Disclaimer: This is not a sponsored post, but this post contains affiliate links. If you sign up for a product through one of these links, I’ll earn a commission to help sustain this blog at no cost to you. For more information, read our affiliate disclosure.

Cashless payment is gaining popularity in Singapore, but this doesn’t always include card payments.

As I always mention, credit cards are the best tools for maximising rewards on your spending, so you’ll want to make payments with them whenever possible.

But the fact is that not every merchant will accept card payments.

However, it might still be possible to pay with a credit card depending on the types of QR payments they accept, if any.

In this post, I’ll tell you 4 types of QR payments that can be processed via credit cards to earn rewards.

- ShopBack Pay

- FavePay

- Kris+

- XNAP

Why QR Payments?

Let’s talk about why we would want to make QR payments in the first place.

As I alluded to earlier, some merchants that don’t accept card payments might accept various forms of QR payments which can be processed via a credit card.

This gives us a way to earn credit card rewards for such transactions that we would otherwise not be able to.

Next, some of these QR payment methods have a native rewards system in place.

This means that when you make payments with them, you can earn rewards from the QR processor’s ecosystem in addition to credit card rewards, allowing you to double dip on rewards.

In such cases, even if the merchant accepts card payments, it’s better to pay via said QR payment instead.

The last reason is quite situational but can be useful.

Most (if not all) QR payments are processed as online transactions.

This means that when you make a QR payment in person, you can process an offline transaction as an online transaction.

The implication of this is that you can process the QR payment with a credit card that earns rewards for online transactions.

For miles chasers, most specialised miles cards have monthly spending limits, and some are better for offline transactions while some are better for online transactions.

QR payments allow you to make offline transactions with a card primarily used for online spending to “conserve” your offline spending limit for other transactions.

For cashback fanatics, most high cashback cards have monthly cashback caps that are split between online and contactless spending.

With QR payments, you can convert an offline contactless transaction to an online one to maximise your cashback earned if you have already hit the cashback cap for contactless spending.

1: ShopBack Pay

You’re probably already familiar with ShopBack.

ShopBack is a platform that allows you to earn bonus cashback at partnered merchants when you pay with a credit card linked to your ShopBack account.

ShopBack Pay works in the same way but with QR payments instead.

When paying via ShopBack Pay, payment is processed via your choice of card as an online payment.

Depending on the merchant’s merchant category code (MCC) and the card you use, you will be able to earn miles or cashback for this transaction.

You will also earn loyalty cashback with the merchant which can be redeemed the next time you transact with this merchant.

Here’s a step-by-step guide on how to use ShopBack Pay.

#1.1: Download the ShopBack app & create an account

If you already have the ShopBack app and a ShopBack account, you can skip this step.

Otherwise, download the app from the Apple/Google Play store and sign up for an account.

There’s a signup reward of $5 if you sign up using a referral code/link, which you can find below.

ShopBack

Referral Code: flshiB

Referral Link: https://app.shopback.com/nTGLezDStEb

Referral Reward: S$5

How To Get Reward:

- Download the ShopBack app

- Sign up for an account by clicking the Referral Link OR from the app and entering the Referral Code

- Make ShopBack transactions to accumulate S$10 of confirmed cashback OR complete S$300 of fully paid PayLater orders

#1.2: Link your credit card(s) to ShopBack

If you already have a card linked to your ShopBack account, you can skip this step.

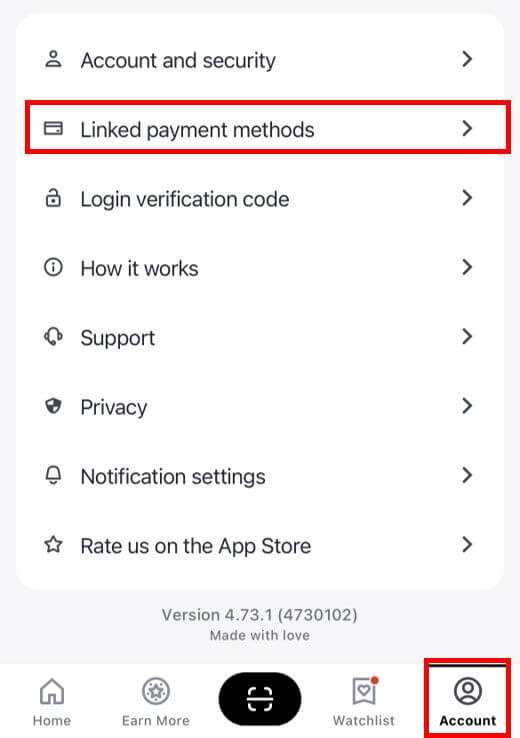

Otherwise, navigate to Account > Linked payment methods to add the credit cards of your choice to your ShopBack account.

