Check out my updated post on US-domiciled ETFs VS Ireland-domiciled ETFs here.

Earlier this year, I wrote a post about why I wasn’t investing in CSPX or other Ireland-domiciled ETFs.

This was mainly due to the fact that at the time, there was no cheap way to invest in Ireland-domiciled ETFs that are listed on the London Stock Exchange (LSE).

The cheapest option was Interactive Brokers (IBKR), but they charged a monthly fee that racks up quickly.

The next best option was Standard Chartered Online, which charges a whopping 10 USD/GBP commission fee per trade.

Thankfully, the situation has changed drastically since then with IBKR’s removal of their monthly fee, which makes investing in the LSE a lot cheaper now and worth considering.

However, is this enough to warrant investors to make the switch from US-domiciled ETFs to Ireland-domiciled ETFs?

What are the costs involved in investing in Ireland-domiciled ETFs with IBKR?

Why should you even consider investing in Ireland-domiciled ETFs over US-domiciled ETFs in the first place?

All of these questions will be answered in today’s post.

Why Ireland-Domiciled ETFs?

Let’s start with the question at the source – why should investors consider Ireland-domiciled ETFs anyway?

While US- and Ireland-domiciled ETFs are almost identical in terms of performance and holdings, Ireland-domiciled ETFs provide significant advantages to non-US investors, ie Singaporeans.

1: Dividend Withholding Tax

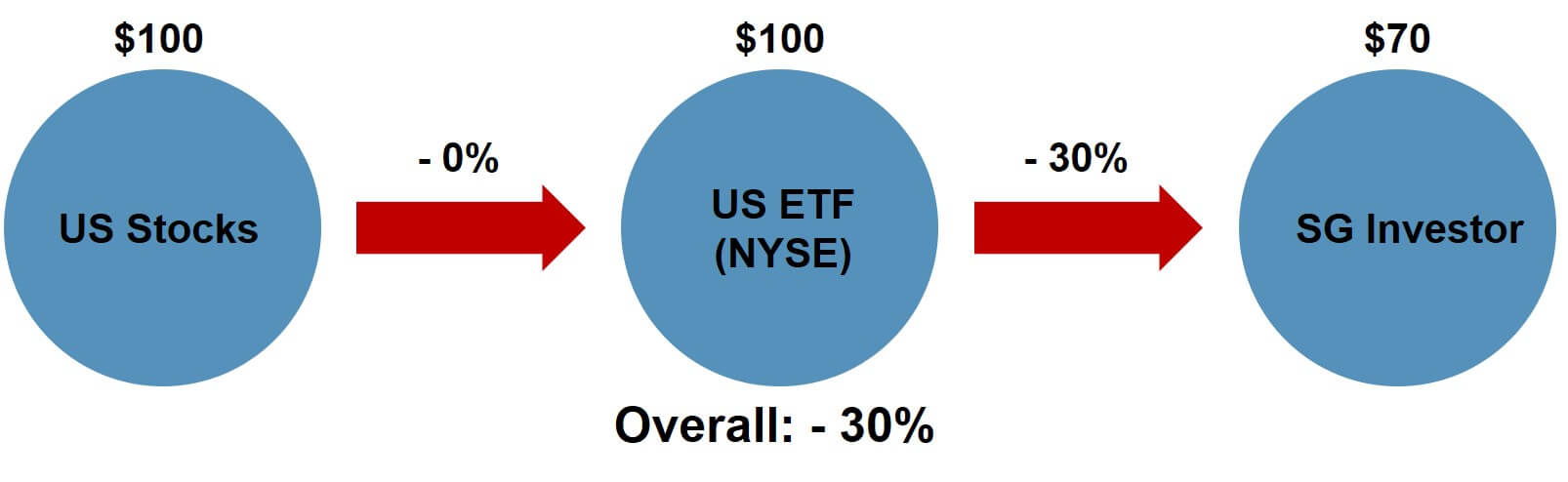

The most notable benefit is a lower dividend withholding tax rate of 15% with Ireland-domiciled ETFs as compared to 30% with US-domiciled ETFs.

This tax is applicable on all dividends being paid out and is dependent on the country of both the payer and the payee.

In the case of ETFs, there are always 2 payer-payee pairs involved.

The first is the underlying stocks of the ETF (payer) and the ETF itself (payee).

The second is the ETF (payer) and the investor (payee).

In the case of an S&P 500 ETF that pays, for example, $100 in dividends, this is the effect of withholding tax on investors.

US-Domiciled ETF:

Ireland-Domiciled ETF:

As you can see, Ireland-domiciled ETFs are favourable for investors when it comes to dividends.

