I have previously advocated for students using credit cards as early as possible to build credit score and cultivate good credit habits.

However, I recently decided to cancel my Citi Clear Visa – Citibank’s student credit card – and honestly, I wish I’d done it sooner.

Let me explain why.

P.S. If you’re a student who’s graduating soon and planning to upgrade your student credit card to regular credit cards, this post may be especially helpful for you!

Sign-Up Rewards

If you’ve read up about credit cards before, you may be familiar with the concept of credit card sign up rewards.

To entice customers to apply for their credit cards, banks often launch promotions where they will offer cash or miles to customers who apply for specific cards and meet certain criteria during a stipulated period.

Here are some examples of such promotions.

Citibank:

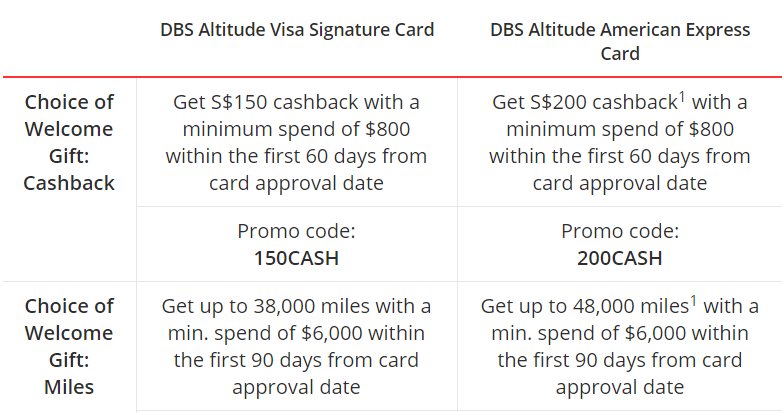

DBS:

To give you an idea of the value of these miles, a round trip Business class ticket to Bangkok requires ~40k miles.

As you can see, the sign up rewards are pretty attractive.

Personally, I’m super excited to begin my miles-chasing journey once I start working and am able to apply for credit cards.

Such sign up rewards in the form of bonus miles will go a long way in helping me accumulate miles for a free flight.

But here’s the catch.

Banks don’t just give these rewards to anyone who signs up for a new credit card.

In most cases, such attractive sign up offers are exclusively for new-to-bank customers only.

While the exact definition of a “new-to-bank customer” differs slightly between each bank, there are 2 general conditions to meet, which go along the lines of:

- an individual who does not have an existing (insert bank) credit card as a primary cardmember; and

- an individual who has not cancelled any (insert bank) credit card in the past x months.

So not only must you not have a card with the bank at the time of application, but you must also not have had a card with the bank for a long enough time (x months) to be considered “new-to-bank”.

What happens if you own a student credit card?

If you own a student credit card, you are considered as a primary cardmember.

This means that if you try to sign up for a regular credit card when you start working, you will not be considered as a new-to-bank customer.

Instead, you will be viewed as a returning customer, and not be eligible for credit card sign up rewards.

This is a huge bummer especially if you own the Citi Clear Visa or DBS Live Fresh Student Card, because Citibank and DBS tend to offer great sign up rewards.

But what are your options?

1: Keep & Upgrade

Your first option is to hold on to your student credit card and upgrade to a regular card when you start working and earn a regular income.

Banks usually make this process seamless for you, taking the initiative to upgrade you and give you a new card.

But this means losing out on the chance to earn any sign up rewards.

2: Cancel & Reapply

Your second option is to cancel your student credit card, wait out the period to be considered as a “new-to-bank” customer, and reapply for a regular credit card when you start working.

Doing this will make you eligible for any sign up rewards that the bank has to offer in the future.

This is exactly what I’ve decided to do.

Personally, I’m eyeing one of Citibank’s sign up rewards. The “probation” period to be considered a new-to-bank customer for Citibank is 12 months.

Having cancelled my Citi Clear Visa this month, this means I’ll only be eligible for Citibank’s sign up rewards from Feb 2022 onwards.

I’ll (hopefully) be entering the workforce this summer, but I’ll have to hold off on applying for a Citi credit card until next year – which is why I said I wish I’d cancelled my Citi Clear Visa sooner.

Other banks may have different durations for this requirement. For example, Maybank uses a period of 9 months.

It’s always best to check the terms and conditions of the sign up bonus to confirm such details.

Implications on Credit Score

If you’re familiar with how credit scores work, you’ll know that cancelling an existing credit card will damage your credit score.

Especially if this leaves you without any credit for a prolonged period of time, your credit score that you worked so hard to build will erode.

So what should you do?

The solution I adopted was to apply for another student credit card before cancelling my existing one.

I know this sounds like I am contradicting my whole point for cancelling your credit card, but hear me out.

Student credit cards are offered by 5 banks: DBS, Citibank, Maybank, CIMB and Standard Chartered.

And all of these banks offer their own variety of credit cards and corresponding sign up rewards.

Out of all these cards, there are bound to be ones that you are interested in, and others that you are not.

So if you know which bank’s credit cards you are least interested in getting when you start working, you can hold on to their student credit card until you graduate and not worry about missing out.

Personally, I feel that neither CIMB nor Standard Chartered have entry level credit cards that stand out in terms of earning miles.

That’s why I decided to apply for CIMB’s student credit card – because I don’t intend to sign up for any of their regular credit cards anytime soon, and therefore won’t miss out on any sign up rewards.

This opens up my options for credit card sign up rewards from every other bank that I may consider applying for in future.

At the end of the day, I cancelled 1 credit card and applied for another.

While this still damages my credit score, I am able to maintain an active line of credit and continue building my credit score, so the damage will be reversed soon enough.

The upside is that I will be eligible for Citibank’s credit card sign up rewards in the future – and that sounds like a good deal to me.

To summarise,

Student credit cards are great, but they shouldn’t impede your ability to maximise the value you stand to gain from credit cards in the future in the form of sign up rewards.

All it takes is a little planning ahead of time and doing some homework on the different credit cards offered by various banks.

Hopefully this post has made you think about the potential credit cards and sign up rewards you want to aim for in the future.

Will you be cancelling your student credit card? Let me know in the comments below!