Fees are a bane of investing.

Investing comes with a myriad of fees that eat away at returns.

Minimising such fees is thus a point of interest for any investor, and there appears to be a way to do so with Interactive Brokers (IBKR).

In today’s post, I’ll tell you how you can avoid paying the currency conversion fee on IBKR and reduce the total fees by more than 50%.

What Is IBKR?

Most of you are probably familiar with IBKR by now as I frequently talk about them.

But for the benefit of those who aren’t, IBKR is a US-based brokerage firm that is popular among investors in Singapore.

The main reason for this is that IBKR charges the lowest commission fees for investing in Ireland-domiciled ETFs compared to the other brokers in Singapore.

The reason why Ireland-domiciled ETFs are particularly popular in Singapore is due to the withholding tax advantages they present compared to US-domiciled ETFs.

If you want to read more about this in detail, you can check out my post here.

IBKR also supports many different stock exchanges, offers spot-rate currency conversions, and has generally low commission fees.

What Fees Does IBKR Charge?

The most common fees you’ll encounter when investing with IBKR are the commission and currency conversion fees.

Other fees that you may encounter are more likely charged by the respective stock exchanges where the securities you are investing in are listed, or sales taxes like GST.

How Much Are IBKR’s Fees?

1: Commission Fee

The commission fees charged by IBKR are affected by 3 factors:

- Account pricing structure

- Stock exchange where the security is listed

- Currency in which the security is denominated

There are 2 pricing structures in IBKR – Fixed and Tiered.

By default, all accounts are on the Fixed pricing structure.

However, if your trading volume isn’t absurdly large, you will enjoy lower commission fees on the Tiered pricing structure.

I explained how you can change this setting in this post.

Next, commission fees vary between stock exchanges.

In cases where securities denominated in different currencies can be listed on the same exchange, this also impacts the commission fee.

Here are some examples of commission fees in different scenarios.

For trading on US stock exchanges, the commission fee is 0.35 USD for Tiered pricing and 1 USD for Fixed pricing.

For trading GBP-denominated securities on the London Stock Exchange (LSE), the commission fee is 1 GBP for Tiered pricing and 3 GBP for Fixed pricing.

For trading USD-denominated securities on the LSE, the commission fee is 1.70 USD for Tiered pricing and 4 USD for Fixed pricing.

You can find the full pricing schedule for IBKR here.

2: Currency Conversion Fee

Unlike commission fees, IBKR’s currency conversion fee is fixed at a rate of 0.002% per conversion (minimum 2 USD).

Bypass Currency Conversion Fee With Recurring Investments

Finally, let’s look at how we can avoid the currency conversion fee on IBKR.

It’s been noticed by several investors that by using IBKR’s recurring investment feature to invest, the currency conversion fee is not charged.

This is true even if a currency conversion was executed, ie from SGD to USD.

It’s not clear why exactly this happens, since IBKR’s website doesn’t specifically mention that this is a feature of their recurring investment feature.

