If you’ve read up about ETF investing as a Singaporean, you’re probably familiar with the topic of Ireland-domiciled ETFs vs US-domiciled ETFs.

It’s broadly agreed that being invested in 1 of these ETFs is more advantageous than the other.

But this doesn’t mean that we should blindly accept it and let it dictate our investing choices.

After all, there are more things that we should consider when deciding on an investing strategy like how much it costs to invest and how often you can invest.

I’ve actually written posts about this topic in the past, but things are slightly different now that brokers are offering zero-commission trading.

Today, I’ll provide my updated analysis about whether it’s better to invest in Ireland-domiciled ETFs compared to US-domiciled ETFs.

In particular, I’ll be using the ETFs CSPX (Ireland-domiciled) and VOO (US-domiciled) to draw comparisons, both of which are S&P 500 ETFs.

Overview

In general, it’s agreed that investing in Ireland-domiciled ETFs is better than US-domiciled ETFs for Singaporean investors.

There are 2 main reasons for this.

1: Lower Dividend Withholding Tax

The dividend withholding tax rate for Ireland-domiciled ETFs is only 15% as compared to 30% for US-domiciled ETFs.

This tax applies to all dividends being paid out and depends on the country of both the payer and the payee.

In the case of ETFs, there are always 2 payer-payee pairs involved.

The first is the underlying stocks of the ETF, like Apple in the case of an S&P 500 ETF (payer) and the ETF itself (payee).

The second is the ETF (payer) and the investor (payee).

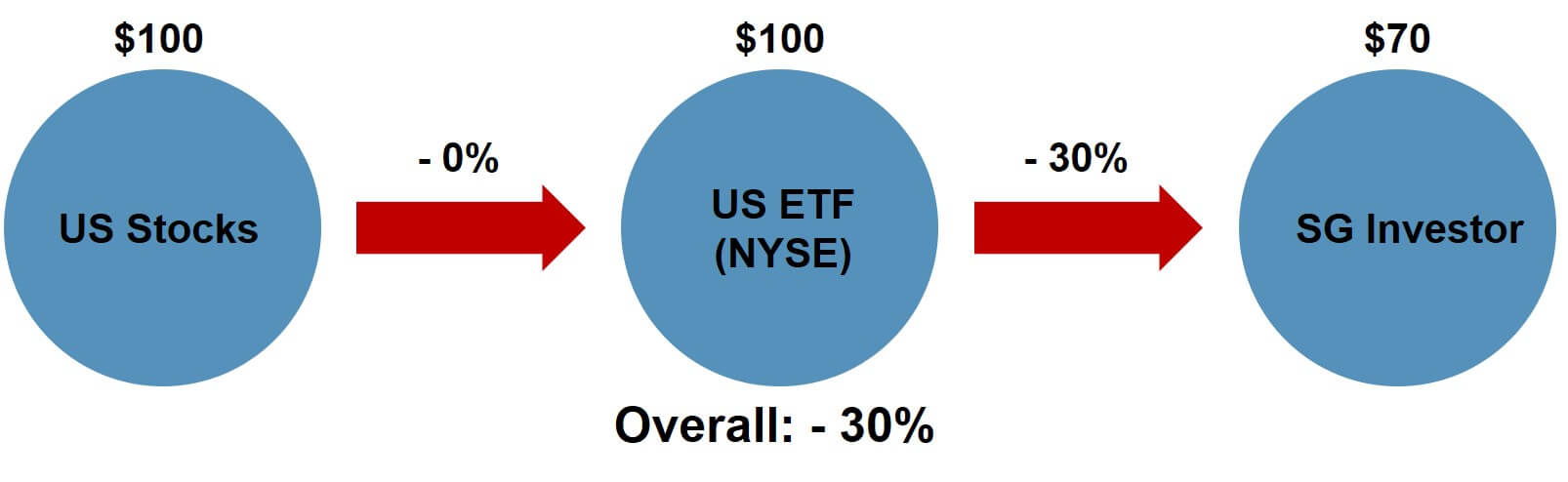

In the case of an S&P 500 ETF that pays, for example, $100 in dividends, this is the effect of withholding tax on investors.

US-Domiciled ETF:

Ireland-Domiciled ETF:

As you can see, Ireland-domiciled ETFs are more favourable for investors when it comes to dividends.

2: Accumulating ETFs

Next, Ireland-domiciled ETFs have the possibility of being Accumulating ETFs, while US-domiciled ETFs are typically Distributing ETFs.

US-domiciled ETFs are required by law to pay out at least 90% of dividends to investors, while there is no such law in Ireland.

There isn’t a whole lot of difference between Accumulating and Distributing ETFs that track the same index.

After all, the underlying stocks and portfolio allocation should be the same.

Still, Accumulating ETFs tend to be more favoured among investors who are seeking to, well, accumulate wealth.

This is because they remove the need for investors to reinvest dividends on their own, which is convenient and reduces idle cash.

It also means that dividends are reinvested into the market more quickly as compared to reinvesting the dividends on your own, as with a Distributing ETF.

These slight differences make Accumulating ETFs slightly more efficient at building wealth than their Distributing counterparts.

You can read more about their differences in my post about Accumulating VS Distributing ETFs.

Other Things To Consider

So far, the points above only focus on the ETF aspect of investing.

But this doesn’t mean that it’s strictly better to invest in Ireland-domiciled ETFs.

This is because we need to account for the big picture and there are other things to consider regarding your investing strategy.

Brokerage fees are an important factor to think about as well.

