Disclaimer: This is not a sponsored post, but this post contains affiliate links. If you sign up for a product through one of these links, I’ll earn a commission to help sustain this blog at no cost to you. For more information, read our affiliate disclosure.

If you’re into maximising credit card rewards like me, you might have heard of Instarem and their amaze card by now.

But if you haven’t, don’t worry, because I’m about to tell you why it’s great, how to use it, and everything else you need to know about it.

Who Is Instarem?

Instarem is a financial company that focuses on cross-border payments, similar to Revolut.

They offer competitive rates for international currency transfers and their payment services are powered by NIUM, which is regulated by the Monetary Authority of Singapore as a Major Payment Institution.

What Is The amaze Card?

The amaze card is a multi-currency debit card similar to YouTrip and Revolut.

However, the mechanics behind how it works are slightly different.

Unlike most debit cards that require a wallet to provide the source of funds, the amaze card directly links to a MasterCard of your choice to use as its source of funds.

You can link up to 5 different MasterCards to your amaze card at once and you’re free to choose which card to use as the primary card – this will be the card to which payments are charged.

Both debit and credit cards can be linked to the amaze card – the only requirement is that it’s a MasterCard, though the GrabPay card is currently not supported on amaze.

When you make payments with the amaze card, you will earn cashback in the form of InstaPoints (IPs).

Here’s what you need to know about IPs:

- only awarded on foreign currency transactions of S$10 or more (in equivalent currency)

- awarded at a rate of S$1 = 0.5 IP (in equivalent currency)

- a maximum of 500 IPs can be awarded per transaction

- can be redeemed at a fixed rate of 2000 IPs = S$20 cashback from 15 Oct 2022

- no spending requirement to earn IPs

- no cap on IPs that can be earned

- credited into your account quarterly, on the 15th of the month after each quarter

So the amaze card basically lets you earn 0.5% cashback on foreign currency transactions.

Why Should You Use The amaze Card?

Double Dip On Rewards

The amaze card is great because it allows us to double-dip on rewards with our credit cards – potentially earning cashback from amaze while still earning our regular credit card rewards.

This basically means bonus rewards for us, so what’s not to like?

The critical thing here is knowing which transactions you will be able to double-dip on.

How the amaze card works is that when you use it to make offline transactions, it converts the transaction into an online transaction and charges it to your linked MasterCard.

However, the category/merchant category code (MCC) of the transaction does not change.

Note: An MCC is a code that dictates the type of service that a business operates as.

This means that if your linked MasterCard is able to earn rewards for online transactions of that category, you will earn rewards from your linked card.

For example, the Citi Rewards card earns 4 miles per dollar (mpd) on online transactions.

If I buy a coffee from Starbucks and pay with my amaze card linked to my Citi Rewards card, this transaction will be converted to an online transaction and allow me to earn 4 mpd.

But if the transaction is not eligible for rewards from your linked MasterCard, you will not earn rewards from your card.

Other than looking out for eligible transactions for your linked MasterCard, you also need to take note of the amaze card’s exclusion list, as shown below.

| MCC | Description |

|---|---|

| 4111 | Railroads, Transportation Services |

| 4784 | Tolls and Bridge Fees |

| 4900 | Utilities: Electric, Gas, Water, and Sanitary |

| 5047 | Medical, Dental, Ophthalmic and Hospital Equipment and Supplies |

| 5199 | Nondurable Goods (Not elsewhere classified) |

| 5960 | Direct Marketing: Insurance Services |

| 5993 | Cigar Stores and Stands |

| 6012 | Financial Institutions: Merchandise, Services, and debt Repayment |

| 6211 | Security Brokers/Dealers |

| 6300 | Insurance Sales, Underwritting, and Premiums |

| 6513 | Real Estate Agents and Managers: Rentals |

| 6540 | Non-Financial Institutions – Stored Value Card Purchase/Load |

| 7299 | Other Services (Not elsewhere classified) |

| 7349 | Cleaning, Maintenance and Janitorial Services |

| 7523 | Parking Lots, Parking Meters and Garages |

| 8062 | Hospitals |

| 8211 | Elementary and Secondary Schools |

| 8220 | Colleges, Universities, Professional Schools, and Junior Colleges |

| 8241 | Correspondence Schools |

| 8244 | Business and Secretarial Schools |

| 8249 | Vocational and Trade Schools |

| 8299 | Schools and Educational Services |

| 8398 | Charitable Social Service Organisations |

| 8661 | Religious Organisations |

| 8675 | Automobile Associations |

| 8699 | Membership Organisations |

| 9211 | Court Costs, including Alimony and Child Support |

| 9222 | Fines |

| 9223 | Bail and Bond Payments |

| 9311 | Tax Payments |

| 9399 | Government Services |

| 9402 | Postal Services |

It’s a fairly standard list as far as exclusion categories go, so it shouldn’t be too surprising.

