Synthetic ETFs have become the preferred choice of ETF among some investors.

They have an edge over physical ETFs in various aspects, but all these come at a price that not every investor is willing to pay.

In this post, I’ll go through the basics of what a synthetic ETF is and how it works, as well as the benefits and risks associated with them.

What Are Synthetic ETFs?

As its name suggests, a synthetic ETF is not the same as a regular, physical ETF, but rather, is an imitation of a physical ETF.

The goal of a synthetic ETF is to deliver the same market returns as its physical counterpart while owning a completely different basket of stocks and/or assets.

Let’s use an S&P 500 ETF as an example.

A physical S&P 500 ETF like VOO or CSPX will own stocks of the companies listed in the S&P 500 index like Apple, Amazon, etc.

In doing so, the ETF is able to deliver the aggregate market returns of the S&P 500 index to investors.

Meanwhile, a synthetic S&P 500 ETF will most likely not own stocks for any of the companies listed in the S&P 500.

However, it is still designed to deliver the market returns of the S&P 500 index to investors.

So, in a perfect world, both physical and synthetic ETFs of the same index will deliver the same level of returns to investors, but achieved by different means.

How Do Synthetic ETFs Work?

So, synthetic ETFs are supposed to achieve the same returns as the index they track, but how do they do that without owning the underlying assets in the index?

The short answer is that synthetic ETFs engage in something called a swap agreement with other financial entities.

Under this swap agreement, the ETF will pay these entities cash, and in return, they pay the ETF the performance of the index.

Let’s take a closer look at the structure of a synthetic ETF to understand how exactly this works.

Who Is Involved In A Synthetic ETF?

There are 3 main groups of parties involved in a synthetic ETF:

- ETF provider (the fund itself) – the company that issues the shares of the synthetic ETF to investors

- Swap counterparty – the entity that pays the return of the tracked index to the ETF provider

- Custodian – the 3rd party that holds the assets of the ETF provider/the collateral of the swap counterparty

What Is A Swap Agreement?

According to Investopedia, a swap agreement is:

“a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments.”

Investopedia

In the context of synthetic ETFs, swap agreements exist between the ETF provider and its swap counterparties.

The swap counterparties promise to pay the return of the tracked index to the ETF provider so that the ETF is able to mimic the performance of the index.

In exchange, the ETF provider will pay either cash or the returns of a separate basket of assets to its swap counterparties, depending on the ETF’s funding structure.

This means that the ability of the synthetic ETF to replicate the tracked index’s returns is directly dependent on its swap counterparties’ abilities to pay the return of the index.