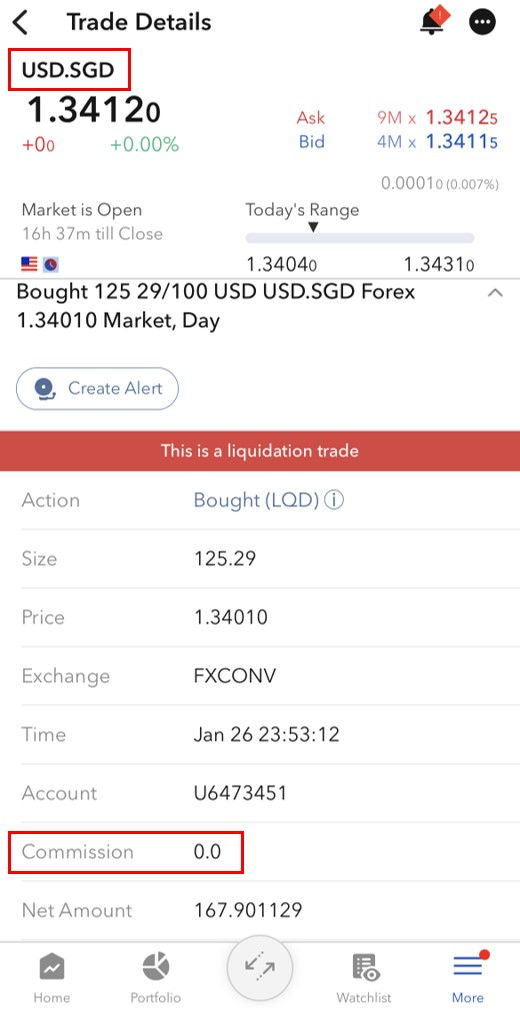

Nonetheless, there have been a lot of anecdotal reports of this, and I can confirm this is true after having tested it out for myself.

I placed a recurring investment order for VUAA which is denominated in USD.

However, the order value was higher than the existing USD funds in my IBKR account.

To complete the order, IBKR liquidated the SGD in my account to make up the shortfall of USD in the order.

As you can see from the screenshot above, the commission fee for this currency conversion was 0, which corroborates the reports of avoiding the currency conversion fee.

I considered the possibility of the fee being priced into the currency conversion, ie if it was deducted from my SGD/USD balance separately.

However, upon checking my account’s cash statements, there didn’t seem to be any discrepancies, which makes me confident that this “hack” works.

You might be wondering – what if you only want to make 1 trade, ie you don’t want to make a recurring investment? Can you still take advantage of this?

The answer is yes.

IBKR’s recurring investment feature allows you to set up a recurring investment, but you can customise it such that you only end up making 1 investment.

In other words, even if you don’t plan to make a recurring investment, you can still make use of this hack to skip the currency conversion fee for your trade.

You can find more details about IBKR’s recurring investment feature here.

Up To 85% Savings In Fees

Being able to avoid the currency conversion fee of 2 USD can allow us to save up to 85% in trading fees.

If you actively invest in stocks/ETFs listed on the US market, then your trading fee of 0.35 USD (commission) + 2 USD (currency conversion) is now simply 0.35 USD.

That’s a huge reduction in fees!

Essentially, the trading fee is now equal to the commission fee, regardless of which market you are trading on.

Given that the currency conversion fee of 2 USD is quite large compared to the IBKR’s commission fees, this is a hack that you should take advantage of while it lasts.

How To Set Up Recurring Investment On IBKR

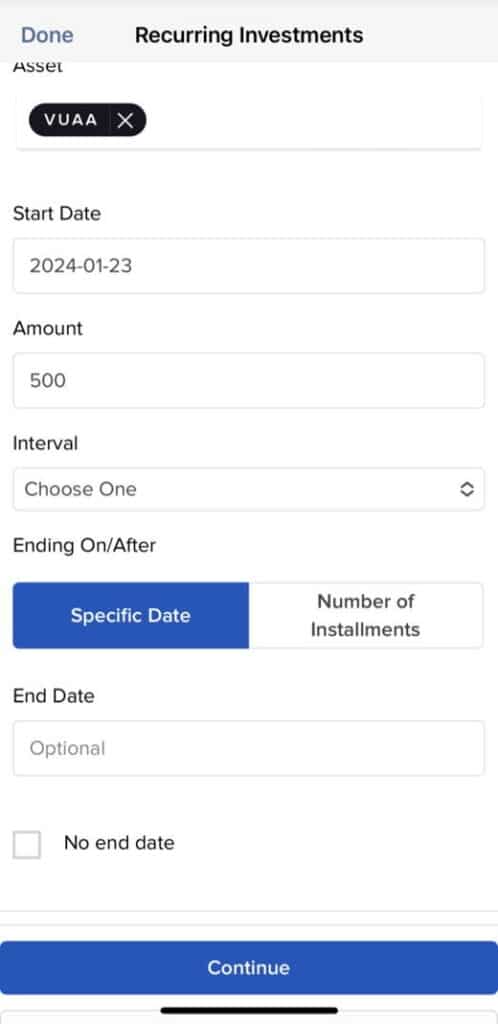

To set up a recurring investment on IBKR, login to the client portal and navigate to “Trade” > “Recurring Investment“.