It should be noted, though, that since the amaze card now only awards IPs for foreign currency transactions, double-dipping is not so easy anymore.

You’ll only be able to double dip when you spend overseas or purchase in foreign currencies in Singapore, but at least it’s still possible to.

Earn Credit Card Rewards More Easily

As mentioned above, the amaze card converts offline transactions into online ones.

This means cards like Citi Rewards that earn 4 mpd on a wide range of online transactions but only on a few categories of offline transactions become much more usable when paired with amaze.

The amaze card effectively allows us to earn 4 mpd with the Citi Rewards card on many offline transactions that would otherwise not earn 4 mpd, like dining and groceries.

Even though the amaze card’s cashback program is thoroughly nerfed, it still adds value in this way if you use cards that earn rewards for online transactions.

Free FX Conversion

Much like YouTrip and Revolut, the amaze card provides free FX conversions on our transactions based on MasterCard’s prevailing rates.

Here’s a comparison of the FX rates between amaze, YouTrip, Revolut, and DBS for SGD – USD.

| Provider | SGD to USD |

| amaze | 0.7193 |

| YouTrip | 0.7199 |

| Revolut | 0.7198 |

| DBS | 0.7148 |

This makes it a suitable candidate for a travel card or for making foreign currency transactions like on Taobao.

Update 2023: Instarem’s FX conversion rates have become less competitive than before and can be 2 – 3 % worse than YouTrip and Revolut. But if it allows you to earn 4 mpd, it’s probably still worth it!

In fact, since it allows us to earn credit card rewards and cashback, it’s probably a better candidate than Youtrip and Revolut which generally don’t earn rewards with spending.

No Top-Ups Required

Since amaze links directly to the paired MasterCards, it is not a mobile wallet and doesn’t require top-ups.

This is a significant advantage over other multi-currency cards like YouTrip or Revolut which function as mobile wallets.

You never have to worry about running out of cash in your account and needing to top up your card when you’re at the counter trying to make a payment.

You also won’t have to worry about having unused cash left over in the account.

Best Cards To Link With amaze

Remember that only MasterCards are compatible with amaze.

Here are some of the best MasterCard to link with the amaze card for each type of credit card – specialised miles, general miles, high cashback, and unlimited cashback.

Specialised Miles – Citi Rewards

The best card to pair it with for miles is definitely Citi Rewards.

Citi Rewards is a specialised miles card that earns 4 mpd on offline retail shopping and online transactions excluding travel.

Given that the amaze card converts offline transactions to online transactions, it allows us to earn 4 mpd on a much wider range of transactions.

For example, dining out at a restaurant and paying with Citi Rewards will not earn 4 mpd since it’s an offline dining transaction.

But paying with the amaze card will earn 4 mpd because the transaction would now be an online dining transaction.

This greatly increases the utility of the Citi Rewards card and makes it more comparable to its Visa competitors – HSBC Revolution and UOB Preferred Platinum Visa.

You can find more details about these 3 cards in my best specialised miles credit card post, but note that it doesn’t take into account the amaze card being paired with Citi Rewards.

Check out my review on the Citi Rewards card here!

General Miles – UOB PRIVI Miles/Citi PremierMiles

For general miles cards, there isn’t much difference among the available options.

The miles earn rate for UOB PRIVI Miles and Citi PremierMiles are 1.4 mpd and 1.2 mpd respectively, and miles are earned on generally all transactions.

So there wouldn’t be much discernable difference between the 2 options when it comes down to the rewards rate.

However, there are other differences between these cards such as miles transfer partners, points pooling, complimentary insurance coverage, etc.

You can find out more about these differences in my best general miles card post.

