If you’ve been considering buying an HDB flat, you’re probably familiar with the HDB Flat Eligibility (HFE) letter.

While the HFE letter helps to streamline the HDB-buying process, the rigidity that it comes with can pose a serious challenge for some young couples.

My partner and I experienced this firsthand while going through our recent HDB resale application, but thankfully, we found a way around it.

In this post, I’ll share how we got our HFE letter reassessed; hopefully, this helps other couples looking to do the same.

Things To Note About Reassessing HFE

Let’s get some context as to what reassessing an HFE means and why some couples might want to have their HFE reassessed.

What Does It Mean?

The HFE letter assesses your eligibility for an HDB flat purchase and the amount of housing grant and HDB housing loan you are eligible for all at the same time.

“Reassessing HFE” usually refers to reassessing the HDB housing loan amount you are eligible for while retaining your existing HFE letter.

Who Is It For?

You should only consider reassessing your HFE letter if you meet both of the following criteria:

- you have a significant change in your salary, and

- you are already in the middle of a flat application (BTO/resale).

You must have a good reason for wanting to reassess your HFE letter, and the most common cause of this is a salary increase.

Due to the complications associated with reassessing your HFE letter, it should only be used as a last resort, which is usually only the case when you’ve already started a flat application.

If you have not started any flat applications, then you should consider cancelling your HFE letter and applying for a new one instead.

This will automatically result in a reassessment of your HDB housing loan amount and there are fewer hoops to jump through this way.

Flat Applications Are Tied To HFE Letter

HDB flat applications are tied to your HFE letter.

That is to say, if you are already in the middle of an application with your existing HFE letter, then cancelling your HFE letter is not an option.

This is why only people who have started a flat application should try reassessing their HFE letter – anyone else has the option to cancel their HFE and apply for a new one instead.

Further to this point, it is important that if you’re in this situation and are trying to reassess your HFE letter, you make it clear to HDB that you need to retain your existing HFE letter and not cancel it.

Specifically, you’ll want to ensure that your HFE serial number remains the same since this ties your HFE letter to your flat applications.

Time-sensitive

Assuming that you’re in the middle of a flat application, then you’re also in a rather time-sensitive situation since you probably need your HFE letter reassessed before you can proceed with your application.

In my case, I needed to get my HFE letter reassessed during the 21-day Option Period after receiving the Option To Purchase (OTP) from the sellers in my resale flat application.

Why Increase HDB Housing Loan?

The assessments for your HFE letter are done based on your details at the time of your HFE letter application.

An HFE letter is valid for 9 months.

While 9 months isn’t particularly long, it’s long enough for you to have increased your salary – especially if you or your partner were not working at the time of your HFE letter application.

Since your housing loan eligibility is directly dependent on your salary, having an increase in salary means you are also eligible for a larger housing loan.

A larger housing loan means you need to use less of your available cash to pay for your flat purchase, which you can keep for other uses like renovation, wedding expenses, etc.

In particular, younger couples who haven’t been working for long might struggle to be able to afford to pay for a flat even with housing grants.

A larger housing loan might be the determining factor for them being able to afford a flat in the first place.

Disclaimers

Before I get into what we did to reassess our HFE letter successfully, I want to state some disclaimers.

Firstly, reassessing your HFE letter should only be a last resort, ie cancelling your current HFE letter is not an option.

If you haven’t started any flat applications, it’s probably better to cancel your HFE letter and apply for a new one.

Secondly, HDB is not obligated to reassess your HFE letter, so don’t go into the process thinking that you’re entitled to it.

Thirdly, just because I got my HFE letter reassessed by following these steps doesn’t mean that you will be able to as well even if you follow the same steps.

Reassessment of HFE letters is done on a case-by-case basis by HDB officers, so there is no guarantee that you’ll be able to reassess your HFE letter – but at least you’ve done what you can.

