Disclaimer: This is not a sponsored post, but this article contains referral links that allow me to earn referral rewards at no cost to you if you choose to signup with them, which helps me maintain the blog.

A multi-currency debit card is an essential travel item as it allows us to make cashless payments overseas with little to no fees.

YouTrip and Revolut are 2 of the most popular multi-currency debit cards around due to their extremely competitive foreign exchange (FX) rates.

But a new challenger has arrived at the scene, and they’re coming off strong.

Instarem has recently launched a multi-currency wallet feature on the amaze wallet of its amaze card.

This allows the amaze card to function as a multi-currency debit card just like YouTrip and Revolut – but better.

Today, I’ll talk about how the amaze wallet works and what makes the amaze card the superior multi-currency debit card.

Who Is Instarem?

Instarem is a financial company that focuses on cross-border payments, similar to Revolut.

They offer competitive rates for international currency transfers and their payment services are powered by NIUM.

NIUM is regulated by the Monetary Authority of Singapore as a Major Payment Institution, which makes them a safe and reputable company.

What Is The amaze Card?

Some of you might already be familiar with the amaze card.

It is a card that allows you to make foreign currency (FCY) transactions with no upfront fees, and you can choose to pay via the wallet feature of the card or by linking another credit/debit card to it.

I’ve written a guide about taking advantage of its card-linking capability to double-dip on credit card rewards like miles while making FX payments.

You can find this post here!

But today, I’ll be focusing on the amaze wallet feature of the amaze card, something I haven’t talked about so far.

How Does The amaze Card Work?

The amaze card is slightly different from YouTrip and Revolut.

While the other 2 are exclusively mobile wallets, the amaze card has 2 possible payment sources – the amaze wallet or a linked credit/debit card.

You can select your payment source via the Instarem app, which is also where you’ll manage everything about the amaze card.

This is important because the amaze card works quite differently depending on which payment source you select.

Using the amaze wallet as the payment source, it works quite similarly to YouTrip and Revolut.

It is essentially a mobile wallet that you need to deposit funds.

Like most other multi-currency wallets, the amaze wallet employs a base currency, SGD.

This cannot be changed as far as I’m aware, and it’s the only currency you’re able to fund your amaze wallet with.

Funds can be converted between 10 different currencies as you wish, and any FCY transaction you make is debited from the respective currency balance.

As of June 2023, the supported currencies on the amaze wallet are:

- SGD

- EUR

- USD

- JPY

- THB

- GBP

- AUD

- CHF

- NZD

- CAD

The amaze card linked to amaze wallet can still be used for transactions in currencies other than the 10 listed above.

For such cases, the amount will be converted to SGD at the time of transaction and debited from your SGD wallet balance.

An FCY transaction will be converted to SGD and debited from your SGD wallet balance if:

No fees are applied for this conversion, and the applied FX rates remain extremely competitive.

Why Should You Use The amaze Card?

1: Competitive Exchange Rate

The first thing that most people would compare when it comes to multi-currency debit cards is the exchange rate it offers.

A card that offers better exchange rates will help to reduce costs because the same amount of your base currency yields a larger amount of the desired currency.

When the amaze card uses a linked card as its payment source, it is known to have relatively poor exchange rates.

FX rates have recently been 2 – 3% worse than YouTrip’s and Revolut’s, which can add up to a significant amount over the course of a vacation.

But when using the amaze wallet, FX rates are actually extremely competitive – on par with that of YouTrip and Revolut.

For reference, here is a comparison of the exchange rates from SGD to USD and SGD to EUR for the amaze wallet, YouTrip, and Revolut, at approximately the same time.

| amaze | YouTrip | Revolut | |

|---|---|---|---|

| SGD – USD | 0.7481 | 0.7482 | 0.7475 |

| SGD – EUR | 0.6833 | 0.6834 | 0.6826 |

2: Earn 1% Cashback On Foreign Currency Transactions

Next, the amaze card allows you to earn 1% cashback on foreign currency (FCY) transactions in the form of InstaPoints (IPs).