Brokerage Fees

Brokerage fees commonly comprise commission fees, platform fees, and foreign exchange (FX) fees.

US-domiciled ETFs can be traded on US exchanges like the New York Stock Exchange (NYSE).

More often than not, commission fees for investing on US exchanges are the cheapest.

There are even several brokers in Singapore that offer zero-commission trading for US markets.

This makes brokerage fees extremely low and reduces investing costs.

Investing in the London Stock Exchange (LSE), which is the exchange in which Ireland-domiciled ETFs can be traded, is not quite as cheap.

Platform fees may or may not be charged by brokers, and FX fees may be upfront costs or implicit costs by pricing it into the exchange rate.

Fractional Shares

Fractional shares are now supported for both US- and Ireland-domiciled ETFs.

Usually, shares are traded in whole – meaning that you can only trade shares in whole numbers.

As a result, the minimum amount you need to invest in a share would be the cost of the minimum trading quantity, which is usually 1, ie the share price.

It also means that you can only invest in increments of that price since you’d be forced to buy the shares in whole units.

Fractional shares allow us to invest in a fraction of a share, which means that we don’t need to trade shares in whole numbers.

This is an advantage when share prices are high because it reduces the “barrier to entry”, which is usually the price of 1 share.

It also allows you to invest all of your cash to minimise idle cash since you’re able to trade shares in fractions.

For example, if an ETF costs $600 and you only have $500, you wouldn’t be able to invest at all.

With fractional shares, you can invest your $500 into that ETF by owning a fraction of it rather than a single unit.

Or, if you have $1000 to invest, you’d normally only be able to buy 1 share and have $400 leftover.

Fractional shares will allow you to invest $1000 by owning 1.67 shares.

Generally, fractional shares are supported for US-domiciled ETFs, but not for Ireland-domiciled ETFs.

Comparison – CSPX vs VOO

To decide whether Ireland-domiciled ETFs are better than US-domiciled ETFs, I’ll do a comparison of the whole investing process for each case.

The ETFs I will use are CSPX and VOO, both of which are S&P 500 ETFs that track the same index, as they are some of the most popular ETFs.

Choosing The Brokers

First, we need to decide which broker to use when investing in CSPX and VOO respectively.

CSPX trades on the LSE and VOO trades on the NYSE.

I’ve written a post on the best broker for investing on the LSE, and that’s Interactive Brokers (IBKR) due to their low commission fees.

You can check out my guides on IBKR here.

Note: if you’re a priority banking customer with Standard Chartered, you might want to use Standard Chartered’s online trading instead as the minimum commission fee is waived

As for investing on the NYSE, I’ll look at brokers that offer zero-commission trading, since that will play a part in minimising investing costs.

Based on my previous post comparing various zero-commission brokers, the best option here is Syfe Trade.

You can check out my review on Syfe Trade here.

I’ll also consider the case of using IBKR to invest in VOO since the fees are still reasonably low and might even be cheaper than Syfe Trade with all things considered.

Assumptions

Before we dive into the comparison analysis, we need to make some assumptions about the investing behaviour and strategy that will be adopted.

First, I will assume that investments will be made monthly, as per a dollar-cost-averaging (DCA) strategy.

Next, I will assume that investments are made in only 1 ETF each month, which is either CSPX or VOO.

I will also assume that SGD is deposited into the brokerage account and converted to USD within the brokerage platform on the same month that the investment is being made.

Finally, I will assume that we can ignore the effect of ETF performance since both CSPX and VOO track the same index.

Brokerage Fees

Let’s first take a look at the fees incurred from each brokerage platform.

Neither IBKR nor Syfe Trade charge a platform fee.

IBKR charges a minimum commission fee of 1.70 USD or 0.35 USD depending on the country of the exchange and an FX fee of 2 USD.

Syfe Trade offers 2 free trades every month and doesn’t charge any upfront FX fees but has implicit FX fees in its conversion rates.

As of writing this post, this implicit FX fee stands at ~0.37%.

In other words, the total brokerage fees incurred from IBKR and Syfe Trade are 3.70 USD/2.35USD and 0.37% of the sum invested respectively.

| IBKR (LSE) | IBKR (NYSE) | Syfe Trade | |

|---|---|---|---|

| Commission Fee | 1.70 USD | 0.35 USD | Free |

| FX Fee | 2 USD | 2 USD | 0.37% |

| Total | 3.70 USD | 2.35 USD | 0.37% |

Note: The fees quoted for IBKR are based on the minimum per order. You can find IBKR’s pricing structure here and Syfe Trade’s pricing structure here.

Remember how I mentioned earlier that IBKR might be cheaper than Syfe Trade even after accounting for the latter’s zero-commission pricing?

That’s because of Syfe Trade’s implicit FX fee of 0.37%.

Depending on how much you are converting, it might be cheaper to pay the upfront fees on IBKR to enjoy a better conversion rate.

This is true when 0.37% of the amount you’re converting is equal to or greater than 2.35 USD – or 2.35/0.37% = 635 USD = 850 SGD.

ETF Costs

There are 2 types of costs or fees that ETFs are subjected to.

The first is the expense ratio, which is a fee that is charged for the management and upkeep of the ETF.

This is 0.07% for CSPX and 0.03% for VOO.

Next, there is a dividend withholding tax that is imposed on the dividends that are paid out by the ETF.

As mentioned earlier in the post, this tax is 15% for CSPX and 30% for VOO.

However, this does not mean that the effective cost to investors is 15% and 30% respectively.