Create a recurring investment and configure the settings as you desire.

First, under “Asset”, search for the stock/ETF you wish to invest in.

Next, select the start date of your investment. Note that the earliest date you can select is the next trading day, ie you cannot select the current date.

Then, enter the amount you wish to invest during each recurrence.

If you only wish to make 1 investment, this should be the amount you wish to invest.

Select the periodic interval at which you want to invest.

This can be daily, weekly, monthly, etc.

If you only wish to make 1 investment, you can select “Daily“.

Next, you can choose whether you want to specify an end condition for your recurring investment.

This can be either a specific date or the number of recurrences.

If you only wish to make 1 investment, you can select “Number of Installments” and enter 1.

Once you have entered all the details, confirm your recurring investment to place the order.

After your recurring investment is created, it will be executed on the specified starting date.

What If You Don’t Have Enough Cash?

If you do not have sufficient funds in the currency that the stock/ETF is denominated in, cash from your other currencies will be liquidated to make up the shortfall, similar to what happened in my test.

To summarise,

By making use of IBKR’s recurring investment feature, it’s possible to avoid the 2 USD currency conversion fee that they charge, making investing via IBKR even cheaper than it already is.

This can be done even if you only wish to make a one-off investment – you don’t have to make a recurring investment, you just have to use the recurring investment feature.

It’s unclear whether this will be a permanent feature of IBKR’s recurring investments, but you might as well take advantage of it while it lasts.

Will you be using this hack to save on fees? Let me know in the comments below!

18 replies on “How To Avoid Currency Conversion Fee On IBKR”

If I buy fractional shares instead of a recurring investment, will I incur the same commission and have the currency conversion fee “waived”?

Hey John,

Thanks for checking out my blog and for leaving a comment!

I haven’t tried it myself, but I believe that won’t work. If you try to make a normal investment, you will need to have sufficient funds in the required currency before you can place the order, which means you would need to already have converted your currencies and paid the currency conversion fee.

Hope this helps!

Dear Frugal Student,

I have been placing orders on IBKR for past three years. Wish had seen/read your blog post earlier. Will try out on next purchase.

Thanks for the insight.

Appreciate it.

I avidly read your weekly posts.

Hey Gaurav,

Thanks for supporting my blog all this time! I really appreciate it 🙂

Don’t feel too bad about this as I believe this feature is relatively new (<1 year), so you probably didn't miss out on much.

Happy weekend!

Hi, great post.

I’m interested in investing on US shares, i’m from Portugal.

So to avoid paying these fee i need to deposit funds in Euros and do a recurring investment and they convert my currency automatically?

Hope for your reply

Hey David,

Thanks for checking out my blog and for leaving a comment all the way from Portugal!

I’m not sure if the behaviour of the recurring investment feature works the same for the version of IBKR that you use in Portugal, but you could try it out and see how it goes.

You can also try researching on personal finance blogs/communities that are catered specifically for Portugal and see if people report the same behaviour.

Hope this helps & all the best!

Hi, I’m just looking for the lowest fee to exchange recurring small amounts of CAD to USD now that I have retired to the US. Do you know if there’s away to do that with IB? I’m not stock Davy and no desire to trade stocks.

Thanks

Hey Cindy,

Thanks for checking out my blog and for leaving a comment!

IBKR certainly has good exchange rates, but I’m not sure if it provides the lowest fees in the US (as I’m unfamiliar with other options in the US).

Also, there have been reports of people getting their IBKR accounts suspended for using it to convert currencies without investing, so I’m not sure this is a valid option for you.

Sorry I couldn’t be more helpful, but perhaps directing your question to Personal Finance communities that are based in the US would yield better results.

All the best!

Hi TFS, great write up!

Just wanted to clarify a little, when I set up a recurring investment to purchase an ETF at an amount lower than the share price, will they make a fractional purchase at the amount i set it to? ie. Recurring investment of $100 means purchasing a fractional share worth $100

In my case, I’m looking to DCA into CSPX – am i right to say that the fees will be 1.70USD*12 + 0.34%*total sum invested?