To my knowledge, this makes the amaze card the only multi-currency debit card that offers competitive FX rates while also giving out spending rewards.

Here’s what you need to know.

- Only FCY transactions are eligible to earn IPs, and the transaction value must be the equivalent of S$10 or more.

- IPs will be awarded at a rate of 1 IP/S$1 spent.

- IPs can be redeemed at a rate of 2,000 IPs for S$20 cash, where the cash will be credited into your amaze wallet.

- No cap on the total amount of IPs that can be earned.

- Maximum amount of IPs that can be earned per transaction is 500 IPs.

- IPs are valid for a period of 6 months.

The rewards structure of IPs isn’t the best, but it’s decent enough given that there’s no competition.

The main limitation of IPs is that it’s less effective for large transactions of >S$500 in value since IPs are capped at 500 per transaction.

The validity period of 6 months could also be a hindrance to some people as they might not be able to accumulate sufficient IPs for redemption.

But personally, neither of these points has been a concern for me, and I’ve managed to successfully redeem all my IPs so far.

What’s Bad About The amaze Card?

1: Fewer Currencies Supported

Currently, the amaze card supports payment in more than 150 currencies, but the amaze wallet only supports 10.

This is on par with YouTrip, though the selection of 10 currencies differs slightly, but is far beyond that of Revolut, whose wallet supports more than 30 currencies.

If you’re travelling to a country that uses a currency that is not among the 10 amaze wallet-supported currencies, you’d have no way of converting your cash ahead of time.

Instead, you’ll be forced to use the market exchange rate whenever you make a transaction, which varies according to market conditions.

It also means that you won’t know the exchange rate that will be applied to your transaction until the transaction is already made.

Personally, I think this isn’t too big of a deal.

After all, it’s entirely possible that the exchange rate improves over the course of your trip, and you’d be thankful that you didn’t convert a lump sum of cash in advance.

But the converse is also possible, in which case this becomes a disadvantage.

Given that exchange rates remain generally stable, I don’t think that this would have a large impact on the cost of one’s holiday and is more of a “nice-to-have” feature.

2: Fees For Overseas ATM Withdrawals

One handy feature of multi-currency debit cards is that they often allow you to withdraw cash from overseas ATMs during your holiday.

So, if you ever run out of cash in the local currency while you travel, you’re able to tap on an emergency source of cash.

While competitors like YouTrip and Revolut offer free cash withdrawals, the amaze card charges a fee for this service.

Here is a comparison of the overseas cash withdrawal details for YouTrip, Revolut, and amaze.

| amaze | YouTrip | Revolut | |

|---|---|---|---|

| Free Withdrawal | N/A | S$400/month | S$350/month |

| Withdrawal Fee | 2% | 2% | 2%, min S$1.49 |

| Withdrawal Limit | S$1,000/day | S$5,000/day | €3,000/day |

Note that fees are also often imposed by ATM providers, which are separate from the fees imposed by the card providers.

In most cases, the fee for cash withdrawal from ATMs will be displayed before you confirm your withdrawal.

So even though YouTrip and Revolut offer free cash withdrawals per month, fees imposed by ATM providers will still apply.

From the comparison table above, it’s quite clear that the amaze card’s offering for overseas cash withdrawals isn’t great.

But again, I don’t think it’s too big of an issue because I’ve never withdrawn cash while I was overseas before.

I always bring sufficient cash with me on my trips, so this is truly a feature that would only be used in emergencies.

If such a situation does occur, then the amaze card is inferior compared to YouTrip and Revolut since it has no allowance for free cash withdrawals and has a lower withdrawal limit.

3: No Support With Apple Pay

Finally, the amaze card is not supported by Apple Pay.

This is definitely more of an inconvenience rather than a flaw of the actual card, and by no means is it a major issue.

Among the 3 cards mentioned in this post, Revolut is the only one that is supported by various mobile wallets like Apple Pay and Samsung Pay.

Meanwhile, both YouTrip and amaze don’t have such support.

All this means is that you’ll have to bring around the physical card to use for your transactions.