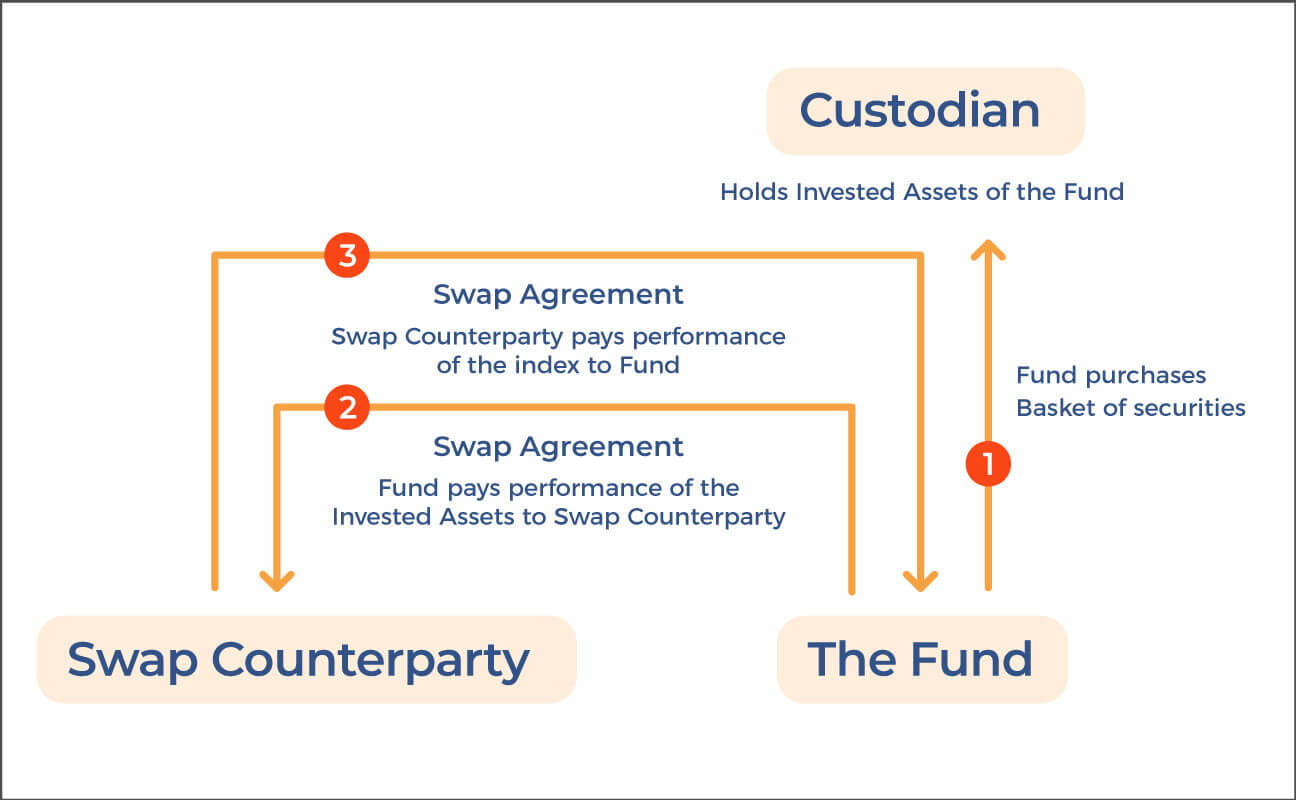

Unfunded Structure

In an unfunded structure, the synthetic ETF uses the cash received from investors to purchase a basket of assets.

The returns from this basket of assets are paid to the swap counterparties through the swap agreements.

Since the ETF owns this basket of assets, it serves as collateral in the event that the swap counterparties default.

Usually, the ETF’s exposure to its swap counterparties is limited to 10% of its Net Asset Value (NAV).

So, if the ETF’s swap counterparties default, the ETF could experience a loss in NAV of up to 10%.

This may be aggravated during adverse market conditions if the ETF’s assets are liquidated.

It’s also important to note that the basket of assets owned by the ETF may be completely unrelated to the index tracked by the ETF.

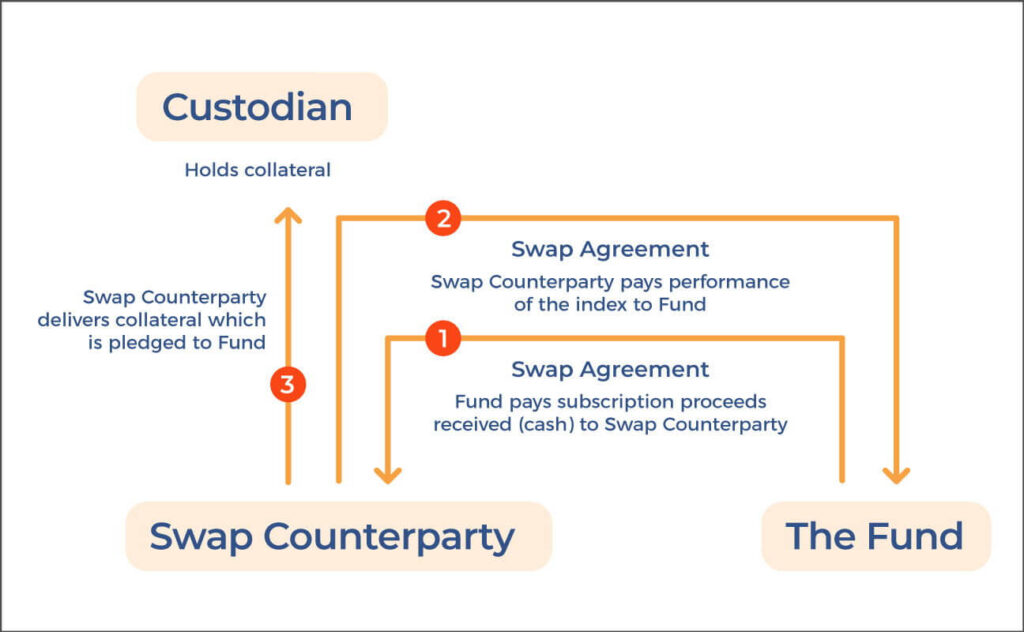

Funded Structure

In a funded structure, the synthetic ETF passes the cash received from investors directly to the swap counterparties.