2: Accumulating ETFs

Next, Ireland-domiciled ETFs provide an opportunity for investors to invest in Accumulating variants of US ETFs, which are typically only available as Distributing ETFs.

This is because US law requires ETFs to pay out at least 90% of their dividends to investors.

However, there is no such law in Ireland, so Ireland-domiciled ETFs can be either Accumulating or Distributing.

Accumulating ETFs can be advantageous for investors because it saves them the trouble of needing to reinvest dividends, which more often than not results in “idle cash”.

You can read more about this in my post about Accumulating VS Distributing ETFs.

What Are The Costs Involved?

1: Commission Fees

The first fee you need to take note of is commission fees.

For investing in the LSE with IBKR, commission fees are dependent on the currency in which the stock/ETF is denominated.

Consequently, the commission fee will be charged in the same currency.

The commission fees for the respective currencies are summarised below.

| Commission Fee |

Minimum Fee |

|

| USD | 0.05% | 1.70 |

| GBP | 0.05% | 1 |

| EUR | 0.05% | 1.25 |

For example, since CSPX is denominated in USD, the commission fee will be 0.05% of the trade value with a minimum of 1.70 USD.

2: FX Conversion Fees

Next, unlike many other brokers, IBKR charges a fee for every FX conversion you make.

This fee is 0.002% of the trade value with a minimum of 2 USD.

However, what you get in return is a competitive, spot-rate conversion on your FX while other brokers give you an FX spread that results in ~0.3% in losses.

While a flat fee of 2 USD may seem like a huge turnoff, given that FX losses are ~0.3% from other brokers, a conversion amount of 2/0.3% = 667 USD or higher makes IBKR the superior choice.

When converting large sums of cash, this will save you much more money than the cost of the conversion fee.

You can read more details about this in my IBKR guide if you’re interested to find out more.

Should You Make The Switch?

Before making this decision, further analysis is required.

Specifically, you need to compare the costs of the investments you’re currently making against the Ireland-domiciled investments you’re thinking of making.

Let me walk you through the steps I took to decide whether or not I should switch from US-domiciled ETFs to Ireland-domiciled ETFs.

Personally, I was investing in VOO using Tiger Brokers.

As soon as I found out that IBKR removed their monthly fee, I knew that I was going to start using IBKR no matter what.

Not only does IBKR have lower commission fees for US investments than Tiger Brokers, but they also present an opportunity to invest in Ireland-domiciled ETFs at an affordable rate.

So the question then became whether I would continue investing in VOO or switch to CSPX, ie US-domiciled or Ireland-domiciled ETFs.

For a cohesive analysis, I compared both the broker-related costs and ETF-related performance of both options.

Broker Costs

| VOO | CSPX | |

| Commission Fee |

0.35 | 1.70 |

| FX Fee | 2 | 2 |

All fees in the table above are in USD.

Note that I only stated the minimum fees rather than the nominal fees because in most cases, I don’t expect the fees to be much higher than the minimum.

From this, we can see that investing in VOO is cheaper than CSPX by 1.35 USD/trade.

Assuming that investments are made once every month, this adds up to 16.2 USD/year.

ETF Costs

| VOO | CSPX | |

| Expense Ratio | 0.03% | 0.07% |

| Net Dividend Yield | 0.91% | 1.20% |

Source: Bloomberg

The net dividend yield for VOO is after the effect of the 30% withholding tax.

Meanwhile, since CSPX is an Accumulating ETF and doesn’t pay out dividends, it’s not possible to determine its dividend yield.

Instead, I assumed that CSPX’s dividend yield is similar to that of VUSD – an Ireland-domiciled, S&P 500 Distributing ETF.

For Ireland-domiciled ETFs, the disclosed dividend yield is already the net dividend yield.

Further, I will also assume that VOO and CSPX will produce similar returns in the long run since they are both tracking the S&P 500.

As a result, the expense ratio and net dividend yield of both ETFs will determine which is the better ETF.

Since the expense ratio is a cost while net dividend yield represents returns, we need to compare the difference between these 2 values.

From the table above, VOO will have a net return of 0.88% while CSPX will have a net return of 1.13%.

Thus, CSPX outperforms VOO by 0.25%/year.

Putting It Together

From the broker-related costs, we know that it’s cheaper to invest in VOO than CSPX by 16.2 USD/year.

On the other hand, CSPX outperforms VOO by 0.25%/year.

So if 0.25% of your portfolio value is less than 16.2 USD, investing in VOO is better. Otherwise, CSPX is the better choice.

A simple, static calculation reveals that the point where CSPX becomes better than VOO is 16.2/0.25% = 6480 USD, or 8.7k SGD.