More details about these cards can be found here: UOB PRIVI Miles and Citi PremierMiles.

High Cashback – Citi Cash Back/Maybank Family & Friends

Both of these cards are reasonable options to pair with the amaze card.

They both have a monthly spending requirement of S$800, but the mechanics of their cashback are slightly different.

The Citi Cash Back awards 6% cashback on dining and 8% cashback on groceries and petrol.

There is no monthly cap per category – instead, the Citi Cash Back has a collective monthly cashback cap of S$80 across all categories.

More details about the Citi Cash Back card can be found here.

Meanwhile, the Maybank Family & Friends (F&F) awards 8% cashback on up to 5 of the following 10 categories:

- Groceries

- Transport

- Dining & Food Delivery

- Retail & Pets

- Data Communication & Online Streaming

- Online Fashion

- Entertainment

- Pharmacy

- Sports & Sports Apparels

- Beauty & Wellness

By default, the first 5 categories are selected, but you’re able to change the selection of categories on a yearly basis.

Cashback awarded is capped at S$25 per category per month, up to a maximum of S$125 cashback in total per month.

More details about the Maybank F&F card can be found here.

Unlimited Cashback – Citi Cash Back+

There aren’t too many options for MasterCard-issued unlimited cashback cards, but the Citi Cash Back+ is the best pick here.

Citi Cash Back+ offers 1.6% cashback on all spending with no spending requirement and no cashback cap, which makes it a great fuss-free card.

Pairing it with the amaze card brings your total cashback to 2.1%, which sounds decent, but really isn’t.

For one, this is only for foreign currency transactions.

Since we’ve established earlier that the FX rate of the amaze card linked to a MasterCard incurs an implicit fee of 2-3%, you’re probably losing money on FX transactions.

In my opinion, the Citi Cash Back+ and amaze pairing isn’t worth using because you won’t earn IPs from SGD transactions, and you don’t need the benefit of converting offline transactions to online ones.

If you want to use an unlimited cashback card, I’d recommend you go with AMEX TCB/UOB Absolute.

More details about the Citi Cash Back+ card can be found here.

Citibank Signup Rewards

If you want to sign up for a Citibank credit card to use in conjunction with the amaze card, now might be a good time to do it.

Citibank Offer: Dyson Supersonic*, Dyson V8 Slim Fluffy, or S$300 Cash

*: Citi PremierMiles only

Promotion Period: 26 Jan – 31 Jan 2024

Eligible Cards:

How To Get Reward:

- Be a new Citibank credit card customer

- Sign up for your preferred card via the promotion link above

- Fill in the rewards redemption form within 14 days of card application

- Receive approval for your card by 29 Feb 2024

- Make a qualifying spend of S$500 within 30 days of card approval

- Do not cancel the card for the first 12 months (the gift may be retracted otherwise)

Link To SingSaver Signup Rewards Guide:

https://thefrugalstudent.com/singsaver-sign-up-rewards-guide-what-you-need-to-know/

Things You Should Know

MasterCard Only

The amaze card only supports MasterCards, so if you don’t have any good MasterCards, you might not have much use for it when it comes to daily usage.

Linked Card Rewards Criteria

While the amaze card allows us to double-dip on rewards, it’s not a given that you will be able to stack rewards on every transaction.

At the end of the day, you will only earn rewards from your linked card for eligible transactions.

For example, using my amaze card linked to my Citi Rewards card to pay for a hotel booking will not earn me 4 mpd on my Citi Rewards card.

This is because hotel bookings are a part of Citi Rewards’ exclusion list of eligible transactions to earn 4 mpd.

So I’d be better off using a different card like HSBC Revolution for such a transaction.

Amaze InstaPoints Criteria

Just as how credit and debit cards have rewards eligibility criteria and rewards-exclusion transactions, amaze does too.

Only foreign currency transactions of S$10 (in equivalent currency) or more are eligible to earn IPs.

IPs are awarded at a rate of S$1 = 0.5 IP for foreign currency transactions.

All IPs earned during the quarter will be credited into your amaze account on the 15th of the month after the quarter.

This means cashback earned from Jan-Mar will be awarded on 15th Apr, cashback earned from Apr-Jun will be awarded on 15th Jul, and so on.

