Disclaimer: This is not a sponsored post, but this article contains referral links/codes that allow me to earn referral rewards at no cost to you if you choose to signup with them, which helps me maintain the blog.

Interest rates have been declining over the past 2 years since Covid hit and we’re experiencing a period of low interest rates.

This means that the returns we can expect to earn for holding cash are generally low.

Nevertheless, we still need to park our cash somewhere, so we might as well find the best places to do so and work our money harder.

For the purpose of this post, I will only focus on products/accounts for fiat currencies and not cryptocurrencies.

The Contenders

In this post, I’ll take a closer look at the following:

- Singlife

- Singtel Dash PET

- Syfe Cash+

The main reason I picked these 3 accounts is that as of writing this post, all of them are still accepting new signups.

So it’s possible for you to signup and start using them if that’s something you decide to do after reading this post.

I also currently use all 3 of these accounts, so I’ll be able to provide my personal experience and thoughts about them.

I decided not to include any bank savings accounts in this post because as of now, none are offering interest rates high enough to catch my eye.

1: Singlife

Singlife is the oldest kid on the block, and I think it was the first of its kind.

Singlife is an insurance savings plan, but not the same type of plan that your bank may have tried to sell to you before.

It basically functions as a savings account, but also provides very basic insurance coverage with the amount insured depending on your account balance.

Singlife Account Details

Currently, the Singlife account’s rate of returns are:

- 1% on the first S$10k,

- 0.5% on the next S$90k,

- 0% on sums >S$100k

To get started with Singlife, an initial deposit of S$500 is required, but you only need to maintain an account balance of S$100 to start earning returns.

Deposits can only be made via FAST transfers.

There is no lock-in period for the Singlife account, so you’re free to withdraw your funds from it anytime, even if you’ve just started using it.

Withdrawals are free and can be made in any amount to a bank account via wire transfer.

In my experience, withdrawals are executed reasonably fast – within minutes.

The Singlife account is capital guaranteed and also protected under SDIC (Singapore Deposit Insurance Corporation), so you can be sure that your funds are safe with them.

Singlife Referral Bonus

If you’re interested in using Singlife, they are currently running a referral campaign where you can earn up to S$35 for signing up.

This is broken down into:

- S$5 reward (Singlife account + card)

- S$30 reward (Singlife Grow)

To get the $5 reward, you need to signup for a Singlife account via this link or enter the code ‘KLkjyHY5‘ when signing up.

Then, simply fund your account, order your free Singlife debit card and activate it after it arrives.

To get the $30 reward, you need to signup for Singlife Grow, their investment product.

As with their Singlife account, there is no lockup period for the Grow portfolio, so you’re free to signup simply for the reward then liquidate your portfolio to recover your capital.

I wrote a post about Singlife Grow and the referral promotion which you can check out if you’re interested.

All rewards will be directly credited to your Singlife account.

2: Dash PET

Dash PET is the newest kid on the block and is an insurance savings plan, similar to Singlife.

Dash PET Account Details

Dash PET’s rate of returns are:

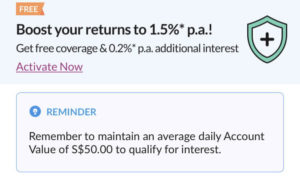

- up to 1.5% on the first S$10k,

- 0.3% on the next S$20k,

- 0% on sums >S$30k

Of the 1.5% on the first S$10k, it is further broken down into:

- 1% guaranteed

- 0.3% bonus for the 1st year

- 0.2% bonus for the 1st year for opting in for free additional coverage

Note that the 0.2% bonus will only be applicable if you choose to opt-in for the free additional coverage.

There is no initial deposit amount required for Dash PET, but you need to maintain an account balance of S$50 to start earning returns.

There are several ways you can top up your Dash PET account:

- Dash Wallet transfer (min S$1)

- PayNow (min S$1)

- eNets (min S$50)

Just like the Singlife account, Dash PET also has no lock-in period.

Withdrawals from your Dash PET account can be made via:

- Dash Wallet (free, but cannot be withdrawn out of Dash)

- PayNow (S$0.70 fee)

I’ve only ever withdrawn via PayNow, which were executed almost instantly.

As with the Singlife account, Dash PET is capital guaranteed and protected under SDIC.

3: Syfe Cash+

Unlike the other 2 contenders, Syfe Cash+ is not an insurance savings plan.

Instead, it is an investment portfolio that invests in money markets, which are generally highly liquid, low risk, and low in returns.

Syfe Cash+ Account Details

Since Syfe Cash+ is an investment portfolio, the returns it generates are not guaranteed and tend to fluctuate.

So while Singlife and Dash PET are able to guarantee returns of 1% and 1.5% respectively, Syfe Cash+ is only able to provide projected returns, ie the returns they expect to generate.