My Decision: CSPX

After analysing both options, it became clear to me that CSPX is the better investment decision.

At the time I was making this decision, my portfolio value had already passed the threshold value.

But even if it hadn’t, I would’ve picked CSPX anyway because it’s only a matter of time before that happens.

Since the threshold value of $8.7k is fairly low, it should be achievable in a reasonably short period of time.

Also, it’s more convenient to invest in Accumulating ETFs now when I’m young and trying to build up my wealth.

The automatic reinvestment of dividends helps to make the effect of compounding work in my favour without having to do anything.

Fractional Shares

One thing to note is that fractional shares on IBKR are only supported for US investments.

This is an advantage that you’ll have if you choose to invest in VOO over CSPX.

Fractional shares allow you to own stocks/ETFs in fractional lot sizes.

So even if you don’t have enough cash to invest in whole lot sizes, you can still invest all your cash.

For example, if an ETF costs $600 and you only have $500, you normally wouldn’t be able to invest your $500 at all.

With fractional shares, you can invest your $500 into that ETF by owning a fraction of it rather than a single unit.

Or, if you have $1000 to invest, you’d normally only be able to buy 1 share and have $400 leftover.

Fractional shares will allow you to invest your whole $1000 by owning 1.67 shares.

Depending on your regular investment sum and the price of what you want to invest in, fractional shares may be more beneficial to you and may make US-domiciled ETFs more favourable.

To summarise,

Ireland-domiciled ETFs are advantageous to us as Singaporean investors due to the lower dividend withholding tax rate.

They also provide us with a way to invest in Accumulating variants of US ETFs which are generally Distributing.

While IBKR’s removal of its monthly makes investing in Ireland-domiciled ETFs much cheaper than before, it’s still not as cheap as investing in US-domiciled ETFs.

To decide whether US- or Ireland-domiciled ETFs are better for you, you need to further analyse the effects of both the broker and ETF costs.

You can follow the same approach I used to perform this analysis and adjust it however you deem fit for your situation.

While my approach isn’t perfect, hopefully, it gives you an idea of the things you should be considering when making this decision.

Are you investing in US- or Ireland-domiciled ETFs? Why? Let me know in the comments below!

52 replies on “Should You Invest In CSPX And Ireland-Domiciled ETFs?”

Hi, for IBKR, when I use USD to buy VWRA, why am I still charged a USD2 fx fee? I have already paid for the fx fee when converting SGD to USD. Am i being double charged for fx?

Hi,

Thanks for checking out my blog and leaving a comment!

That’s strange, you shouldn’t be charged a FX fee again if you already have sufficient USD. Could this 2 USD fee you’re seeing be the commission fee? Since VWRA is traded on the LSE and denominated in USD, the minimum fee is 1.70 USD. Taking into account other exchange fees, this may add up to 2+ USD.

Otherwise, maybe you have insufficient USD balance to execute the trade + pay for the commission fees, so the balance is being paid by converting your SGD balance to USD on the spot and incurring the 2 USD FX fee. I’m not sure if this is how it works since I haven’t encountered this issue before, so it’s just a guess.

Hi, TST,

Thanks for sharing of your analysis.

I took a look at the statements of my trades on IBKR of the last a few months. I have used ready USD to trade CSPX and VWRA. The “Comm/Fee” has been consistently S$4.28 per trade. Shouldn’t it be US$1.7 * ~1.35 = S$2.3? (Note (US$1.7 + US$2) * 1.35 = S$5.0)

Look forward to your thoughts.

Hi Victor,

Thanks for checking out my blog and leaving a comment!

By “ready USD”, I assume this means you didn’t need to convert SGD to USD, and already had USD on hand – which means you didn’t convert SGD to USD and didn’t incur any FX fees.

You’re right that your fees appear to be higher than expected. It sounds like your account is using the fixed pricing structure for commission fees (default setting) rather than the tiered pricing structure (requires customisation, low fees as stated in the post).

I have a post where I outline the steps on how to make the change in your account settings – you can check it out here.

Hope this helps! Happy New Year!

Hi,

I tried buying fractional shares of CSPX via IBKR but not allowed (system error). I suspect that LSE does not allow fractional shares as what US stock exchange does. Could you advise if this is correct please ? Thank you

Hi Mic,

Thanks for checking out my blog and leaving a comment!

Yup, you’re right about that. As I mentioned in the post as well, fractional shares is only supported for US investments, so CSPX is not eligible for it. If you want to invest in fractional shares, you’ll have to pick a US-domiciled ETF like VOO.

Hi,

Thanks for the advice. having less than 8k in my CSPX portfolio and only SGD 500 to invest a month , I switched from CSPX to VOO to take advantage of purchasing fractional shares as it cost around 630 SGD to purchase a share of CSPX.