This tax is applied only on the dividends that are paid out, ie the dividend yield of each ETF.

For example, if VOO’s dividend yield is 1%, the effective cost of the 30% withholding tax is 0.3%.

According to Morningstar, the dividend yield of CSPX and VOO is 1.80% and 1.88% respectively.

| CSPX | VOO | |

|---|---|---|

| Dividend Yield | 1.80% | 1.88% |

| Withholding Tax Rate | 15% | 30% |

| Effective Cost | 0.27% | 0.56% |

Factoring in the dividend withholding tax rate for CSPX and VOO, the effective cost of this tax is 0.27% and 0.56% respectively.

This brings the total ETF costs for CSPX and VOO to 0.34% and 0.59% respectively, based on the sum invested.

| CSPX | VOO | |

|---|---|---|

| Expense Ratio | 0.07% | 0.03% |

| Withholding Tax | 0.27% | 0.56% |

| Total | 0.34% | 0.59% |

Total Investing Costs

Let’s put together the total investment costs for each scenario.

CSPX/IBKR

For investing in CSPX via IBKR, the total cost is 3.70 USD per trade + 0.34% per year of the total sum invested.

To compare the costs, we need to annualise the cost of the brokerage fees.

Since 3.70 USD is the cost per trade, and 1 trade is placed per month, the annual cost of the brokerage fee is 3.70 * 12 = 44.40 USD.

This means the annual investing cost of CSPX via IBKR is 44.40 USD + 0.34% of the total sum invested.

VOO/IBKR

Following a similar approach for investing in VOO via IBKR, the annual cost of the brokerage fee is 2.35 * 12 = 28.20 USD.

This means the annual investing cost of VOO via IBKR is 28.20 USD + 0.59% of the total sum invested.

VOO/Syfe Trade

For investing in VOO via Syfe Trade, the total cost is 0.37% of the total amount invested each year + 0.59% of the total sum invested.

Which Is Cheaper?

Now that we’ve totalled up the investment costs for each scenario, which is the cheaper option?

Based on the total costs, we can see that the final comparison for CSPX/IBKR VS VOO/IBKR VS VOO/Syfe Trade is 44.40 USD VS 28.20 USD + 0.25% VS 0.37% of the total amount invested/year + 0.25%.

CSPX/IBKR VS VOO/IBKR

In this case, we can further simplify the comparison to 16.20 USD VS 0.25% for CSPX VS VOO.

This means we are comparing a fixed brokerage fee of 16.20 USD against an annual percentage-based cost of 0.25%.

Due to the way that a percentage-based cost works, it is advantageous when your total invested sum is small but disadvantageous when your total invested sum is large.

In other words, it makes sense that investing in VOO will be the more economical option initially.

Eventually, it will tip in favour of investing in CSPX when the annual cost of 0.25% outweighs the fixed brokerage fee of 16.20 USD.

We can determine this tipping point by taking 16.20/0.25% = 6,480 USD = 8,680 SGD.

This means that if you have less than 6.4k USD or 8.6k SGD invested, VOO is the cheaper option; if you have more than 6.4k USD or 8.6k SGD invested, CSPX is the cheaper option.

CSPX/IBKR VS VOO/Syfe Trade

In this case, we are comparing a fixed brokerage fee of 44.40 USD against 0.37% of the sum invested per year + an annual percentage-based cost of 0.25%.

Similar to the scenario above, investing in VOO via Syfe Trade will be the more economical option initially, but CSPX/IBKR will eventually become the cheaper option.

Determining the tipping point in this case is a bit more tricky since there are now 2 variables at play – the amount invested each year and the cumulative invested amount.

As a result, there isn’t a single answer as to when Syfe Trade will be more expensive than IBKR.

However, if you’re deliberating between these 2 options, this is the formula you can use to determine the cost of investing in Syfe Trade:

0.37% * (total amount to invest/year) + 0.25% * (total amount invested)

If this sum exceeds 44.40 USD, then Syfe Trade is more expensive than IBKR, and vice versa.

Which Is Better?

So, we’ve concluded that CSPX/IBKR is always going to be the cheaper investing strategy in the long run.

Now that fractional shares are also supported for CSPX and many other Ireland-domiciled ETFs, it’s clear that CSPX/IBKR is the winner in this case.

My Verdict: CSPX/IBKR

I think CSPX/IBKR is the best option.

For one, the tipping point at which CSPX/IBKR becomes cheaper than VOO/IBKR and VOO/Syfe Trade is at a fairly low sum (<10k SGD).

Most of us will be able to hit this amount reasonably quickly once we start investing, so we will start enjoying the cost savings from CSPX early on in our investing journey.

Next, both VOO/IBKR and VOO/Syfe Trade incur additional percentage-based costs as compared to CSPX/IBKR.

Percentage-based costs grow in tandem with your portfolio value – so as your investment grows, does the cost.

Meanwhile, CSPX/IBKR incurs more fixed brokerage costs, which will likely remain largely constant throughout your investment horizon.

The result is that there will be a growing divergence between the fixed brokerage cost and percentage-based costs as time passes and your investment portfolio grows in value.

Remember also that every additional dollar paid to fees is a dollar that you’re not able to compound.

This can easily add up to tens or hundreds of thousands of dollars over an investment horizon of 30 – 40 years!

To invest in Ireland-domiciled ETFs, Interactive Brokers is a reputable and affordable broker you can use.

You can check out my guides on IBKR here.