Note that ShopBack only supports Visa and MasterCard cards.

You can add as many cards as you want – you will then be able to choose from any of these linked cards to make payment for a ShopBack Pay transaction.

#1.3: Pay with ShopBack Pay

After linking your credit card to ShopBack, you’re ready to pay with ShopBack Pay.

First, look out for the ShopBack Pay QR code when making a payment.

If the merchant accepts ShopBack Pay, the QR code will be displayed.

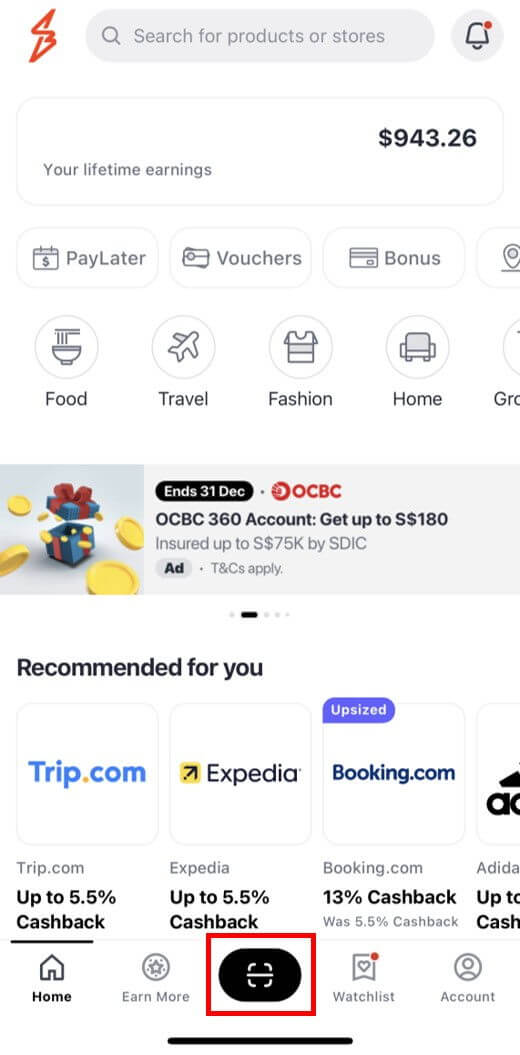

Open your ShopBack app and tap on the scan icon at the bottom.

Scan the merchant’s ShopBack Pay QR code, select which card you wish to use to make payment, and swipe to confirm and complete the transaction.

#1.4: Earn and confirm loyalty cashback

Upon completing your transaction, you will earn loyalty cashback at this merchant, which will be tracked in your ShopBack account immediately.

However, to confirm this cashback (ie make it withdrawable), you’ll need to transact with this merchant again within 3 months.

2: FavePay

Fave is another loyalty cashback platform similar to ShopBack.

FavePay transactions are processed via your choice of card as an online payment.

Depending on the merchant’s MCC and the card you use, you will be able to earn miles or cashback for this transaction.

You will also earn loyalty cashback which will be used to offset your next transaction with this merchant.

Here’s a step-by-step guide on how to use FavePay.

#2.1: Download the Fave app & create an account

If you already have the Fave app and a Fave account, you can skip this step.

Otherwise, download the app from the Apple/Google Play store and sign up for an account.

#2.2: Link your credit card(s) to Fave

If you already have a card linked to your Fave account, you can skip this step.

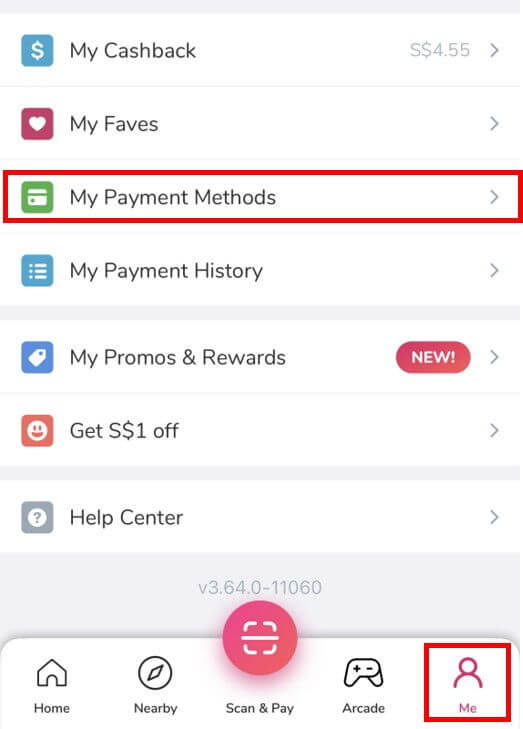

Otherwise, navigate to Me > My Payment Methods to add the credit cards of your choice to your Fave account.