My question is with regards the recent narrative of a potential stock market crash/correction in the coming months , whats your opinion in

1. DCA into one share of ever rising CSPX per month

2 . Invest a fixed sum of money per month in VOO (e.g 500 SGD) and hold cash to take advantage of the potential “correction”

Hi,

Thanks for checking out my blog and leaving a comment!

Personally, I don’t think it’s helpful to listen to the narrative of a potential stock market in the next few months. The reason is that stock market crashes will always come, so as long as people keep saying it will come, eventually, it will come. But no one knows if it will come next week, next month, next year, or 5 years later.

If you only have 500 SGD to invest every month, it’s not enough to buy 1 share of CSPX every month. I think it’s better to invest within your means – if you’re able to squeeze out more money in a particular month to buy CSPX instead of VOO, then go ahead. If you’re not, don’t worry about it and just buy VOO. Eventually, when you are able to set aside more to invest, you can shift more towards CSPX over VOO if you wish. It’s definitely nice to hold some cash to take advantage of any potential market corrections, but don’t hold too much cash – this will cause you to lose out on returns while waiting for a crash to come. Even if a crash comes, if the market rallies a lot before that, you may still lose money if the crash is not substantial enough (ie if market is up 20% from now – next year, but the crash next year is only 10%).

Hope this helps!

Hi,

I recently invested in CSPX after reading up about potential ETFs and with your advice!

I would like to ask, how do you safely invest in CSPX without real-time quotes? I found this out as I saw that IBKR doesn’t show real time quotes of its stocks as compared to Tiger Broker. Wouldn’t this mean at the time of investing, you would be paying a higher/lower as compared to the current market price?

What are some things that I can do to counter this, or the price change is negligible?

Thanks!

Hi,

Thanks for checking out my blog and leaving a comment!

You’re right about IBKR not providing live market data, which results in delayed data being displayed on the interface. IMO, I don’t think this is much of an issue especially for long-term investing where you’re not looking to arbitrage pockets of profit here and there. Long-term investors are usually price takers, ie they continue to invest regularly regardless of the market price. With that said, I don’t think it is necessary to invest based on live data because the end-game is 10, 20, or even 30 years down the road and mere minutes of price changes are likely to be insignificant, especially for ETFs.

If you want to curb this, there are 2 possible workarounds:

1. When placing your order in IBKR, instead of placing a limit order (the default order type), you can place a market order. This means that instead of stating a price at which you want your order to be executed (limit order), you execute the trade at the current market price. Even though IBKR displays delayed data, trades occur in real-time, so this can help you get around any price changes during the delay. Of course, this can also work against you if the market price has gone up as compared to the delayed data displayed on the interface.

2. You can use Tiger Brokers to view the price of CSPX before placing your order in IBKR. Tiger’s data is more up-to-date as compared to IBKR’s.

Hope this helps!

Thanks TFS for the super useful information. I’m very keen on starting what will hopefully be a decades-long passive investing strategy and this thread has been incredibly helpful.

Just curious, have you noticed that over the long-term US domiciled ETFs (e.g. VOO) tend to outperform their Irish domiciled counterparts (CSPX) slightly, despite the latter being accumulating? CSPX has a 10year annualised return of 16.04% vs VOO’s 16.58%

I wonder why that may be the case since they are both tracking the identical S&P 500 index.

And might that negate the potential benefit of the lower dividend withholding tax of the Irish-dom ETF (CSPX)?

References:

https://www.morningstar.com/etfs/arcx/voo/performance

https://www.morningstar.com/etfs/xlon/cspx/performance

Hi Wei Guang,

Thanks for checking out my blog and leaving a comment! I’m glad you’ve enjoyed the content 🙂

Hmm, I’m not sure of the exact reasons, but I’m going to make some guesses here:

– Tracking error. Even though both CSPX and VOO track the same index, they may not hold all the stocks in exactly the same weightage. This may result in slight differences in performance over time.

– Dividend withholding tax. VOO is US-domiciled and CSPX is Ireland-domiciled. The raw dividends paid by VOO are not taxed, while the dividends that CSPX receives are subjected to a 15% WHT from the US. This means that on paper, CSPX receives less dividends than VOO. But in reality, the dividends that are paid out by VOO are also taxed, just on the investor level. This may cause VOO to portray better performance, even if it’s not actually realised by the investor.

Again, I don’t know if the reasons I’ve stated above are true, but these are my guesses!

Dear TFS,

Thank you for taking the time to respond. Yes after a bit of review I realise that each fund’s portfolio is slightly different from each other (and the S&P500 index) so tracking error may be one reason.