Then, the swap counterparties will post assets to serve as collateral with a 3rd party custodian.

This will reduce the ETF’s exposure to the counterparties, usually to less than 10% of its NAV.

If the counterparty defaults, the loss experienced by the ETF will be the difference in value between the tracked index and the collateral.

As with an unfunded structure, this may be aggravated if the collateral is liquidated during adverse market conditions.

Also, the assets serving as collateral may be unrelated to the tracked index.

What Are The Benefits Of Synthetic ETFs?

Tax Savings

Synthetic ETFs provide an opportunity for tax savings against their physical counterparts to investors.

Physical ETFs own the underlying stocks of an index.

This means they are subjected to the tax laws of each of those underlying stocks, depending on the country of domicile of each stock.

For instance, US-domiciled stocks are subjected to dividend withholding tax and UK-domiciled stocks are subjected to UK stamp duty.

The net return of a physical ETF is thus the return of the index it tracks less any applicable taxes.

This means that the performance of a physical ETF is almost always poorer than the actual performance of the index it tracks.

However, since synthetic ETFs don’t own the underlying stocks of the index, it doesn’t face this problem.

Instead, the ETF will receive the actual performance of the index through swap agreements with its counterparties.

All things equal, synthetic ETFs are likely to outperform their equivalent physical ETFs.

Access To Remote Products/Markets

Synthetic ETFs also make it easier to invest in products that are difficult to access and/or own.

A common example is ETFs that track commodity prices.

Many such ETFs don’t own the physical commodities as they might be impractical or could incur large administrative fees in the process.

Instead, they own futures.

Another example is ETFs that track indices which are difficult to physically replicate.

This could be because the stock exchanges on which the underlying stocks are traded are highly inaccessible.

Reduced Tracking Error

Finally, synthetic ETFs can also reduce the tracking error between the ETF and the index it tracks.

Again, this arises due to the fact that the synthetic ETF does not physically own the underlying stocks of the index.

The swap counterparties can simply pay the ETF according to the reported performance of the index.

Meanwhile, the performance of a physical ETF is the aggregate performance of its stock portfolio.

While the ETF managers will try to keep their portfolio composition and weightage as similar to the index as possible, it is inevitable that there will be deviations between the two.

This results in a tracking error between the ETF and the underlying index.

However, it’s important to note that the presence of a tracking error merely indicates a deviation in performance.

Whether the deviation results in a positive or negative return against the index is a separate matter.

What Are The Risks Of Synthetic ETFs?

While there are benefits to be had with synthetic ETFs, they also come with their fair share of risks.

Counterparty Risk

First, synthetic ETFs are exposed to counterparty risk, which is the risk that a counterparty defaults on the swap agreement.

Remember that the success of a synthetic ETF in replicating the performance of its tracked index depends on its counterparties fulfilling their end of the swap agreement.

In the event that a counterparty fails to do so, the ETF will suffer some losses.

The extent of the loss depends on the ETF’s exposure to the defaulted counterparty.

Collateral Risk

The use of collateral is one way in which synthetic ETFs reduce their exposure to their counterparties.

If a counterparty defaults on its swap agreement, the ETF will be able to seize the collateral to mitigate its losses.

However, there are some challenges to this.

The collateral is an asset, and its value can change over time.

If it declines, then its effectiveness in reducing the ETF’s exposure to the swap counterparty erodes.

There might also be a liquidity risk if the types of assets that make up the collateral are relatively illiquid.

This will make it difficult for the ETF to convert the collateral into cash which it needs to pay investors.

Conflict Of Interest

Remember that a synthetic ETF requires the involvement of several parties like the ETF provider and swap counterparty.

Furthermore, there are other entities involved like the index provider and market makers of the ETF.

It’s possible for a financial institution or its subsidiaries to take on multiple roles in this process.

This might result in a conflict of interest as the parties are not independent and might therefore not act in their best interests for the role they are taking on.