To summarise,

Even with cheaper or zero commission fees for US market trading, investing in Ireland-domiciled ETFs still results in the greatest cost savings over time.

Now that Ireland-domiciled ETFs have fractional shares support as well, there’s not much reason to choose US-domiciled ETFs.

Are you investing in Ireland-domiciled ETFs or US-domiciled ETFs?

Let me know in the comments below!

43 replies on “CSPX vs VOO: Is Investing In Ireland-Domiciled ETFs Better?”

Dear TFS,

Thank you again for the informative content. I am passionate about DCA-ing into a S&P 500 ETF. At the moment I am using IBKR to buy IVV, but will likely change to an Ireland-domiciled one. Have you thought about VUAA (Vangaurd) as opposed to CSPX (Blackrock)? Both are London-listed, Ireland-domiciled, USD-priced, accumulating S&P 500 ETFs with the same 0.07% expense ration. CSPX is priced at 435 USD and VUAA at 78 USD. CSPX has a higher daily volume of 83k vs VUAA 50k. However as IBKR has a limit order function, which I always use, I dont expect the difference in bid-ask spreads from the difference in daily average volume to matter. Would you go for CSPX, or VUAA? Thank you once again for your time 🙂

Christopher

Hey Christopher,

Thanks for checking out my blog and leaving a comment!

Yes, I am aware that there is an alternative to CSPX in VUAA, and they are both very similar.

Personally, I don’t have a particular preference towards either, but I tend to reference CSPX more as it is generally more well-known. VUAA is useful because of its lower share price which makes the barrier to entry much lower, and I’d recommend it if the share price of CSPX makes investing in it difficult.

I agree with you that I don’t expect the difference in trade volume and bid-ask spread to have much impact. At the end of the day, I think it’s up to personal preference whether one goes for VUAA or CSPX.

Hope this helps! All the best with your investing journey!

Dear TFS ,

Its quite a thought provoking article with a lot of insights, researches and helpful examples. Thanks a lot for your efforts and time to come up with this useful peace of information.

I am currently using IBKR and started DCA monthly on CSPX and VGT as 40/60 ratio.

Do share your thoughts. Many thanks in advance.

Hey Fahad,

Thanks for checking out my blog and leaving a comment! I’m glad you’ve found my posts helpful 🙂

Personally, I don’t think there’s much that needs to be said on your portfolio – CSPX and VGT are both fine ETFs to invest in.

However, I’m not sure that I would weight VGT higher than CSPX, since this means that there is a degree of “stockpicking” in your portfolio – where you are specifically overweighting your portfolio towards tech stocks, presumably because they have performed extremely well in the last decade. Nothing inherently wrong with it as long as you understand what you’ve done and can accept that you’re at higher risk towards tech stocks.

Hope this helps & all the best!

Hi TFS,

Following up my response from a separate post:

How would you compare recurring investments of CSPX through IBKR vs Blackrock Ishares through Endowus?

Fees for Endowus would be:

0.3% via fundsmart and 0.9% expense ratio of Blackrock Ishares.

compared with CSPX via IBKR:

commission fee, fx fee, bid offer spread, 15% withholding tax, 0.7% expense ratio

Note that Blackrock Ishares is registered with MAS and is SGD denominated, therefore there is no FX cost unlike CSPX. Endowus does not take a spread or charge clients anything on the FX conversion.

Ishares is also a synthetic replication of the S&P500, and not a physical replication like CSPX. This means that Ishares is subjected to zero dividend withholding tax compared to 15% for CSPX

Hi Miguel,

Good to hear from you again! Thanks for checking out my blog.

I’m assuming that the Blackrock iShares fund you’re referring to is IE0000F26BG9, which I found at this link. Also, I think you meant that the expense ratios for the Blackrock fund and CSPX are 0.09% and 0.07% respectively (instead of 0.9% and 0.7%).

Cost for Blackrock iShares/Endowus: 0.3% + 0.09% = 0.39% / year

Cost for CSPX/IBKR must be broken down into fixed brokerage costs and annual fund costs.

Fixed brokerage cost / trade: 1.70 (commission) + 2 (FX) = 3.70 USD

Fixed brokerage cost / trade + GST: 1.08*3.70 = 4 USD

Annual brokerage cost (assuming 1 trade / month): 4 * 12 = 48 USD

Annual fund costs: 15%*1.80% (withholding tax on dividend yield) + 0.07% (expense ratio) = 0.34% / year

Total cost for CSPX/IBKR: 48 USD + 0.34% / year

Comparing the final cost for each scenario, CSPX/IBKR seems to be the final winner as it has a lower % cost, which as I explained in my post, will contribute more significantly to the total cost as your portfolio increases.

Of course, this is assuming that the performance of both funds is the same. Even though the synthetic Blackrock ETF is designed to replicate the performance of S&P 500, it might outperform or underperform against it.

Also, it should be mentioned that the risk level of a synthetic ETF is generally higher than that of a physical ETF. So you also need to take into account your risk appetite if you are considering investing in a synthetic ETF.

Hope this helps!

Hello TFS! I find this comparison with Blackrock iShares/Endowus vs CSPX/IBKR interesting because I was looking into this and trying to calculate the difference myself.

Following your logic above, am I right to say that the breakeven point (assuming both funds’ performances are the same) will be 48USD / (0.38-0.34) = 96,000 USD invested before CSPX/IBKR would be better than Blackrock iShares/Endowus?

Hey Josh,

Thanks for checking out my blog and for leaving a comment!

Yes, you are spot on in your calculation of the breakeven point being 96k USD.