You make a great point about in the calculations, dividends reinvested in CSPX (accum) have already been taxed, whereas the dividends from VOO have yet to be taxed. However I’m not sure this explains the slight outperformance of VOO over CSPX in terms of NAV

You’re right, I really don’t know what exactly causes the slight outperformance of VOO over CSPX – they’re just guesses. It’s interesting to note, but ultimately I think there are other things that should weigh heavier like dividend withholding taxes!

Hi TFS,

For CSPX is there a minimum sum I should be putting in each month/quarter for the fees to be worth it? E.g 2 shares per quarter?

– I note we should change at least 667 USD each time

– invest more than 8.7k into cspx eventually

DCA with IBKR would mean having to put in a manual request to buy every month/quarter right? For tiger to buy Voo, what is the extra cost vs IBKR? $1.99 vs $0.35 per trade?

Hi Lyn,

Thanks for checking out my blog and leaving a comment!

I wouldn’t say that there’s a minimum sum to invest to justify the fees, since this is pretty subjective and would vary from one person to the next. Personally, I think 2 shares/quarter is fair.

Yes, you need to manually submit a buy order (and convert your currencies) in IBKR to DCA.

For VOO, the fees to compare between Tiger and IBKR are:

1.99 USD vs 0.35 USD commission

0.3% (implicit in conversion rate) vs 2 USD FX conversion

Hope this helps!

Since fractional shares are not allowed, what will happen to the accumulating dividends. I assume when is being accumulated it generally increases it’s position size no?

Hi Patrick,

Thanks for checking out my blog and leaving a comment!

You’re right that accumulating ETFs use their accumulated dividends to increase their position size in their underlying stocks. When I said that fractional shares are not allowed, I meant that investors are not allowed to own fractional shares of the ETF itself – in this case, CSPX.

However, it’s highly likely that CSPX, as an ETF, owns fractional shares of the underlying S&P 500 stocks.

You can check out this post about how accumulating ETFs work to find out more:

https://thefrugalstudent.com/how-do-accumulating-etfs-work/

Hope this helps!

Hi, fee for IBKR minimum is 0.35usd and not like what u posted. Remember to change from account setting to “Tiered” instead of fixed pricing (default is fixed). Check the differences here:

https://www.interactivebrokers.com/en/index.php?f=1590&p=stocks

https://www.interactivebrokers.com/en/index.php?f=commission

Hi David,

Thanks for checking out my blog and leaving a comment!

IBKR charges 0.35 USD for commission only for US-listed stocks and ETFs.

In this post, I am referring to the commission charged for USD-denominated stocks and ETFs that are listed on the LSE – which is not the same as US-listed stocks and ETFs.

In this case, the commission is 1.70 USD for tiered pricing.

Hope this clarifies things!

HI, I’m wondering why not VUAA in the list? is this not a good ETF? any thought? Thanks

Hi Lw,

Thanks for checking out my blog and leaving a comment!

VUAA is a great ETF as well, similar to CSPX. In this post, I was simply trying to draw a comparison between 2 similar ETFs that are domiciled in the US and Ireland respectively, and chose VOO and CSPX as they are 2 of the more “well-known” ETFs.

Considering that VUAA is much younger than CSPX, its trading volume is much lower than CSPX’s. If you’re not trading, this shouldn’t make too much of a difference, but you may want to opt for limit orders over market orders to avoid getting hit by large bid-ask spreads.

VUAA’s share price is also much lower than CSPX’s, which may actually be a good thing if you plan to DCA and your DCA amount isn’t enough to buy 1 share of CSPX. VUAA’s share price makes it easier to invest in, since you don’t need as much capital every time you want to DCA.

Hope this helps!

Hi I currently am thinking of selling 50% of my STI etf portfolio to buy CSPX. I also have invested quite a few years in VWRD before VWRA came about. Both of which I am using POEMS brokerage.

Is it better for me to purchase CSPX and VWRA from IBKR or do you think POEMS is good enough as well? Also, how would you advise me to switch from VWRD to VWRA? Will I be losing out on my investments over the years that I made?

Hey R,

Thanks for checking out my blog and reaching out!

I’m not too familiar with POEMS, but based on a quick search, it seems that POEMS charges a custodian fee (though it seems to be waived for now).

Based on this, I’d prefer to buy new shares on IBKR rather than POEMS since IBKR doesn’t charge any custodian fees.

From what I see, there doesn’t seem to be much difference in commission fees since for IBKR, you need to take into account the 2 USD FX conversion fee as well.

But another thing to take note of is the FX conversion rate. IBKR offers competitive spot rates, while I’m not sure what rate POEMS offers. This may further skew the favour towards IBKR.