Step-by-step Guide To Redeem InstaPoints

1: Download The Instarem App

To start off, download the Instarem app.

You can do this via the app store, or if you’d like to support me, you can use my referral link.

2: Sign Up For An Account

Launch the Instarem app and sign up for an account.

If you’d like to support me, you can use my referral code “MAMVW9“.

3: Request For The amaze Card

In the app, request for the amaze card.

Your virtual card will be activated immediately and you can start using it for online transactions.

It can also be added to Google Pay, though it’s not supported on Apple Pay as of now.

You’ll have to wait a while for your physical card – mine took between 1-2 weeks to arrive.

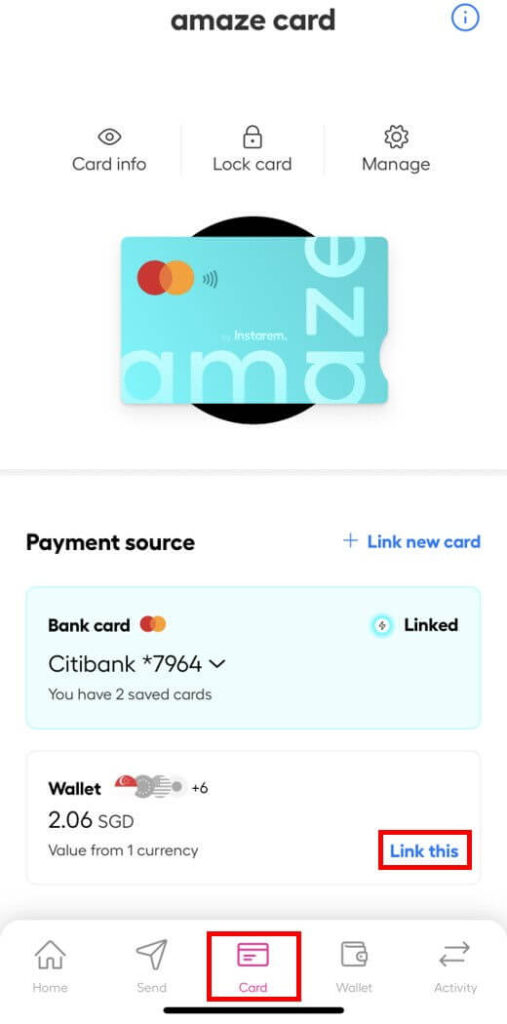

4: Select Your Payment Source

Next, you’ll need to select “amaze wallet” as the payment source in order to use the amaze card as a multi-currency debit card.

In the Instarem app, go to “Card”, and under “Wallet”, select “Link this”.

5: Add Funds To Your amaze Wallet

Before you can start using the amaze card, you need to add funds to your amaze wallet.

In the Instarem app, go to “Wallet”, and select “Top up”.

Note that the minimum top-up amount is S$20, and top-ups can only be made using a credit/debit card.

A 2% fee is applied for top-ups made using a Visa-issued card, so be sure to use a MasterCard.

Enter the amount to top up and your card details, and then you’ll be presented with a summary before you confirm your top-up.

6: Convert Your Desired Currencies

If you wish to convert your SGD into other currencies, here’s how you can do it.

In the Instarem app, go to “Wallet”, and select “Convert”.

Select the source currency and target currency, then enter the amount you wish to convert.

The applicable conversion rate will be displayed before you confirm the transaction.

7: Pay With amaze

Now that your amaze card is all setup, the next thing to do is start paying with your amaze card as normal.

Remember that the amaze card isn’t supported on Apple Pay, so if you’re an iPhone user, you’ll need to bring the physical card around with you after you get it.

Also, remember that only eligible FCY transactions of S$10 or more will earn IPs.