Instead, they might take actions that are in the interest of their institution at the expense of the ETF’s investors.

Lack Of Transparency

As it is, synthetic ETFs are complex products that require a deeper understanding to grasp.

To make things worse, there is often a lack of transparency when it comes to the workings of a specific synthetic ETF.

Many funds do not openly disclose who their swap counterparties are and what assets they are holding to reduce their exposure to their counterparties.

This means that it is difficult for investors to make informed decisions about what they are getting into when investing in a synthetic ETF.

Synthetic ETFs VS Physical ETFs – Which Is Better?

Now that we have a better understanding of synthetic ETFs, are they better than physical ETFs?

Costs/Fund Performance

Both synthetic and physical ETFs can be traded normally on the stock exchange, which means that there is generally no difference between them in terms of broker-related costs.

When it comes to fund-related costs, many synthetic ETFs also have low expense ratios.

For example, I500, an Ireland-domiciled synthetic S&P 500 ETF, has an expense ratio of 0.07% – the same as that of CSPX, an Ireland-domiciled physical S&P 500 ETF.

However, as mentioned above, synthetic ETFs enjoy tax advantages over their physical counterparts due to the difference in their fund composition.

In this regard, it can be argued that synthetic ETFs are likely to and are capable of outperforming their physical counterparts.

Risk VS Reward

Just because synthetic ETFs can outperform physical ETFs, does that make them better?

Another important factor we need to consider is the risk that must be borne to enjoy the increase in performance.

In an article in 2020, the head of iShares EMA investment and product strategy expects synthetic ETFs to be able to outperform physical ETFs by 0.30% by virtue of tax advantages relating to US-domiciled stocks.

This sounds like a small amount, but we know that compounding can result in a large difference over the years.

Remember that synthetic ETFs are exposed to significantly higher risk than their physical counterparts.

Counterparty risk, collateral risk, and conflict of interest are very real risks that must be considered when deciding whether or not to invest in synthetic ETFs.

These risks can be mitigated by doing extensive research on the synthetic ETF before taking on any position, but this can be challenging if the ETF is not being transparent.

From a risk-reward perspective, it can be argued that synthetic ETFs provide little reward for taking on much more risk than their physical counterparts.

My Take: Physical ETFs Are Better

As of now, I think that physical ETFs are the better option for the majority of retail investors, including myself.

While I acknowledge that synthetic ETFs are able to outperform physical ETFs, I feel that the extent of this is overshadowed by all the added risk that comes with them – the risk-reward ratio is just not worth it.

Also, synthetic ETFs are complex investment products that require extensive due diligence on investors’ parts before making any investment decision involving them.

Anyone who doesn’t understand them well enough should refrain from investing in them to avoid taking on more risk than they are comfortable with.

Chances are that most retail investors fall into this bracket, so sticking with physical ETFs is the better option.

Personally, forgoing the tax advantages that synthetic ETFs have over physical ETFs is a price I’m willing to pay in exchange for taking on less risk, at least for now.

Of course, if you’re familiar with how synthetic ETFs work and know what you’re doing, there’s a case to be made to take advantage of them in your portfolio – I just don’t think it’s for most people.

How To Invest In Synthetic ETFs?

Synthetic ETFs can be traded on the stock exchange via your preferred broker, as you would a physical ETF.

Some exchanges mandate that synthetic ETFs follow a certain naming convention.

For example, on the SGX, synthetic ETFs are tagged with an ‘X’ next to the ETF’s name.

However, the best way to determine whether an ETF is a physical or synthetic ETF is to check the fund document.

Look for the information labelled “Replication“, “Product Structure“, or the like – it should clearly state either “Physical” or “Synthetic”.

To summarise,

A synthetic ETF is designed to deliver the returns of its tracked index without owning the underlying stocks by engaging in swap agreements with various counterparties.

This allows it to benefit from tax advantages and reduced tracking errors while also allowing investors access to markets or products that are otherwise remote.

However, synthetic ETFs also expose investors to risks such as counterparty risk, collateral risk, and conflict of interest, all of which may be aggravated by a lack of transparency by the fund.

Ultimately, while synthetic ETFs might be able to outperform physical ETFs, the added risk that comes along with them is not worth it for most investors.

Will you invest in synthetic ETFs? Let me know in the comments below!