Note that Fave only supports Visa, MasterCard, and AMEX cards, and you can add multiple cards.

#2.3: Pay with FavePay

After linking your credit card to Fave, you’re ready to pay with FavePay.

First, look out for the FavePay QR code when making a payment.

If the merchant accepts FavePay, the QR code will be displayed.

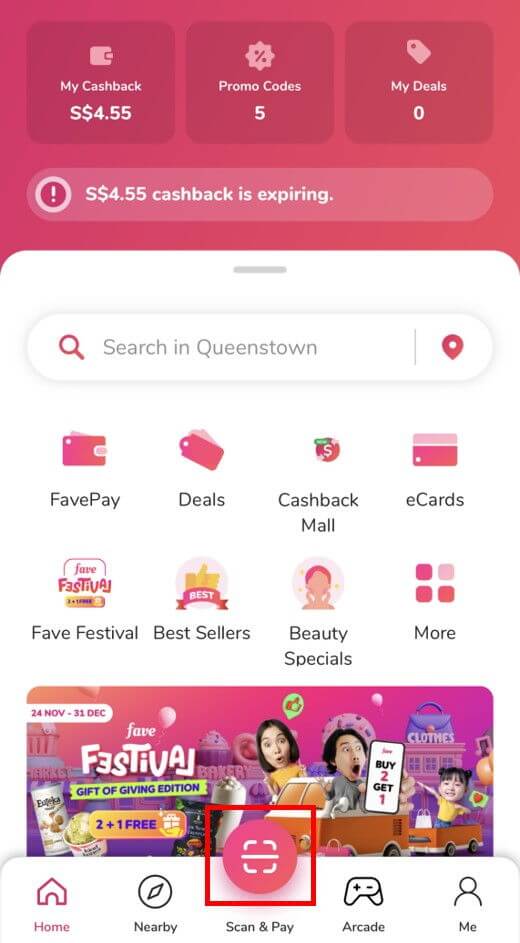

Open your Fave app and tap on “Scan & Pay” at the bottom.

Scan the merchant’s FavePay QR code, select which card you wish to use to make payment, and complete the transaction.

#2.4: Earn and redeem loyalty cashback

Upon completing your transaction, you will earn loyalty cashback at this merchant, which will be stored in your Fave account immediately.

This cashback cannot be withdrawn but will be automatically used to offset your next transaction at this merchant.

3: Kris+

I recently wrote a post dedicated to Kris+, which is where you’ll be able to find the nitty gritty details – I’ll only go through the details briefly here.

Kris+ is a lifestyle app launched by KrisFlyer, Singapore Airlines’ frequent flyer program.

While the app offers a range of benefits, the point of concern here is that it offers a QR payment method within the app.

Paying with Kris+ lets you earn credit card rewards and KrisPay miles which can be used as either cash rebates or KrisFlyer miles.

However, the way it works is slightly different compared to ShopBack Pay and FavePay.

It’s not possible to add a credit card to your Kris+ account to use for QR payments – instead, QR payments are processed via your mobile wallet (Apple Pay, Google Pay, etc.).

In-app mobile wallet transactions are also considered online transactions, so this seems like a minor difference.

And for most cards, this is true.

However, there is at least 1 card – the Citi Rewards card – that does not recognise in-app mobile wallet transactions as eligible online transactions for earning rewards.

This means that using the Citi Rewards card to make Kris+ QR payments will not earn 4 miles per dollar (mpd).

Here’s a step-by-step guide on how to pay with Kris+.

#3.1: Download the Kris+ app and create an account

If you already have the Kris+ app and a Kris+ account, you can skip this step.

Otherwise, download the app from the Apple/Google Play store and sign up for an account.

There’s a signup reward of $5 if you sign up using a referral code/link, which you can find below.

Kris+

Referral Code: L981798

Referral Link: https://sqkrisplus.page.link/2r4EtG5vfNu15e2aA

Referral Reward: 750 KrisPay miles (= S$5 value)

How To Get Reward:

- Download the Kris+ app

- Sign up for an account by clicking the Referral Link OR from the app and entering the Referral Code

- Make a Kris+ transaction with a value of S$5 or more via Apple Pay or Google Pay by either:

- purchasing a Kris+ in-app deal, or

- scanning the Kris+ QR code in-store at any Kris+ partner

Link To Blog Review: https://www.thefrugalstudent.com/how-to-earn-bonus-miles-and-cash-rebates-with-kris

#3.2: Add your credit card(s) to your mobile wallet

As mentioned earlier, Kris+ uses your phone’s mobile wallet (ie Apple Pay/Samsung Pay/Google Pay) to process payments.