Thank you for your insightful posts!

Hey Kelly,

Thanks for checking out my blog and for leaving a comment!

Yes, if you set up a recurring investment based on amount instead of number of shares, you will be buying fractional shares so that the entire amount gets invested.

Yes, your understanding of the fees is correct as well. However, as I explained in my reply to your previous comment, the fees for investing with IBKR will be significantly higher than if you use Syfe Trade based on your current situation, and it would take a while before IBKR becomes cheaper than Syfe Trade. If you don’t mind paying the higher fees during this time in exchange for not needing to switch brokers in the future, then go ahead – this is just something for you to consider.

Hope this helps & all the best!

Hi TFS, can i check on the fees on DCA-ing to IBKR CSPX, for the part on 0.34%*total sum invested, where does this portion comes from?

Hey crs,

Thanks for checking out my blog and for leaving a comment!

The comment you saw on 0.34%*total sum invested comes from a previous post that I wrote, where I was trying to quantify the cost of owning CSPX.

Hope this helps!

Hi there,

This is a very informative post. Very well done!

On the IBKR website, it is stated that each investor in an ETF/stock who uses the Recurring Investment feature will receive the same Volume Weighted Average Price (VWAP) at the end of the day. IBKR says it uses its “best-effort” VWAP algorithm.

My question is: does VWAP price execution for recurring investments tend to result in relatively worse fills? For example, if the investor wishes to purchase the Ireland-domiciled CSPX periodically, does the comparative lack of liquidity of CSPX (relative to US-domiciled ETFs like VOO/VTI) mean that the investor will be buying at significantly higher prices using VWAP? Would it be better to save up cash, convert currency into USD in one go, and purchase CSPX using limit orders instead?

Hey Yoyomaster,

Thanks for checking out my blog and leaving a comment! I’m glad you enjoyed my post.

To be honest, this is the first time I’m hearing about the VWAP algorithm, so I haven’t done any research on the impact of this on the fill price of recurring investment orders.

It would be an interesting experiment to schedule a recurring investment on 1 day, and also make a limit order on the same day to see the price deviation in both cases. If you do such an experiment, I’d love to hear your findings!

Hello! I’ve just made my first purchase of CSPX stock following your guides, through SGD to USD conversion in DBS multiplier acc > depositing USD to my IBKR acc > Buying 1 CSPX stock at market price. I realised there is a commission fee of USD $2.08. Do you know if this is a conversion fee or something else? And how can this be avoided? It differs from your $0 commission fees.

Hey John,

Thanks for checking out my blog and for leaving a comment!

This article explains how the currency conversion fee (normally 2 USD) can be bypassed by using the recurring investment feature on IBKR. If you had placed a normal order (not recurring), you wouldn’t be able to bypass this, and you would be charged the commission fee. Since you mentioned that you deposited USD into IBKR, you probably didn’t incur this fee regardless.

Another source of fees is the brokerage commission fee. For USD-denominated ETFs listed on the LSE such as CSPX, this fee is 1.70 USD if you’re on tiered pricing. This commission fee cannot be bypassed.

Finally, there are exchange clearing fees that are applicable by the LSE.

Based on your incurred commission fee of ~2 USD, it is likely due to the commission fee + clearing fees + GST, which is in the expected fees to be incurred.

Hope this helps!

Hi TFS,

I came across your great content not long ago, it has been really useful. Can you advise on the desktop generated statement in IBKR, where do you look for this currency conversion fee to see if it was applied or “waived”. Thank you and look forward to more great posts!

Hey Magalan,

Thanks for checking out my blog and for leaving a comment!

I don’t think any line in your statement would reflect that your currency conversion fee is waived. Rather, it is just never incurred, so the only fees incurred should be the brokerage commission fee + exchange fees + GST.

You can check it by looking at your trade details and seeing how much fees were incurred. E.g. if you make a small trade and expect to only incur the minimum commission fee, your total fee for the trade should be quite close to the minimum commission fee. The currency conversion fee is normally 2 USD, so it would result in a noticeable difference if it was charged.

Hope this helps!