Next, you won’t be losing money by switching from VWRD to VWRA, other than the fees you pay to commission during the selling and buying of shares.

In fact, you’ll likely be earning money in the long run since VWRA, as an Acc ETF, is more effective at compounding than VWRD, a Dist ETF.

If you do decide to switch from POEMS to IBKR when selling VWRD and moving to VWRA, you’d want to be careful of how you manage currency. Given your 6 digit portfolio, even a small FX loss will result in hundreds or even thousands of dollars of losses, so it might be in your interest to keep your cash as USD as you move it around.

You may get charged a TT fee for withdrawing USD from POEMS into a bank account, but this is likely less than the FX loss you will experience by converting it to SGD. Once you have USD in your bank account, if you use DBS, USD deposits into IBKR are free.

Hope this helps!

Hello

Thank you for your information

I’ve decided to investing in CSPX using IBKR.

Previously have bought VOO using Tiger.

May I ask your advice if I should open IBKR SG or IBKR US account version??

Thanks in advance

Hey Cynthia,

Thanks for checking out my blog and leaving a comment!

To my knowledge, there are a few differences between IBKR SG and IBKR LLC (US):

1. IBKR SG allows investing on SGX, IBKR LLC doesn’t

2. IBKR SG uses a DBS MCA so funding (in SGD or FX) can be done via wire transfer if you also have a DBS MCA, IBKR LLC uses a US bank account so funding must be done via an overseas remit

3. IBKR SG is not protected by SIPC, IBKR LLC is. However, IBKR SG has its own set of regulations in place to safeguard your investments if IBKR SG goes underwater.

Personally, I use IBKR SG, and I think it’s fine. The convenience of funding my IBKR SG account is great, and I’m not too bothered by IBKR SG not being protected by SIPC since it’s regulated nonetheless.

Also, I believe you can only sign up for IBKR LLC if you use an existing IBKR LLC customer’s referral link, so you might want to take note of that if you do decide to go with IBKR LLC.

Hope this helps!

Hi TFS, thank you for your detailed introduction on the fees involved in investing in CSPX with IBKR. I have only recently started to invest and I want to invest 30k sgd existing savings into CSPX + 1k sgd monthly budget for CDA. Can you please advise me on the FX strategy and CDA strategy to use?

Hi Michelle,

Thanks for checking out my blog and leaving a comment!

$1k SGD to DCA/month is a good amount to invest in itself, but with the share price of CSPX at ~400+ USD, this means you can only buy 1 share of CSPX every month since IBKR doesn’t support fractional shares of CSPX. In this regard, you won’t get to invest the full $1k SGD every month even though you have to pay the fees involved each time. So you might want to consider investing every 2-3 months instead so that you can fully invest the amount you intend to while only paying 1 round of fees (for FX conversion + commission fees).

Hope this helps!

I am a Filipino, starting to invest. I have read alot about irish-domiciled ETF, and you’re the first one to mention that US domiciled ETF might be a better choice for some.

I don’t have much to invest, and I can see the broker fees eating up my investment.

But I can see that in the long run, VUAA is better than VOO because of the dwt.

I will try to do my own computations. Thank you for the info!!

Hi Marc,

Thanks for checking out my blog and leaving a comment! I’m glad you’ve enjoyed my post 🙂

Yup, it’s always important to consider your own circumstance when it comes to investing because everyone has a different financial situation. All the best!

Hi TFS! Was not sure on where I can find more info on how/when CSPX releases the accumulating dividends. With the distribution ones, there usually is an ex dividend date. I understand you cannot calculate a dividend yeld, but wondering how can I check past history on this and what to expect in the future. Searched quite a lot and found no real info on this. Also looked in IBKR interface and I see nothing there (assuming that owning the etf shares for a few weeks is enough to qualify for acc dividends)

Also, regarding bot being to own fractions of CSPX, I understand that the ETF is able to receive fractions, but how will they the credit the investor if the attributed value is less than one share? Thanks so much!

Hi Alex,

Thanks for checking out my blog and leaving a comment!

You’re right, I don’t think there’s much info about when dividends are received by CSPX. You probably won’t find any info on IBKR’s interface either since it’s not registered as dividends. One possibility may be finding out when the index receives its dividends, and assume that it’s around the same period.

Regarding the fractional shares, CSPX (the ETF) can own fractional shares of the underlying stocks, which results in an increase in NAV of the ETF. This is simply reflected to the investor as an increase in value of each share of CSPX.

Hope this helps!

Hi TFS, I’m confused of your reasoning behind your static calculation (eg. 16.2/0.25% = 6480 USD) How do you know CSPX is better than VOO based on that value?