Note: Even though Instarem claims that IPs are only awarded quarterly, in my experience, IPs have been awarded as soon as the transaction is posted.

Cashing Out

IPs that you earn can be redeemed for cashback.

But since amaze is not a mobile wallet, you can’t directly withdraw the cashback that you’ve earned.

You can either spend it or use a workaround to withdraw the cashback.

To spend the cashback, you have to change the payment source of your amaze card from your linked MasterCard to amaze wallet.

Then, make payment with your amaze card as normal.

If you want to withdraw the cashback instead, the workaround is that you can use your amaze card to top up either your GrabPay or Revolut wallet, again after changing the payment source of your amaze card.

The amaze card is considered a debit card, so whatever amount you top up your GrabPay wallet with the amaze card can be withdrawn to your bank account.

I’ll show you how to do this in the step-by-step guide below.

Step-by-step Guide

1: Download The Instarem App

To start off, download the Instarem app.

You can do this via the app store, or if you’d like to support me, you can use my referral link.

2: Sign Up For An Account

Launch the Instarem app and sign up for an account.

If you’d like to support me, you can use my referral code “MAMVW9“.

3: Request For The amaze Card

In the app, request for the amaze card.

Your virtual card will be activated immediately and you can start using it for online transactions.

It can also be added to Google Pay, though it’s not supported on Apple Pay as of now.

You’ll have to wait a while for your physical card – mine took between 1-2 weeks to arrive.

4: Link Your Preferred MasterCard

Once your virtual card is activated, you’ll need to link a MasterCard to it before you can start using it.

To do this, tap on the “cards” tab in the bottom menu and tap on “Payment Source”.

Then tap on “Link New MasterCard” and enter your card details accordingly.

5: Pay With amaze

Now that your amaze card is all set up, the next thing to do is start paying with your amaze card as normal.

Remember that the amaze card isn’t supported on Apple Pay, so if you’re an iPhone user, you’ll need to bring the physical card around with you after you get it.

Also, remember that only eligible foreign currency transactions of S$10 or more will earn IPs.

6: Redeem Your InstaPoints

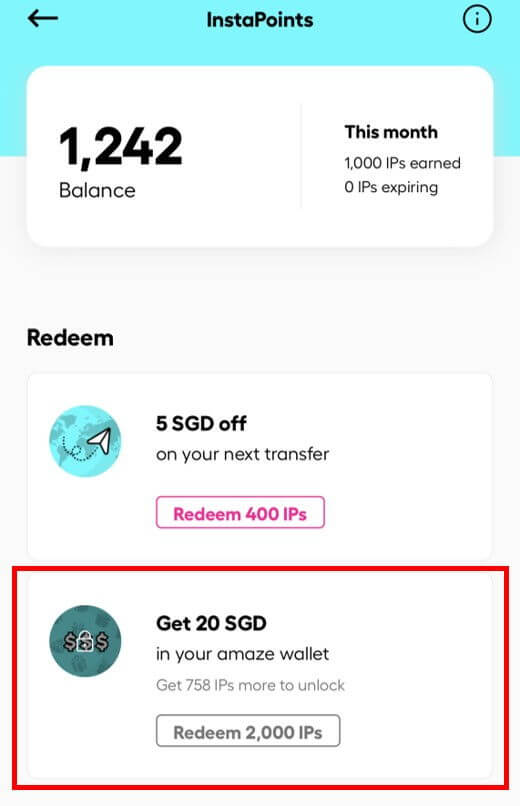

After accumulating at least 2,000 IPs, it’s time to redeem them for cash.

On the home page of the Instarem app, scroll down to “InstaPoints”.

Here, you’ll see your current IP balance and how many IPs are expiring soon.

For more details, click “See more”.

Under “Rewards”, select “Get 20 SGD in your amaze wallet” and confirm the redemption.

The 20 SGD should be credited to your amaze wallet almost immediately.

You can also check your historical IP transactions on the same screen, at the bottom.

7: Cash Out/Spend

As mentioned earlier, you can’t directly withdraw your cashback from your amaze wallet – you’ll either have to spend it or withdraw it via a workaround.

