As the title states, trading fractional shares for Ireland-domiciled ETFs with Interactive Brokers (IBKR) is now possible.

This is huge news – up until IBKR made this change, it wasn’t possible to trade fractional shares for Ireland-domiciled ETFs.

While fractional share trading is not supported for all Ireland-domiciled ETFs, most of the popular ones are.

In today’s post, I’ll tell you which ETFs are supported for fractional shares, how to trade fractional shares with IBKR, and what this means for us.

What Are Fractional Shares?

First, let’s briefly talk about what fractional shares are.

True to its name, fractional shares refer to owning a fraction of a share instead of owning the share in full.

In other words, instead of being forced to own 1 or 2 units of a share, you could own 1.5 units.

What Is The Benefit Of Fractional Shares?

So, what’s the benefit of being able to trade shares of a security in fractions?

Most notably, it allows us to invest our money more efficiently.

Imagine you have $1000 to invest, and the stock/ETF you want to invest in is trading at $400/share.

Without fractional shares, you can only buy 2 shares and have $200 left over.

The $200 that is not invested will not be able to work for you and you might end up missing out on market gains.

With fractional shares, you can invest the whole $1000 to buy 2.5 shares, leaving no cash left over.

It also reduces the barrier to entry for investing.

CSPX, an Ireland-domiciled S&P 500 ETF, is currently trading at ~486 USD or 646 SGD per share.

Without fractional shares, the minimum amount you need to invest in CSPX is 646 SGD.

With fractional shares, you can invest in CSPX with as little as 100 SGD.

Why Ireland-Domiciled ETFs?

Fractional shares aren’t a new concept and have been widely supported for US-domiciled securities for years.

So what’s the fuss over it being supported for Ireland-domiciled ETFs now, all these years later?

For Singaporean investors, this is because Ireland-domiciled securities, specifically ETFs, present tax advantages compared to their US-domiciled counterparts.

When companies pay out dividends, a portion of it is taxed by the government – this is the dividend withholding tax.

This tax rate depends on:

- the country where the company paying out the dividend is listed in, and

- the country where the recipient of the dividend is.

The US-Singapore dividend withholding tax rate is 30%.

However, the US-Ireland tax rate is 15%, and the Ireland-Singapore tax rate is 0%.

This means that by investing in an Ireland-domiciled ETF instead of a US-domiciled ETF, we can reduce the tax losses by half.

Given that there are many Ireland-domiciled equivalent ETFs of US-domiciled ETFs, this is a no-brainer strategy to minimise investment losses.

What Does This Mean For Investors?

Ireland-domiciled ETFs are generally favoured against US-domiciled ETFs due to the lower dividend withholding tax.

However, some people still choose to invest in US-domiciled ETFs because of lower commission fees and support for fractional shares.

Now that fractional shares are also supported for Ireland-domiciled ETFs, the case for investing in their US counterparts is considerably weaker.

If you’ve been investing in Ireland-domiciled ETFs all along, the good news is that you can now invest a specific amount instead of a specific number of shares.

This might smoothen out your investing process if you’re trying to adopt a dollar-cost-averaging strategy.

If you’ve been investing in US-domiciled ETFs, it might be time to reconsider this decision.

Now that fractional shares are supported for both, the main factor that remains is trading fees.

Most US-listed ETFs that have an Ireland-domiciled counterpart are available to trade in USD.

The commission fee for trading such ETFs is 1.70 USD on IBKR.

While this is still more expensive than the fees for trading US-listed securities on most brokerage platforms, the difference is considerably small (~1 USD).

With such a small difference in fees, it might be worth switching to Ireland-domiciled ETFs.

Which ETFs Have Fractional Shares Support?

As I mentioned earlier, not all Ireland-domiciled ETFs have fractional shares support on IBKR.

There is some requirement on the daily trade volume and total asset value of the ETF to be eligible for fractional shares support.

Thankfully, many popular ETFs fit this criteria.

S&P 500 ETFs:

- CSPX

- VUAA

- VUAG

- VUSD

- VUSA

World ETFs:

- VWRA

- VWRD

- VWRL

- V3AA

- IWDA

- ISAC

- SWRD

If you’re interested in investing in Ireland-domiciled ETFs, there’s a good chance that one of those listed above will fit your bill.

How To Trade Fractional Shares On IBKR

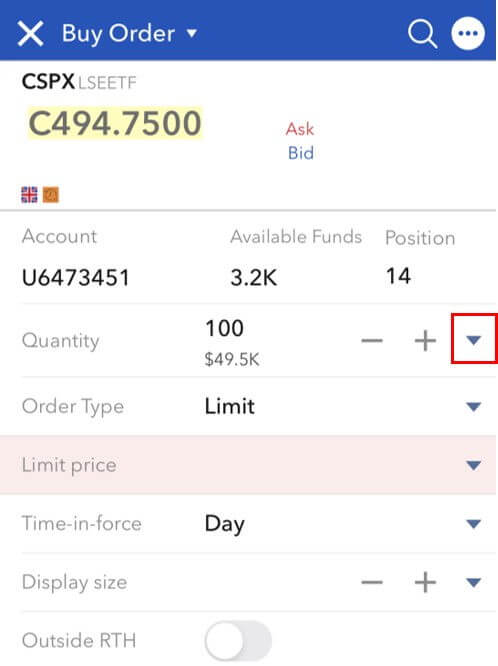

Trading fractional shares on IBKR is easy and can be done directly on the order page without needing to change any settings.

First, log in to your account, search for the stock/ETF that you want to invest in, and click “Buy” to open the order page.

By default, the purchase mode will be by lot size, ie number of shares.

To invest in fractional shares, you will need to change the purchase mode to dollars.

Click the arrow under “Quantity”.

At the bottom, select “USD” and then the amount of USD that you want to invest.

Note that the currency displayed is the currency that the stock/ETF is denominated in.

So if you are investing in an ETF that trades in GBP, you will see GBP instead of USD, etc.

Also, you will notice that the amount you can choose to invest is in increments of $500, with a minimum of $500.

If you wish to invest a different amount, click on the amount and edit it as you wish.

Finalise the other details of your order before submitting it to complete your order.

To summarise,

It is now easier to invest in many popular Ireland-domiciled ETFs with IBKR providing support for fractional shares.

Coupled with the lower dividend withholding tax rate, it is now more attractive to invest in them as compared to their US-listed counterparts.

4 replies on “Fractional Shares Now Supported For Ireland-Domiciled ETFs”

Hi, any idea if this new fractional shares for Ireland-Domiciled ETFs will apply to the DCA in IBKR as well?

Hey Spacer,

Thanks for checking out my blog and leaving a comment!

Yes, you can DCA into Ireland-domiciled ETFs using IBKR’s Recurring Investment feature, and you will be able to purchase fractional shares this way.

Hope this helps!

Thanks this is super helpful blog. Other than IWDA i also purchase IGLN, IGIL and EIMI.

They are also irish domiciled etfs, so can i buy fractional shares of these too?

What i am looking for is automatic monthly purchase. I use scb singapore bank ans brokerage account and they dont offer monthly automatic purchases. If i can do that with IB will open an IB account then

Hey Rook,

Thanks for checking out my blog and for leaving a comment! I’m glad you’ve found my post helpful.

Yes, IBKR allows you to invest in IGLN, IGIL, and EIMI in fractional shares.

You can setup recurring investments in IBKR so that investments are done automatically on a desired periodic basis (ie monthly). As long as you have sufficient funds in your IBKR account for the order to execute, it is possible.

Hope this helps!