Dear TFS,

I’m constantly seeing investing in cspx with interactive broker. Is it reliable? I read horror stories on them asking people to fill in forms aft forms once in a while. Any idea?

Hey Fengyi,

Thanks for checking out my blog and leaving a comment!

From my experience, I haven’t needed to fill up any physical forms since I’ve signed up and started investing, though there are some forms you need to fill up when signing up for an account.

Hope this helps!

Hello author,

First of all I want to say that you are doing an AMAZING job! Very thankful that I cam across your posts – bookmarked them.

I have 3 questions. Pls help me clarify based on my calculations below.

VOO:

——–

Assuming, an investment amount of 10000 USD at a shot in a year and going to leave it for long-term. May be will re-invest another 10000 USD every year – but planning no monthly trades.

Expense Ratio = 0.07 %

Dividend Yield = 1.88 %

Withholding Tax Rate = 30 %

Fixed brokerage cost / trade: 0.35 (commission) + 2 (FX) = 2.35 USD

Fixed brokerage cost / trade + GST: 1.08*2.35 = 2.538 USD —> Assuming GST is 8%

Annual brokerage cost (assuming 1 trade (more of investment)/ year in my case): 2.538

Annual fund costs: 30% * 1.88% (withholding tax on dividend yield) + 0.03% (expense ratio)

(30% * 1.88% * 10000) + (0.03% * 10000) = 59.4 USD

CSPX:

—–

Assuming, an investment amount of 10000 USD at a shot.

Expense Ratio = 0.07 %

Dividend Yield = 1.80 %

Withholding Tax = 15%

Fixed brokerage cost / trade: 1.70 (commission) + 2 (FX) = 3.70 USD

Fixed brokerage cost / trade + GST: 1.08*3.70 = 4 USD

Annual brokerage cost (assuming 1 trade (more of investment)/ year in my case): 4 USD

Annual fund costs: 15% * 1.80% (withholding tax on dividend yield) + 0.07% (expense ratio)

Assuming the investment amount is 10000.

(15% * 1.8% * 10000) + (0.07% * 10000) = 34 USD

Pls me clarify the below.

Q1. Is my calculation correct for both the above cases?

Q2. How did you consider GST as 8% for brokerage cost in one of your previous comments? Is IBKR going to charge based on SG tax rate since my IBKR registered location is SG? or is the GST going to be based on the stock denomination (USD)?

Q3. How does the CSPX auto-reinvestment of dividends work? I understand CSPX does not allow fractional shares.

Assuming that my dividend after witholding tax is eliminated is 27 USD, how will they re-invest it provided no fractional shares? coz one share costs around 474 USD now.

Hey Karthi,

Thanks for checking out my blog and for your kind words – I’m glad you’ve enjoyed my posts!

1. Your calculations seem to be correct!

2. GST of 8% is charged by Singapore because IBKR is operating its services in Singapore. Even if the transaction is denominated in USD, the same tax rate of 8% will apply.

3. The reinvestment of dividends by CSPX happens at the fund level, not at the shares level. Ie if the fund (CSPX) earns $100,000 in dividends, it will reinvest those dividends by buying more of the underlying stocks of the S&P 500. The result is that each share of CSPX is now worth more than before because each share of CSPX is now made up of more units of each underlying stock. On the investor’s side (our side), we will not see any increase in number of shares, but we should see an increase in share value.

Hope this helps!

Dear TFS,

Firstly, truly appreciate your content, it’s incredibly insightful! I just have a quick question.

I’m planning to DCA VOO/CSPX monthly with USD500 (which should get me a share at least). I’m on tiered instead of fixed on IBKR. I do prefer accumulating, and CSPX is thus the logical option, but given the higher commission fees for CSPX, do you suggest I buy 2 shares of CSPX every two months, thereby bypassing the higher commission fee instead of getting 1 share of CSPX a month? Or should I go for 1 share of VOO a month?

Hey Suraj,

Thanks for checking out my blog and leaving a comment!

Your concern on commission fees is valid. What you should do depends on what matters more to you. If you think owning an Accumulating ETF vs a Distributing ETF is more important, then go with CSPX. But if you think that investing in the market every month is more important, then go with VOO.

If you want to go with CSPX, then I would recommend buying 2 shares every 2 months instead of 1 share every month. If you decide on VOO, buying 1 share every month is fine.

Another point worth factoring in is the FX fee for converting SGD to USD (assuming you don’t have a steady flow of USD to invest with). This fee is 2 USD, which will add to the commission fees whenever you want to invest.

Hope this helps!

Hi Frugal Student, Thank you so much for the detailed blogs, they have been very useful to me. Can I check with you if there is a way to automate the investment into CSPX via IBKR? Recurring Investment is not allowed for CSPX since it cannot be bought in Fractions. I am finding it difficult to track and monitor when to buy the ETF in a month, is there a way to automatically buy in at a particular date in a month, which over a investment horizon of 10-20 years should help in DCA. Or am I missing any basic point here 🙂 Thanks!

Hey Nisha,

Thanks for checking out my blog and for leaving a comment! I’m glad you’ve enjoyed my content 🙂

You’re not missing the point; in fact, you’ve nailed the point quite well. To my knowledge, there is no way to automate investments into CSPX on IBKR right now, so the only way is to do it manually.

If you’re having trouble remembering when to do it, you can consider setting up a monthly-recurring reminder on your phone to remind you to DCA into CSPX. If you think this is too much of a hassle, it might be worthwhile considering reducing your DCA frequency to bimonthly or quarterly. This way, you spend less time actively investing, and you get to save on brokerage fees too.