Finally, my partner and I were in quite a specific situation when we requested a reassessment of our HFE letter:

- we already started our resale flat application (paid the initial deposit and received the OTP) with our existing HFE letter,

- our HFE letter was old and outdated (applied 7 – 8 months ago), and

- we had a significant salary increase shortly after we applied for our HFE letter.

These points may or may not have been factors in HDB’s decision to reassess our HFE letter.

Tips To Reassess HFE Letter

Now, let’s get into what you’re here for.

1: Have a strong, valid reason

If you’re thinking of trying to get your HFE letter reassessed, make sure you have a strong and valid reason for wanting to do so.

As I mentioned earlier, reassessment of HFE letters is done only upon request, and only on a case-by-case basis.

So if you want to convince HDB to reassess your HFE letter, you’ll need to have a solid case for it and be prepared to “present” it to HDB.

HDB says that they will only reassess your HFE letter if there have been significant changes to your eligibility requirements, but they don’t explicitly say what constitutes said “significant changes”.

Salary increase is probably the most common one of those things, but the question is: how much of an increase is considered significant?

My partner and I were fortunate enough to receive pay bumps shortly after our HFE letter application.

In total, our salary increased by ~20%.

While I don’t know the minimum increase that HDB considers “significant”, this can serve as a baseline – if you and your partner have a salary increase in the range of 20%, you probably have a strong case.

It’s important to note, though, that reassessing your HFE letter with a salary increase also has negatives.

Your housing grant eligibility will be affected, and you will likely qualify for a lower grant than before.

However, the increase in the HDB housing loan amount that you will get from a salary increase should outweigh the decrease in housing grants.

So, reassessing your HFE letter should still be a net positive in terms of easing the cash burden of your flat purchase.

2: Submit a request on the HDB portal

HDB isn’t monitoring everyone’s income levels and keeping tabs on when their HFE letters need reassessment.

Again, reassessing your HFE letter is done only upon request, so having a strong case alone isn’t enough – you need to formally make it known to HDB by submitting a request via the HDB portal.

To do this, visit the HDB website.

Scroll down to the page footer and click “Contact Us“.

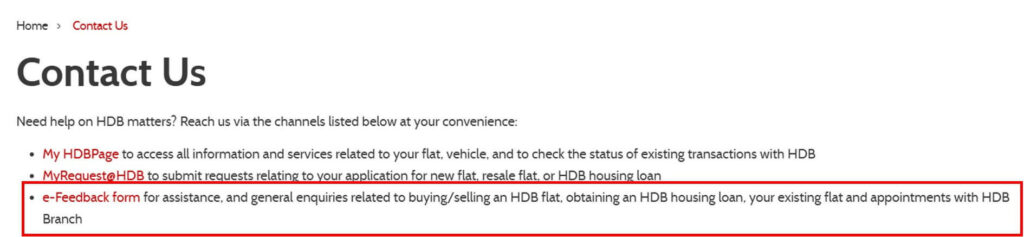

Then, click “e-Feedback form“.

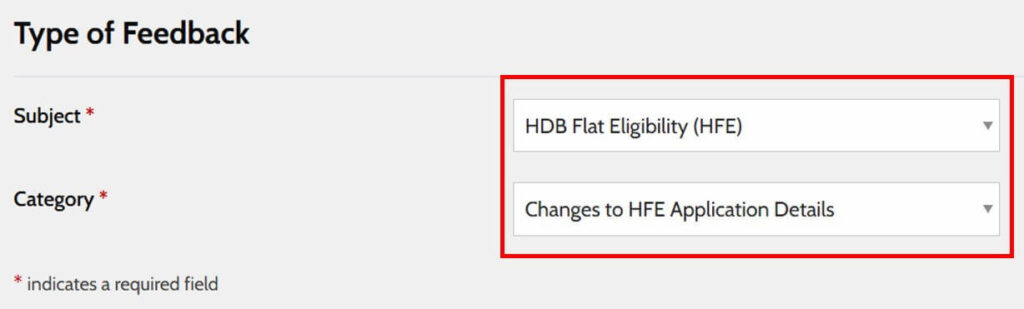

Under Type of Feedback, select “HDB Flat Eligibility (HFE)” as the Subject and “Changes to HFE Application Details” as the Category, then continue to the next page.