So, to pay with Kris+, you’ll need to have at least 1 card added to your mobile wallet.

If you already have a card linked to your mobile wallet, you can skip this step.

Otherwise, proceed to add a card to your mobile wallet.

Here are some guides if necessary:

#3.3: Pay with Kris+

First, search for a Kris+ merchant on the Kris+ app or look for the Kris+ QR code when making a payment.

To pay with Kris+, open your Kris+ app, tap “Pay”, and scan the merchant’s Kris+ QR code.

Select the card you wish to use to make the payment from your mobile wallet and complete the transaction.

#3.4: Earn KrisPay miles and transfer to KrisFlyer

After completing the payment, you will earn KrisPay miles where applicable.

If you wish to use them as cash rebates, then you don’t have to do anything else.

But if you wish to convert them to KrisFlyer miles, you’ll have to take an extra step to do so.

Also, remember to do this ASAP because KrisPay miles can only be converted to KrisFlyer miles within 7 days from the time they are credited.

4: XNAP

I also have a post dedicated to XNAP which is where you can find more concise details about the app.

Unlike all the previous apps, XNAP is not a rewards/loyalty app, so there is no cashback or points to be earned.

It is simply a payment processing app that allows you to make QR payments via a credit card.

Similar to Kris+, there is no in-app wallet for XNAP – it relies on the cards in your mobile wallet to make payments.

Payments are transacted as online spending, but remember that it is considered an in-app mobile wallet transaction.

This again means that the Citi Rewards card should not be used for XNAP payments as they will not be recognised as eligible online payments.

#4.1: Download the XNAP app

If you already have the XNAP app, you can skip this step.

Otherwise, download the app from the Apple/Google Play store.

#4.2: Add your credit card(s) to your mobile wallet

Similar to Kris+, you need to have a credit card in your mobile wallet to pay with XNAP.

If you already have a card linked to your mobile wallet, you can skip this step.

Otherwise, proceed to add a card to your mobile wallet.

Here are some guides if necessary:

#4.3: Pay with XNAP

Look for the XNAP logo when you make a payment.

Unlike ShopBack/Fave/Kris+, the QR code used for XNAP is not branded – it uses the regular SGQR code that is used for PayNow.

To identify whether the QR code is compatible with XNAP, look for the XNAP/LiquidPay logo in the list of supported payment apps at the bottom of the QR code.

If XNAP is supported, scan the QR code with your XNAP app and select which card you wish to use to make payment.

Which Credit Cards Should You Use For QR Payments?

Since QR payments are processed as online transactions, credit cards that earn rewards for online spending will work.

However, not all credit cards are equal.

Some credit cards only earn rewards for online spending made under certain categories, while others will earn rewards for any online spending in general.

Here are some notable ones to consider:

- DBS Woman’s World – 4 mpd

- Citi Rewards – 4 mpd (review)

- HSBC Revolution – 4 mpd – Dining, Shopping (review)

- UOB Preferred Platinum Visa – 4 mpd – Dining, Shopping (review)

- OCBC Titanium Rewards – 4 mpd – Shopping

- UOB Lady’s/Lady’s Solitaire – 6 mpd – Dining, Shopping, Beauty (review)

- UOB KrisFlyer – 3 mpd – Dining, Shopping

- UOB EVOL – 8% cashback

- DBS Live Fresh – 5% cashback

Again, remember that Citi Rewards shouldn’t be used for Kris+ and XNAP as in-app mobile wallet transactions will not earn 4 mpd.

A workaround exists for Android users if they link the Citi Rewards card to an amaze card and add the amaze card to their mobile wallet.

The 6 mpd earn rate for the UOB Lady’s cards is a promotional rate, which would otherwise be 4 mpd, and the eligible categories depend on the selected bonus categories quarterly.

For UOB KrisFlyer, the 3 mpd earn rate will only apply with an S$800 spending on the Singapore Airlines group within the card member year.

For UOB EVOL and DBS Live Fresh, monthly minimum spending of S$600 and S$500 respectively is required.

To summarise,

There are several ways to earn credit card rewards even when the merchant doesn’t accept card payments.

Some QR payments are even better than paying with a credit card directly because we can double dip on loyalty rewards like cashback or miles.

By taking advantage of these QR payment methods, we can maximise the credit card rewards earned for our spending, and I will almost always use them when available.