Hope this helps and have a great week ahead!

Dear TFS,

Thank you for such a wonderful update to the voo vs cspx topic. Appreciate your hardwork! It is definitely a blessing to the society. I would like to ask if investing into CSPX through ibkr is still worth it if I can invest into VOO with zero commission and zero fx fees(truely zero fees)? Thank you!

Hey Romeo,

Thanks for checking out my blog and for leaving a comment, I’m glad you’ve found my posts helpful!

If you have a way to invest in VOO through a broker that offers 0 commission fees and FX fees, that means you’re effectively able to omit all broker-related fees when investing with VOO.

This means the only “fee” you’re paying for investing with VOO is the 30% dividend withholding tax as an SG investor, compared to the 15% with CSPX + the broker-related fees for investing with CSPX.

In the short run, investing in VOO will prove to be better simply because you pay no fees upfront. Fractional share also means you can invest whenever you want and how much you want, which is a flexibility that CSPX doesn’t have.

But in the long run, CSPX will still become cheaper than VOO for the very simple reason that a %-based fee grows as your portfolio grows. In contrast, fixed broker-related fees become a smaller % of your portfolio as your portfolio grows.

So, investing in VOO through a zero-fee broker might be good in the first few years of your investing journey, but in the end, you’ll probably want to switch over to CSPX regardless. As for when it’s best to make the shift, you can run some calculations to determine that for yourself.

Hope this helps!

Thank you for the great post! I have been silly enough to purchase US domiciled etfs till now and I intend to replace them all with Ireland domiciled ones after reading this. Just a quick question: is there anything i should be careful of when making this change? Eg. having to pay any capital gain tax on my current etfs etc. Would there be any possible reasons why I should continue holding my US domiciled etfs instead? I intend to hold them for long term – at least 10 years horizon

Hey there,

Thanks for checking out my blog and for leaving a comment, I’m glad you’ve found my posts helpful!

Assuming you’re an SG investor, you don’t have to worry about paying taxes on investments – there is no capital gains tax or dividend tax in SG.

One reason people might prefer investing in US-domiciled ETFs is that the broker commission fees are usually cheaper and they support fractional shares. The lower fees can provide savings in the early stages of one’s investment journey, while fractional share support brings flexibility to investors by allowing them to invest smaller amounts of money.

But, in the long run, Ireland-domiciled ETFs should be the way to go for SG investors because the lower dividend withholding tax will eventually outweigh all other benefits of investing in US-domiciled ETFs.

Hope this helps!

Dear TFS,

Thank you for your insightful update! Appreciate ur hardwork! Quick question, which would you think have higher return in long run?

1) cspx through ibkr

2) voo through schwab broker(with truely zero commission and fx fees)

Thank you!

Hey Romeo,

Thanks for checking out my blog and for leaving a comment, I’m glad you’ve found my posts helpful!

If Schwab allows you to invest in VOO with 0 commission fees and FX fees, that means you’re effectively able to omit all broker-related fees when investing with VOO.

This means the only “fee” you’re paying for investing with VOO is the 30% dividend withholding tax as an SG investor, compared to the 15% with CSPX + the broker-related fees for investing with CSPX.

In the short run, investing in VOO will prove to be better simply because you pay no fees upfront. Fractional share also means you can invest whenever you want and how much you want, which is a flexibility that CSPX doesn’t have.

But in the long run, CSPX will still become cheaper than VOO for the very simple reason that a %-based fee (ie the dividend withholding tax) grows as your portfolio grows. In contrast, fixed broker-related fees become a smaller % of your portfolio as your portfolio grows.

So, investing in VOO through a zero-fee broker might be good in the first few years of your investing journey, but in the end, you’ll probably want to switch over to CSPX regardless. As for when it’s best to make the shift, you can run some calculations to determine that for yourself.

Hope this helps!

A brilliant summary. Was googling for almost an hour and was unable to find a simple answer to this question – until I chanced upon this post. Thank you for adding so much value!

Dear TFS,

I’m in my early 50s and intend to quit my job this year.

I have a lump sum of SGD200K to invest / derive passive income from. I intend to get SGD6k from my investment every year for spending purpose. [Note : I have other savings to tap on for retirement].

Currently, I am thinking of 2 options :

1] CSPX : Purchase $200K worth of units and sell off some units (about $6K worth) every year.

2] 3 Bank Shares (DBS/OCBC/UOB) : The other method would be to put the $200K in the 3 Bank Shares and derive dividend income for spending.

My investment horizon is at least 10 years.

Which method would you recommend?

Thank you.

Hey Serene,

Thanks for checking out my blog and for leaving a comment!

As I understand it, you are planning to make a lump sum investment of $200k with the intention of generating an annual cash flow of $6k, and you plan to be invested for 10 years. In other words, the investment you make needs to yield average annual returns of at least 3%.

Among the options you presented, I think going for dividends is the better option. The main reason is that you want to generate cash flow from year 1 even though you are investing for 10 years, and dividends are a better way of generating consistent cash flow. I won’t comment on whether or not SG bank stocks are the best way to go about this, though it is a popular strategy among many Singaporeans.

An index ETF like CSPX is more suited for a long-term buy-and-hold strategy as the main principle behind it is to allow time for your investment to grow as the economic market grows. If your strategy involves selling off a portion of it every year, then 1) the market might have gone down between the time you invest and the time you cash out, causing you to effectively lose money, and 2) by reducing the number of shares you have, you are limiting the growth potential of your remaining investment over the remaining years.