Currently, the projected return is 1.2%.

But the actual returns you receive may be more or less depending on the performance of the underlying investments.

There is no cap on the amount that can generate returns, unlike the case of Singlife and Dash PET.

There are also no initial deposit or minimum account balance requirements to generate returns and no lock-in period.

Withdrawals can be made to your bank account.

However, because Syfe Cash+ is an investment portfolio, the withdrawal speed is slower than Singlife and Dash PET, taking up to 3 – 4 business days to process.

To expedite withdrawals, Syfe released the Quick Withdrawal feature, exclusively for Cash+ portfolios.

If you submit your withdrawal notice before 11 am on business days, you can expect to receive your funds by 7 pm on the same day.

Quick withdrawals are capped at 90% of your portfolio value with a max of S$10k.

Being an investment portfolio, Syfe Cash+ is not capital guaranteed and is not protected under SDIC.

Syfe does not charge any management fees for its Cash+ portfolio, unlike the other portfolios that are available under Syfe Wealth.

Syfe Referral Bonus

Under this campaign, new Syfe users can enjoy a 6-month waiver of the management fees under Syfe Wealth.

Syfe Wealth comprises of their Core, REIT+, Select, and Cash+ portfolios.

Cash+ does not incur any management fees, so this reward is only beneficial if you use their other portfolios.

Nonetheless, if you’re new to Syfe, there’s no harm in obtaining this fee waiver so you have the option to explore Syfe’s other portfolios without having to pay for the management fees.

To enjoy this reward, enter the code ‘SRPT54W4C‘ when signing up for a Syfe account.

Then, fund a minimum of S$1000 on any Syfe Wealth portfolio.

Overview

| Singlife | Dash PET | Syfe Cash+ | |

| Returns | First $10k: 1%

Next $90k: 0.5% |

First $10k: 1.5%

Next $20k: 0.3% |

1.2% (projected) |

| Min Balance | $100 | $50 | N/A |

| Initial Deposit | $500 | N/A | N/A |

| Lock-In Period | N/A | N/A | N/A |

| Withdrawal Fee |

N/A | $0.70 (PayNow) |

N/A |

| Capital Guaranteed |

Yes | Yes | No |

| SDIC Insured | Yes | Yes | No |

My Pick: Dash PET

If I had to pick 1 winner among these 3 accounts, it’d be Dash PET.

Quite simply because it has the highest return rate of 1.5%, and it’s capital guaranteed.

I can park my money in Dash PET to earn higher returns than in a bank account and still not have to worry about anything happening to it.

But since Dash PET’s return rate of 1.5% is only applicable on the first S$10k balance, what about my savings in excess of S$10k?

The next highest return rate, in theory, is Syfe Cash+.

But I actually prefer to use Singlife first instead of Cash+ for a few reasons.

The first is because Cash+ doesn’t guarantee a return of 1.2% – it is simply an expected value.

And, over the past few months of using Cash+, my actual returns have been <1%.

To be fair, it’s been a relatively short period of time, and the returns may grow over the next few months.

But even if Cash+ does achieve its projected return of 1.2%, that’s only a 0.2% premium over the 1% that Singlife guarantees.

In my opinion, this small premium isn’t worth giving up a guaranteed 1% return from Singlife.

Furthermore, Cash+ is not capital guaranteed, while Singlife is.

This means my funds are safer in Singlife than they would be in Cash+.

One might argue that money markets are generally safe investments and Cash+ is, therefore, a reasonably safe place to stash your savings.

And I agree.

But again, I don’t think it’s worth taking on this added risk, regardless of how small it is, for a 0.2% premium since there are other options.

Of course, if you’ve reached the $10k cap for both Dash PET and Singlife, your next best option would be Cash+.

And I think it’s reasonable to use it even if it’s not capital guaranteed because money markets are relatively safe.

Disclaimer: NOT Savings Accounts

Finally, just a reminder that all 3 accounts mentioned in this post are not savings accounts, even though there may be similarities to a savings account.

While Singlife and Dash PET will keep your money safe since they are capital guaranteed, they lack functionalities like making payments to 3rd parties.

And Syfe Cash+ is completely different from a savings account in that it’s not even capital guaranteed and is less liquid.

To summarise,

Interest rates are low, with Dash PET’s 1.5% being one of the best rates available for fiat currencies today.

But since you need to keep your cash somewhere, you might as well opt for a higher return rate whenever you can.

All 3 accounts in this post are good options to park your savings with Dash PET offering the highest rate.

Even though they’re generally safe, they’re not the same as a traditional bank account, so keep that in mind.

It’s actually possible to get much higher interest rates with cryptocurrencies, but that’s a whole other topic to be discussed in a future post.

Where do you keep your savings? Let me know in the comments below!