Wth new brokers offering 0 commission trade (eg. Webull, TD), they were paid through payment for order flow, does it affect us or is it something we need to worry in the long run?

Also there’s Syfe Trade offering 2 free trades per month (subsequent US$1.49 flat) in US market which would be perfect for DCA in ETFs like VOO

So right now I’m still deciding between IBKR or Syfe Trade, and the reasoning behind your static calculation will greatly help.

Btw thank you so much for writing this guide, this is what I needed

What if I am a resident of England and still want to buy Irish Accumulating ETFs? Do I still have to pay 41% tax or provide deemed disposal? What taxes I need to pay if I invest through Stock and Share ISA?

Hey Andrei,

Thanks for checking out my blog and for leaving a comment!

I’m not familiar with England’s tax policies and the most efficient ways to invest as an England resident, so I don’t think I’m able to give you much advice on this – sorry!

Perhaps you’ll have more luck on an England-based personal finance website or Reddit community – I’m sure someone will be better suited to answer your question!

All the best!

Hi TFS and thanks for the great post!

Maybe you can help me with this question:

I have Interactive Brokers set up as Ukraine resident, and I see that Ukraine is on the US Tax Treaty list with values of 15, 5, 0 written in the table.

As a novice, it’s difficult for me to understand:

tax-efficiency-wise, does this put me now on the US VOO side of the market, or Ireland CSPX side?

Can you give your own opinion please?

Hey Vladi,

Thanks for checking out my blog and leaving a comment, I’m glad you found my post helpful! I’m writing this email to give you my response.

From what I understand, as a Ukraine resident, this seems to put you on the Ireland-CSPX side of things, in that you are only liable to a 15% withholding tax from the US. But I’m not too familiar how exactly things work in your context, so it’s best if you check it with personal finance platforms catered specifically for Ukraine residents.

Hope this helps!

TFS thanks a lot for your answer!

On the same topic:

I invest both in VOO and CSPX (on IBKR).

So in my statement I can see the taxes paid by me on VOO, but no taxes mentioned about CSPX.

First, it made me think that CSPX is much better because of that.

But then, I guess I can’t see taxes paid for CSPX just because the tax is paid “invisibly to IBKR” before automatically reinvesting into the same ETF. So it doesn’t relly make it any better.

What is your opinion on that please?

Hey Vladi,

Thanks for checking out my blog and leaving a comment! Glad to hear from you again.

You are correct that there are still taxes paid for CSPX, just that you as an investor do not see it on your statement. However, it is still better than VOO.

The appeal of CSPX and Ireland-domiciled ETFs in general for SG investors is that the dividend withholding tax is only 15% (US-Ireland tax treaty). Meanwhile, for VOO and US-domiciled ETFs, the dividend withholding tax for SG investors is 30%.

So, investing in CSPX does result in tax savings as compared to VOO, but it is not as much as you originally thought (15% VS 30% instead of 0% VS 30%).

Hope this helps!

Hi, I’m a Malaysian thinking to move all my money from TD Ameritrade to IBKR for the lower withholding tax. Do you think it’s a good idea to sell all my ETFs in TD and use them to buy irish accumulating etfs in IBKR now? Or I should leave TD alone and wait for the prices to go up, while I invest in irish ETFs with IBKR? Thanks!

Hey Hokow,

Thanks for checking out my blog and leaving a comment!

Intuitively, I think it makes sense to just sell your ETFs in TD and move your funds to IBKR to buy CSPX because I don’t see any upside to leaving your funds in TD. This is because CSPX ultimately tracks the S&P 500 index (which I assume you’re investing in via TD now). Prices being down now means that CSPX is also down; when prices go up it means that CSPX will also go up. Sure, there might be tracking errors from ETF to ETF that might result in some arbitrage, but I think there isn’t too much difference at the end of the day.

The advantage of moving from TD to CSPX ASAP is that you start saving on withholding tax sooner, which is undebatable.

Hope this helps!

Hi.

Thanks for the useful post. Other than IBKR, is there any Bank that can be used to trade CSPX? I’m think of doing a lump sum trade, therfore I do not have to worry too much about the trading fee. IBRK UI is kind of complicated as compared to Moo Moo and Tiger Broker.

Thanks!

Hey Will,

Thanks for checking out my blog and for leaving a comment!

To my knowledge, one popular bank broker to invest in CSPX is Standard Chartered. They charge a commission fee of 0.25% (min 10 USD) for CSPX trades on the LSE. The minimum fee is also waived for priority banking customers, where the commission fee is reduced to 0.2% as well. You can find the fee schedule here.

I haven’t used this to invest in CSPX myself, but from what I recall, I had to go down to a branch office to open the brokerage account.