Moreover, an investment horizon of 10 years might seem like a long time, but for index investing to really be effective, it’s more prudent to have a longer investment horizon of up to 20 years. Even though the average annual returns of an ETF like CSPX is much greater than 3%, the problem is that it is simply an average – the reality is that it yields negative returns in some years.

Of course, if you think that the potential returns of CSPX outweighs the risks that it bears, it is still a viable strategy, since the rate of returns you are looking to achieve is quite modest.

Hope this helps!

How to avoid US dividend tax entirely as a non-US investor of popular S&P 500 ETFs such as spy, voo, etc?

As foreigners, our US ETF dividends are taxed at 30% rate. We lose about 0.5% a year to the US government. A popular method to deal with the problem is ETFs in Irish, such as CSPX. For an introduction of Irish ETFs, please read this post https://thefrugalstudent.com/cspx-vs-voo-is-investing-in-ireland-domiciled-etfs-better/. But the dividends of Irish ETFs are still taxed at 15% rate. We still lose about 0.30% a year of our investment.

If you care about the 0.3% losses, please take a look at my strategy. Your comments will be deeply appreciated.

The basic idea is simple. Suppose you own voo. You can sell voo on the day before the ex-dividend date, and then buy it back (normally at a lower price due to dividend) on the ex-dividend date. You will no longer receive dividend, yet the price difference makes up for the dividend. As foreigners, we don’t pay capital gains tax. That’s why this sell and buy back next day strategy will work only for foreign investors. You need to do it 4 times a years, as voo pays dividends four times a year.

Two problems with the sell and buy back next day strategy: 1) Trading 4 times a year is a lot of inconvenience. 2) On average S&P 500 goes up 0.04% per trading day (assuming 10% yearly return over about 250 trading days a year). The sell and buy back next day strategy will lose the returns of 4 trading day, which is about 0.16% a year.

To get the 0.16% back, we need to adopt a sell and buy back immediately strategy of the following: Suppose all your investment is in voo. You can sell voo on the day before the ex-dividend date, and then IMMEDIATELY buy spy, a different s&p 500 ETF (assuming ex-dividend dates of spy and voo are different). Then you sell spy on the next day and buy back voo immediately. You need to do 4 transactions for each dividend payment. Lots of work! But you pocket all the dividends, pay zero tax, and lose no trading day returns.

Technical issues to improve the above sell and buy back immediately strategy. (1) To reduce the amount of trading, use pair trading of spy and voo. IB offers this options. You only need to do two transactions around each dividend payment day. (2) Can we find s&p 500 ETFs that only pay dividends once? If yes, we only need to do two pair trading per year. But so far I fail to find any comparable ETFs that pay dividends once a year for foreigners.

Hey FewPani,

Thanks for checking out my blog and for leaving a comment!

This is an interesting strategy which, in theory, sounds like will be able to improve the performance of your investments even while investing in US-domiciled ETFs, though it also sounds like quite a bit of effort for a passive investing strategy.

I don’t think I have deep enough financial understanding of the market to know how well this strategy would work, but it seems to assume that the price movement of the ETFs are exactly proportionate to the dividend amount. While the 2 are probably close, it might be worth considering the possibilities that one is greater than the other, and how that might impact your investments to see if all this work is really worth the effort.

If you are using this strategy, I hope you’re documenting your journey so that you have some results to share in due time! All the best!

Hi, thanks for the detailed analysis, however I spotted a flaw where the FX fee for Syfe trade should be one off rather than recurring annually.

Hey YS,

Thanks for checking out my blog and for leaving a comment!

That’s an interesting point – I get what you mean, and you’re right! I overlooked that point in my original post.

Even though Syfe Trade’s FX fee is 0.37%, it is only charged on the total amount that is converted each year and not the total invested amount to date.

I’ve corrected the post accordingly, thank you!

Hi,

Good day,

How do you derive the implicit FX fee of 0.37% for Syfe. How do I actually work out the math? Not sure if I missed out the conversion fee in Syfe website.

Anyway, your blog have been very insightful. And i look forward to you future post.

Hey tw,

Thanks for checking out my blog and leaving a comment!

You didn’t miss out the conversion fee in Syfe’s website because they explicitly state that they don’t charge a conversion fee. However, this isn’t entirely true.

While they do not directly charge you an FX fee, their FX rates are slightly worse than the market rate (ie the rate you get on Google). In other words, by converting your currency with Syfe, you are effectively paying a cost that is hidden within this poorer exchange rate, which is why I termed it as an “implicit” fee.

Based on the exchange rates that I compared at the time of writing this post, I found that Syfe’s exchange rate was ~0.37% worse than the rates offered by Google (and IBKR), which is why I mentioned it in the post. The math for this is: FX fee = [IBKR FX rate – Syfe FX rate] / IBKR FX rate.

Hope this helps!

Hey there, first of all thank you for investing your time and effort in creating such valuable content. I’m a foreigner residing and working in Singapore. Currently, I have 100,000 SGD that I would like to DCA either monthly or quarterly throughout this year into VOO (80%) and VXUS (20%). However, after carefully reviewing your blog, I’m thinking reassessing this strategy due to potential tax implications. Nonetheless, the impact doesn’t seem overly significant. What are your thoughts on allocating 80% to an S&P 500 ETF and 20% to an international ETF? I would greatly appreciate your guidance 🙂 Have a great day

Hey UX,

Thanks for checking out my blog and for leaving a comment, I’m glad you’ve found my posts helpful!

