If you’re into personal finance, you’ve probably heard and read a lot about investing.

Perhaps you know that you should start investing, but for one reason or another, you haven’t taken that first step.

There are certainly many reasons to be on the fence and have reservations about investing – I did too before I got started.

But there are also good reasons why you should just get started, even if you have doubts.

In this post, I’ll give you 3 reasons why you should take the first step and start investing ASAP.

1: Compound Your Wealth

Investing is probably the easiest way for anyone to build wealth in the long run.

Investing leverages the concept of compounding to snowball your money into a larger sum every time it generates positive returns.

Compounding is when your original sum of money generates money (via interest, capital gains, or etc), and that money is also able to generate money so that the total amount of money you have “working” for you has grown.

So you can easily multiply your money by letting it compound.

And, because of the way compounding works, its effects amplify over time.

A sum of money that has compounded over a period of 5 years will grow even more if left to compound for another 5 years, and so on, assuming that the rate of return is constant.

This means that the earlier you start investing, the more you stand to gain from it because you’ll be able to let your money compound over a longer period of time.

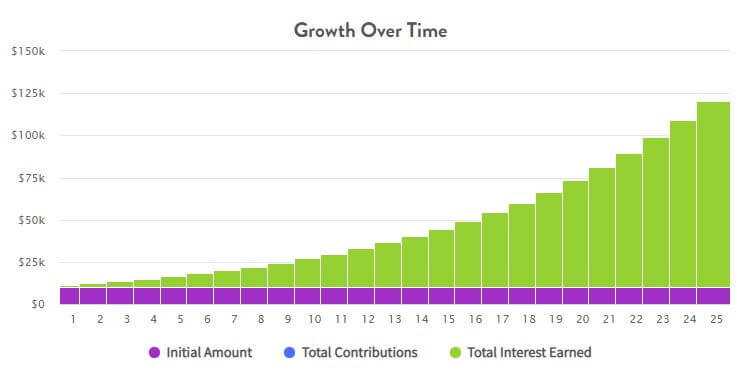

Let’s illustrate this with an example.

Say you make an investment of $10k and it returns 10% every year.

This is the trajectory of the growth of your investment.

Even if you never add another cent to your investment, you will double your money in 8 years and quadruple it in 15 years.

Of course, this is just an example, where the returns have been assumed to be positive and constant every year.

In reality, there may be years where your investment experiences losses and returns will vary every year.

But according to Investopedia, the average annual return of a diversified index like the S&P 500 is 10.5% over a period of 60 years.

This is even after accounting for years with negative returns, which makes the assumption of 10% annual returns a fair one, in my opinion.

Naturally, if you choose to invest in other assets, the returns you can expect would be different.

But what doesn’t change is the fact that investing allows you to accumulate wealth faster, and that the earlier you invest, the better it is for your future wealth.

2: Understand Your Risk Appetite

This builds off of the previous point because understanding how much risk you’re able to tolerate is key when it comes to building long term wealth.

It can help you remain calm and refrain from panic selling when a market crash comes – one of the largest pitfalls for long-term investing.

Since this is such an important factor in your investing journey, the sooner and the better you understand it, the better it is for you.

Even though you may have an idea of what your risk appetite might be like based on your understanding of yourself, there’s no way to know for sure until you start investing.

Once you have money invested and exposed to volatility, you can get a sense of your risk appetite by observing how market volatility affects you.

If you’re unfazed, your risk appetite is probably larger than the risk you’re exposed to, so you may want to consider taking on more risk.

If you feel uncomfortable but find it bearable, your risk appetite is likely close to the level of risk you’re exposed to.

If you find it hard to sleep at night and constantly feel anxious, you’re probably exposing yourself to more risk than you’re able to stomach, so you should probably explore options with less risk.

Understanding your risk appetite allows you to adopt appropriate portfolios and strategies and align your investment goals with your risk appetite.

This helps to maximise your investment performance while maintaining a risk level that you’re comfortable with.

3: Experience It For Yourself

If you’re like me, you grew up in an environment where no one taught you about finances and investing.

Not your family, not your friends – no one.

Most likely, you learned all about it on the internet, so you can’t help but develop some initial scepticism around the idea of investing to build wealth.

I mean, when they say that anyone can become rich in 20-30 years with simple index investing, it sounds too good to be true.

Because if it were true, why is it that not a single adult taught me about this?

So, there has to be a catch.

At least, that was my thought process when I was learning about investing for the first time.

But after doing more research and taking the first step to start investing, I realised that it is true.

Simple index investing over a long time horizon can make anyone rich – as long as they stay committed and don’t make stupid mistakes like trying to time the market.

There’s no catch.

That’s the way it’s been for over 100 years, and that’s the way it will continue to be for years to come.

But the idea of it can be hard for us to wrap our heads around, especially if we’re just learning about investing for the first time.

Experiencing it for ourselves by starting to invest can make it easier to understand.

Words Of Caution

Now, I’m not suggesting that you should jump into investing ASAP at the expense of doing proper research and learning.

What I am saying is that after you’ve developed a fundamental understanding of investing, rather than procrastinating and contemplating about it, just take the first step and start investing.

There’s only so much you can learn and read about investing without being invested yourself.

Once you’ve taken that first step, you’ll learn so much more about investing and how you can use it in your financial journey.

Even if you end up deciding that you’re not comfortable with investing, it was still worth taking that first step because you’d never have known otherwise.

When you do start investing, it’s always better to start small and safe.

That is, start with a small sum of money that you can afford to lose.

To minimise losses, you can let this be the minimum sum required to make your investment.

If you plan to be a DIY investor, this is probably going to be the cost of the minimum lot size of the ETF you wish to invest.

For example, if you want to invest in CSPX, the minimum lot size is 1 share, and it trades at 480 USD/share.

So your minimum investment would be ~480 USD, not forgetting to take into account fees for commission and FX conversion.

If you plan to use a robo-advisor, then this sum is dictated by the platform you choose.

It’s also better to start with less risky investments or investments that you expect yourself to be comfortable with.

You wouldn’t want to get traumatised by investing if you choose to invest in equities just before a market crash when you’re not able to tolerate such risk.

Then, you can slowly ramp up your investment sum and adjust the risk level of your portfolio accordingly as time goes on.

To summarise,

You should start investing ASAP after you’ve understood the basics of investing.

This will allow you to take advantage of compounding to build wealth earlier, understand your risk appetite sooner rather than later, and experience what it’s like to invest for yourself.

Start investing only with money you can afford to lose and in more conservative assets.

Have you started investing? Why or why not? Let me know in the comments below!