vouchers. Some discount vouchers can only be used if you make payment with the specified bank card.

If you use your credit card to top up your ShopeePay wallet, then the end result is that the same amount is deducted from your credit card. But the difference is that most credit cards do not let you earn rewards for topping up a mobile wallet like Shopee Pay, so you will lose out on earning any cashback/miles/points.

Hope this helps!