Without an understanding of your investment objective, it’s hard to comment on your strategy of an 80-20 split of VOO-VXUS. In general, I think this is fine for wealth building. I don’t know that the 20% VXUS makes much of a difference in your portfolio, since it is highly correlated with VOO anyway. It’s a fine ETF to be investing in, but just take note that if your goal was to diversify your portfolio, then VXUS isn’t really doing that.

Hope this helps!

Hi thanks for this article, it was a very useful read! May I know how did u get $2 for FX for IBKR (LSE)? I saw that their website stated that the minimum fess are $0.10 GBP.

Thank you!

Hey c,

Thanks for checking out my blog and for leaving a comment! I’m writing this email to give my response.

It’s stated clearly on IBKR’s website that the currency commission fee is 2 USD minimum: https://www.interactivebrokers.com.sg/en/pricing/commissions-spot-currencies.php?re=amer

Where are you seeing that it’s $0.10 GBP?

Hi TFS!

What a good read! Thank you so much for a great article and including the formulas as well. Many questions I had were answered. Thank you for helping a beginner student investor 🙂

Am i right to say that if I am planning to DCA monthly a lower amount (~$100), i should start with Syfe Trade, then once the fees start to be more than $44.40USD then switch over lumpsum to CSPX/IBKR and continue DCA (preferably a higher monthly amount by then!)?

Hey Kelly,

Thanks for checking out my blog and for leaving a comment! I’m glad you’ve found my post helpful.

If you’re planning to start investing with a DCA strategy of $100/month, then yes, I would definitely suggest going with Syfe Trade first as opposed to IBKR.

The reason is simply because the brokerage fees charged by IBKR are fixed and will make up a huge % of your investment amount: 2 USD (FX) + 1.70 USD (commission) + 9% GST = 4 USD = 5.40 SGD, which means you lose 5% of your investment before you even start investing.

As I explained in my post, the tax savings from Ireland-domiciled ETFs will really only start to kick in when your investment sum is large enough. Investing $100/month means it will take quite a long time before you get to enjoy this tax savings, so I think Syfe Trade is the better short-term approach.

Hope this helps!

Hello Author!

Thanks for the article! I’m from Malaysia and looking to DCA ~1,000MYR (~211USD)[this sum would probably get thinner over time as USD strengthens against MYR lol] into Ireland-domiciled ETFs.

I’m very new to ETF investing and have never done it before, so I’m feeling very overwhelmed with all the cost figures within the fund and within the platforms available.

In your opinion, is it even worth it to DCA monthly into an ETF with this small sum against the backdrop of fixed fee on IBKR?

Thank you!

Hey Lloyd,

Thanks for checking out my blog and for leaving a comment!

Personally, I wouldn’t DCA monthly with IBKR for a sum of ~200 USD because the fixed fees (currency conversion + commission) add up to almost 2%. Instead, I’d DCA every 2-3 months, or whenever I’m able to save up an equivalent sum.

You can also consider using other brokers and/or investing in other ETFs such that the investing fees are lower. It’s important to note that Ireland-domiciled ETFs only become better than US-domiciled when the investment sum reaches a sizeable amount. Until that happens, investing in US-domiciled ETFs might be better in terms of minimizing costs.

Hope this helps & all the best!

Hi TFS! Thank you for the amazing and insightful read. It really helped me alot. I am currently deciding between investing in CSPX and VUAA for a long time frame of about 10-15 years. I intend to DCA about $100/month using IBKR. I would like to ask for your advice regarding the frequency of my investment (whether I should invest with a larger amount every two months instead?). And is it worth it for me to invest in CSPX/VUAA as compared to VOO using IBKR, given my small monthly contribution? Thank you!

Hey Jay,

Thanks for checking out my blog and for leaving a comment! I’m glad you’ve enjoyed my posts.

Personally, I wouldn’t invest $100/month on IBKR because the fees add up quickly. With currency conversion + commission fees adding up to $4+, that’s 4% in fees that you pay for investing $100/month. Even if you reduce the investing frequency to once every 2 months, that’s still 2% in fees each time you invest.

Given that you’re just starting out and presumably have little capital for investing, it might be better to consider investing in US-domiciled ETFs like VOO instead, and to invest using brokers that offer lower fees/free trades to minimize costs.

As your investment grows over the years and you are able to increase your monthly DCA contribution, you can then consider moving to IBKR and Ireland-domiciled ETFs.

Hope this helps!

Hi TFS,

Like some other commentors on this post, I searched the internet for a few hours before landing on your site and found this really useful and informative.

I see that Standard Chartered charges an extra 1% of stamp duty for buy transactions on Ireland based ISIN. link: https://av.sc.com/sg/content/docs/sg-fees-schedule.pdf

I assume that this is a EU/UK govt fee and hence would be charged by other brokers too but could not find any reference. Do you know if that is the case or this is charged only by Standard Chartered. How would this impact the calculations

Hey Manu,

Thanks for checking out my blog and for leaving a comment! I’m glad you’ve enjoyed my posts.

I did some Googling and found this post which might be helpful: https://money.stackexchange.com/questions/21248/when-does-irish-stamp-duty-apply-for-uk-investors-buying-ireland-domiciled-share

It says that the 1% stamp duty is not applicable for Ireland-domiciled ETFs that are listed on the LSE, so that might be why it’s not listed on other brokers’ websites if the pricing schedule is stated per Stock Exchange.

Hope this helps!