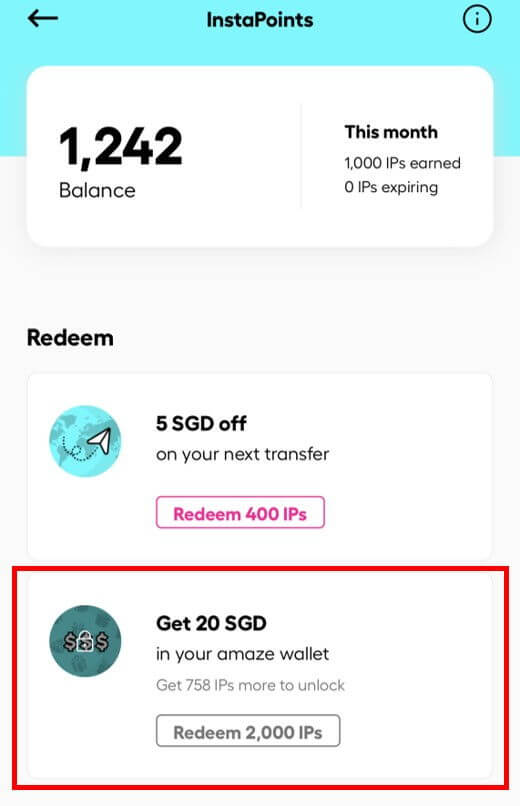

8: Redeem Your InstaPoints

After accumulating at least 2,000 IPs, it’s time to redeem them for cash.

On the home page of the Instarem app, scroll down to “InstaPoints”.

Here, you’ll see your current IP balance and how many IPs are expiring soon.

For more details, click “See more”.

Under “Rewards”, select “Get 20 SGD in your amaze wallet” and confirm the redemption.

The 20 SGD should be credited to your amaze wallet almost immediately.

You can also check your historical IP transactions on the same screen, at the bottom.

9: Cash Out/Spend

As mentioned earlier, you can’t directly withdraw your cashback from your amaze wallet.

If you wish to simply spend the cash, then there’s nothing else you need to do – spend away.

But if you wish to withdraw it, you’ll have to do a workaround.

This will require you to have either a GrabPay or Revolut account.

Top up your GrabPay/Revolut account with your amaze card, making sure that the payment source selected is “amaze wallet”.

Since this counts as a debit card top-up, you’ll be able to withdraw this amount from your GrabPay/Revolut account into your bank account.

amaze Wallet VS Linked Card

As I mentioned earlier, there are 2 ways to pay with the amaze card: via the amaze wallet or a linked card.

The main difference is that FX conversion rates are much better via the amaze wallet, where a conversion of the same currency can have rates that are 2 – 3% poorer with a linked card.

While FX conversions are much more favourable when using the amaze wallet, I still prefer using the amaze card via a linked card.

This is because it allows me to earn 4 miles per dollar (mpd) on almost any transaction with an appropriate credit card like the Citi Rewards card.

PS: I recently wrote a review of the Citi Rewards card. Check it out here!

Personally, 4 mpd is worth more to me than the cost of 2 – 3% in FX rates.

But for anyone who isn’t into the miles game or does not have/want an appropriate credit card, the amaze wallet is still an excellent feature of the amaze card.

Instarem Referral Program

Instarem has an ongoing referral program, where both the referrer and referee will earn 200 IPs (S$2) upon successful referral.

If you’re planning to sign up for an Instarem account and amaze card and want to support me, you can do so by signing up via my referral link here or by entering my referral code “MAMVW9” during the signup process.

To summarise,

The amaze card’s amaze wallet feature makes it an excellent multi-currency debit card with FX rates that are on par with that of YouTrip and Revolut.

But the thing that makes the amaze card stand out is its rewards system in the form of InstaPoints.

It is the only multi-currency debit card that offers both competitive FX rates and a spending reward of 1% cashback.

1% might not be much, but given that you’re getting similar FX rates, it’s 1% that you might as well take, and that’s why I think it’s the best multi-currency debit card around now.

There might be minor inconvenience factors related to the amaze card like no free overseas ATM withdrawals and lack of smartphone wallet support, but I think the 1% cashback still makes it worth it.

Linking the amaze card to a credit card like the Citi Rewards card to earn miles and cashback simultaneously is still my preferred method of using the amaze card, but the amaze wallet feature is still great nonetheless.

Which multi-currency debit card do you use? Let me know in the comments below!