In the description of your request, provide as much information as possible – present your case on why you want to get your HFE letter reassessed.

If a salary increase is your reason, then providing proof of the salary increase will likely help your case.

We provided copies of our payslips and CPF contribution history for the past 12 months to substantiate our salary increase.

Then, fill in the other required details and follow the steps to submit your request.

3: Call the HDB sales department

After submitting your request, HDB will eventually look into it, but this can take a painfully long time to happen.

In my experience, I’ve waited as long as 3 weeks to get a reply from HDB.

As we’ve established earlier, the fact that you need to reassess your HFE letter means that you’re probably in a time crunch and want to get it done ASAP.

Calling the HDB hotline can help expedite your request, especially if you explain to the HDB officer why you need them to look into your request urgently.

But you don’t want to call the generic HDB hotline.

If you do, you’ll first be put on hold until an HDB officer is available to speak to you.

Then, after hearing your purpose for calling, the HDB officer will transfer your call to the relevant department, which means another round of waiting on hold.

Instead, you want to call the HDB sales department directly at this number: 1800 866 3066.

This will save you the need to wait on hold the first time.

Once you’re on the line with the HDB officer from the sales department, explain your situation to them and tell them that you’ve submitted the relevant request on the HDB portal.

During the call, emphasise specifically on these points:

- you’d like to reassess your HDB housing loan due to <insert reason here>,

- you can’t cancel your HFE and apply for a new one as you’re (presumably) in the middle of a flat application already, and

- your request is urgent as you need it to be done to proceed with your flat application.

Hopefully, you’ve convinced the HDB officer of your case and your request gets expedited and resolved.

In my experience, once your request is handed over to an officer to work on, it moves quickly.

I’ve called to get my request expedited twice now, and both times, my requests were resolved within the same day.

But of course, this is only anecdotal, and your experience might be different.

After Reassessing HFE Letter

If you were able to get your HFE letter reassessed, congrats!

But there are still some things you need to check.

As I mentioned earlier, it is important to make sure that your HFE letter’s serial number has not changed.

This is used in flat applications, so if your HFE letter’s serial number is different, it might cause complications when trying to proceed with your flat application process.

And even if your HFE letter still has the same serial number, you might still encounter issues in your flat application process – I did.

When I was trying to submit my resale application after exercising the OTP, I encountered an error in the HDB portal regarding my HFE letter.

The serial number had not changed after getting my HFE letter reassessed, but the system treated my HFE letter like a new one, saying that the HFE letter issue date is later than the OTP issue date.

This prevented me from submitting my resale application, and I had to go through yet another round of calling HDB and submitting requests on the HDB portal.

Thankfully, HDB was able to resolve the issue for me within 2 days, and I was able to proceed with my resale application.

The point is that after your HFE letter gets reassessed, you might encounter further complications, so give yourself ample time to resolve them.

This is yet another example of what a pain it can be to reassess your HFE letter, and why you should only opt for it when you have no other choice.

To summarise,

The details in your HFE letter are final and will not change unless you specifically request for a reassessment.

HDB will review requests on a case-by-case basis; there is no guarantee that your request will be successful.

Reassessing your HFE letter is a tedious process, so you should only do it if you have no other choice, ie you are already in the middle of an HDB flat application.

Since your HFE letter is tied to your flat application, the reassessment may result in other issues further down in your application process.

Depending on which stage of the application process you are in, you might be in a time-sensitive situation.

Therefore, it is important to be proactive throughout the HFE reassessment process to ensure that you can resolve any issues in time.