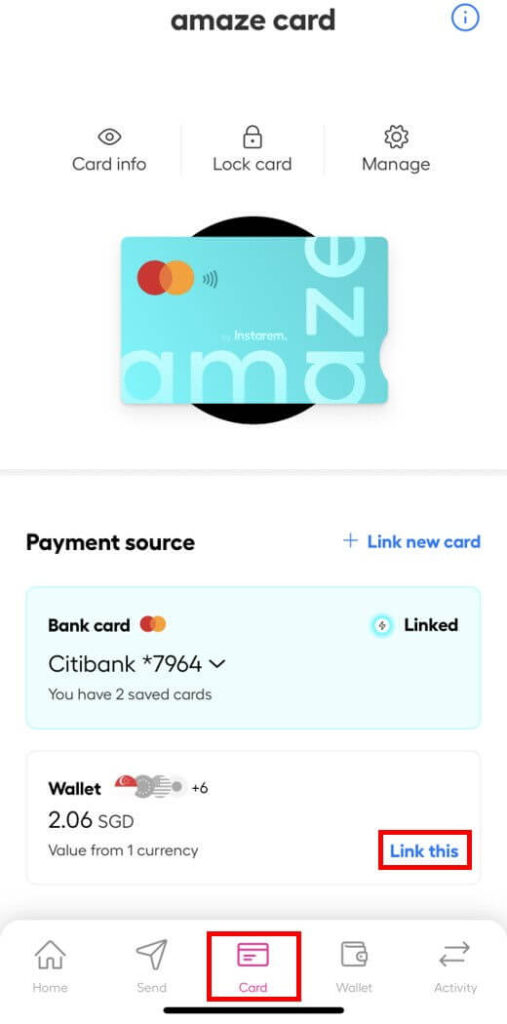

Either way, you’ll need to change your payment method to “amaze wallet” first.

In the Instarem app, go to “Card”, and under “Wallet”, select “Link this”.

If you wish to simply spend the cash, then there’s nothing else you need to do – spend away.

But if you wish to withdraw it, you’ll have to do a workaround.

This will require you to have either a GrabPay or Revolut account.

Top up your GrabPay/Revolut account with your amaze card, making sure that the payment source selected is “amaze wallet”.

Since this counts as a debit card top-up, you’ll be able to withdraw this amount from your GrabPay/Revolut account into your bank account.

To summarise,

The amaze card is great if you have a good MasterCard to link it with.

It provides the opportunity to double-dip on your credit/debit card rewards and doubles up as a travel card by providing free FX conversions.

It’s also one of the few travel cards that earn rewards on overseas spending.

While 1% cashback might not be much, it’s a bonus that we wouldn’t be able to earn otherwise, so I think there’s nothing to complain about.

The question is how long amaze will be able to maintain its rewards structure and whether banks will continue to award credit card rewards for amaze transactions.

The amaze card has been severely nerfed since its initial release, indicating that its current rewards structure is not sustainable.

Nonetheless, I plan to continue taking advantage of it while I still can.

Do you or will you use the amaze card? Why or why not? Let me know in the comments below!

6 replies on “Instarem’s amaze Card: Everything You Need To Know”

Hi. Are u able to topup grabpay with the amaze card still? I’m unable to topup. I tried $10 and 20 also cannot.

Hi EJ,

Thanks for checking out my blog and leaving a comment!

As of 2 Aug, I could still top up my GrabPay with my amaze card using my cashback as the payment source.

I tried again while writing this reply, and I was able to make the top-up, though I used my linked MasterCard as a payment source since I have no more cashback left to cash out.

In the case I do not have the above mentioned credit cards, can I link my grab card as a payment source for amaze? (Since it’s a MasterCard) or does it only work for credit cards?

Hi Nicholas,

Thanks for checking out my blog and leaving a comment!

The amaze card works with debit cards too, but GrabPay isn’t compatible. If you don’t have credit cards, you can link the Standard Chartered debit card (comes with the JumpStart account)!

Can I use my dcs ultimate platinum mastercard credit card to linked amaze card…

Hey Andy,

Thanks for checking out my blog and leaving a comment! I’m writing this email to give my response.

I understand you’re interested to link your DCS credit card to the amaze card. After a quick search in the DCS Ultimate Platinum Card’s terms & conditions, it seems this will not be possible as amaze transactions is listed as one of the exclusion categories.

As a result, any transactions you make with the amaze card linked to your DCS card will likely not earn any cashback.

Hope this helps!