Hope this helps!

Hi IFS,

Stumbled upon your blog by chance

How would you compare recurring investments of CSPX through IBKR vs Blackrock Ishares through Endowus?

Fees for Endowus would be:

0.3% via fundsmart and 0.9% expense ratio of Blackrock Ishares,

compared with CSPX via IBKR:

commission fee, fx fee, bid offer spread, 15% withholding tax, 0.7% expense ratio

Hey Miguel,

Thanks for checking out my blog and leaving a comment!

CSPX/IBKR

Commission fee: 1.70 USD

FX fee: 2 USD

Withholding tax: 15% on dividends

Expense ratio: 0.07%

Total fees: 3.70 USD per trade + 0.07% total sum invested + 15% on dividend yield

Blackrock iShares/Endowus

I’m not too familiar with the fee structure of Endowus, but I will assume that the 0.3% fee you quoted covers that.

Endowus fee: 0.3%

Withholding tax: 15% on dividends (the Blackrock fund is domiciled in Ireland, which means it is subject to the same withholding tax rate as CSPX)

Expense ratio: 0.09% (as stated on Endowus website)

Total fees: 0.39% total sum invested + 15% on dividend yield

Since both funds are tracking the same index, we shall assume the dividend yield is similar, and since the withholding tax rate applied is the same, we can ignore the impact of that.

This simplifies the calculation to 3.70 USD + 0.07% VS 0.39%, or 3.70 USD VS 0.32% of total sum invested.

Since 3.70 USD is the fee per trade, but 0.32% is the fee per year, we need to standardise them: we can assume that a trade is placed 1x per month, which brings the fixed cost of investing in CSPX/IBKR to 3.70*12 = 44.40 USD/year.

So, the final comparison is 44.40 USD VS 0.32% of total sum invested.

If your total invested sum is low, then paying 0.32% is cheaper. But at some point, 0.32% of your total sum invested will become more expensive than 44.40 USD.

To find the tipping point, we take 44.40/0.32% = 13,875 USD – so if your total invested sum is less than that, Blackrock iShares/Endowus is cheaper; if your total invested sum is more than that, CSPX/IBKR is cheaper.

Hope this helps!

Hi TFS,

Stumbled upon your post and found your post to be very useful and easy to understand for not so savvy investors like me! And appreciate the effort that you are still replying to comments from 2021 to 2023!

Recently FSMOne also started the trading on LSE, although just 5 ETFs for now. The ETF that’s tracking S&P is VUAG.

https://secure.fundsupermart.com/fsmone/article/rcms281280/start-trading-on-the-london-stock-exchange-lse-now-available-on-fsmone

Just wanted to seek your opinion on the following:

1. Investing in IBKS (CSPX) or FSMOne (VUAG) – which one would be more advisable for long term over 15-20 years?

2. ETF Regular Saving Plans (RSP) – I saw that FSMOne allows RSP for the 5 listed ETFs, with 0% processing fees. Does this mean RSP actually allows fractional share investing?

https://secure.fundsupermart.com/fsm/regular-savings-plan

Thank you in advance for the advice!

Hi TFS,

May I know why you didn’t go for SPXS which performed better than CSPX?

https://finance.yahoo.com/quote/SPXS.L/

Hey Yufica,

Thanks for checking out my blog and leaving a comment!

SPXS is a leveraged ETF, not a “regular” ETF like CSPX. This means that when the underlying index (S&P 500) goes up, SPXS goes up by more, but the converse is also true.

I don’t know yet if I want to invest in a leveraged ETF given how swingy its performance can be, so I’m sticking to normal ETFs like CSPX for now.

Hope this helps!

I think another factor is estate tax. VOO are US domicile. So for investors who want their funds to be passed down, the 30% – 40% could be a major factor.

Hey Desmond,

Thanks for checking out my blog and leaving a comment!

That’s a good point, thanks for sharing!

Hi this is an interesting writeup. I’m considering cspx over voo to reduce income tax. Where gains should be taxed at long term capital gains rate (20% in US) at sale, compared to normal income tax rate (25~39% in US) on dividend income. But I don’t see you discussing this? Any thoughts? Thanks!

Hey Alex,

Thanks for checking out my blog and for leaving a comment!

The reason I don’t discuss tax implications between VOO and CSPX in my articles is because I’m a Singapore-based investor, and my blog articles are mainly targeted at other investors residing in Singapore as well. Here, there are neither capital gains taxes nor dividend taxes on investments, so this is irrelevant in my decision between VOO and CSPX.

I’m sure there are other finance blogs and websites where they discuss this topic in detail for a US-based investor 😊

Thanks for stopping by, and have a great week ahead!