Disclaimer: this is not a sponsored post. All opinions are my own and I receive no monetary compensation for writing this post.

If you’ve tried shopping at a Giant, Guardian, or other yuu partner merchants over the past few weeks, you’ve probably been driven to the brink of insanity by the yuu commercial song that plays on repeat.

Mad respect for all the retail staff during this period.

With such aggressive advertising, I became curious as to what exactly the yuu Rewards Club is all about and whether it’s worth all the hype that they’re trying to build.

In today’s post, I’ll break it down for you.

I’ll tell you what the yuu Rewards Club is, how it works, and whether I think it’s worth using or not.

What Is The yuu Rewards Club?

The yuu Rewards Club is a free-to-join loyalty program that allows you to earn points when you spend at participating merchants.

The list of partnered merchants includes the following:

- DBS

- PAssion Card

- DFI Retail Group

- Cold Storage

- Giant

- Guardian

- 7-11

- BreadTalk Group

- BreadTalk

- Toast Box

- Butter Bean

- Food Junction

- Food Republic

- Thye Moh Chan

- Mandai Wildlife Reserve

- Singapore Zoo

- Night Safari

- River Wonders

- Jurong Bird Park

- Singtel

How Does It Work?

To enjoy the benefits of the yuu Rewards Club, you need to download the app on your phone and sign up for an account.

Then, whenever you make payments at a partnering merchant, scan your yuu ID from the app to earn yuu Points.

You will earn yuu Points at a base rate of 1 Point / S$1 spent at partner merchants with no minimum spending required and no cap on Points, which is equivalent to a rewards rate of 0.5%.

All yuu Points earned will be valid for 2 years from the date of Points crediting and can be used to redeem rewards at partner merchants.

Earning Bonus yuu Points

Obviously, earning yuu Points at a rate of 0.5% cash rebate is nothing worth getting excited about, especially when you only earn yuu Points at yuu merchants.

However, there are ways to earn bonus yuu Points and boost your rewards earning rate.

1: Buy Selected Products From yuu Merchants

The first way to earn bonus yuu Points is to look out for offers for selected products under yuu merchants.

You can find these products in the yuu app, and these products will earn you a bonus of 2 yuu Points / S$1 spent.

That brings your total points earning rate to 3 yuu Points / S$1 spent, or 1.5% cashback.

Note that this is a limited-time offer, valid only from 27 Oct 2022 – 31 Jan 2023.

2: Link An Eligible DBS/POSB Card

The next way to earn bonus yuu Points is by linking an eligible DBS or POSB card to your yuu account.

The eligible cards are:

- DBS yuu Credit Card

- PAssion POSB Debit Card

DBS yuu Credit Card

The DBS yuu credit card is DBS’s newest credit card, launched in partnership with yuu Rewards Club, and it’s a fairly standard entry-level card.

Here are the details of the eligibility requirements and relevant fees.

| Age | 21 years and above |

| Income | S$30,000 and above per annum (Singaporean & PR) S$45,000 and above per annum (Foreigner) |

| Annual Fees* | S$192.60 (Principal Card) S$96.30 (each Supplementary Card) |

| Fee Waiver | 1 year |

| Late fee | S$100 (For outstanding balance above S$200) |

| Finance Charges | 26.80% p.a. chargeable on daily basis (subject to compounding) |

As its name suggests, the purpose of the card is help you earn yuu Points.

With the DBS yuu credit card, you will be able to earn yuu Points on all eligible retail spending, even at non-yuu partner merchants.

You will also be able to earn bonus yuu Points when you spend at yuu partner merchants.

All you have to do is link your DBS yuu credit card to your yuu account, scan your yuu ID when applicable, and pay with your DBS yuu credit card.

The details for earning yuu Points are as follows:

The maximum earn rate you can achieve is 30 yuu Points / S$1 spending, equivalent to 15% cash rebate, which is huge.

Let’s take a closer look at how this can be achieved.

Base Rate

The DBS yuu credit card has a base earn rate of 1 yuu Point / S$1 spent on eligible retail spending and a bonus of 4 yuu Points / S$1 spent at yuu partner merchants.

There is no minimum spending requirement or cap on earning these points.

In other words, you earn 5 yuu Points / S$1 spent on yuu partner merchants.

This equates to 0.5% cash rebate on non-yuu partner merchant spending and 2.5% cash rebate on yuu partner merchant spending.

Bonus Rate – Buy Selected Products

If you buy selected offer products from yuu merchants, you’ll earn a bonus of 2 yuu Points / S$1 spent (see point 1 above).

This brings your Points earning rate to 7 yuu Points / S$1 spent so far, or 3.5% cash rebate.

Note that this is a limited-time offer, valid only from 27 Oct 2022 – 31 Jan 2023.

Bonus Rate – Spend S$80 In A Single Receipt

Next, if you spend S$80 in a single receipt at DFI Retail Group or BreadTalk Group merchants, you’ll earn a bonus of 800 yuu Points.

Note that this bonus can only be received 3x per card per calendar month.

If you spend exactly S$80, this is equivalent to a bonus of 10 yuu Points / S$1 spent, which brings the earning rate up to 17 yuu Points / S$1 spent, or an 8.5% cash rebate.

Note that this is a limited-time offer, valid only from 27 Oct 2022 – 31 Jan 2023.

Bonus Rate – Spend S$400 In A Calendar Month

Finally, if you spend S$400 or more at DFI Retail Group or BreadTalk Group merchants in a month, you’ll earn a bonus of 5200 yuu Points.

If you spend exactly S$400, this is equivalent to a bonus of 13 yuu Points / S$1 spent, bringing the total earning rate up to 30 yuu Points / S$1 spent, or a 15% cash rebate.

Note that this is a limited-time offer, valid only from 27 Oct 2022 – 31 Jan 2023.

Visa VS AMEX

The DBS yuu card comes in both a Visa version and an American Express (AMEX) version.

They are similar in terms of earning yuu Points, but the AMEX version comes with exclusive benefits.

The AMEX version has exclusive promotions for merchants like Booking.com and IHG Hotels and Resorts.

You can see the full list here.

S$260 Sign Up Reward

To promote the newly launched DBS yuu card, there is an ongoing sign up reward where you can earn up to S$260 for the card.

To be eligible for this promotion, you need to:

- Not currently hold any DBS/POSB credit card or have not cancelled any DBS/POSB credit card in the last 12 months,

- Apply online for a DBS yuu card by 31 Dec 2022 and have it approved by 14 Jan 2023,

- Activate your DBS yuu card, and

- Make minimum spending of S$500 within 30 days of card approval

If you fulfil all of the above criteria, you will receive a S$250 cash credit within 3 months of fulfilling all the criteria.

To receive the final S$10 cash credit reward, you need to activate your DBS yuu card by 31 Dec 2022.

Both the Visa and AMEX versions of the card are eligible for this promotion.

PAssion POSB Debit Card

The PAssion POSB debit card helps to earn yuu points at an accelerated rate, but only at yuu partner merchants.

The details for earning yuu points are as follows:

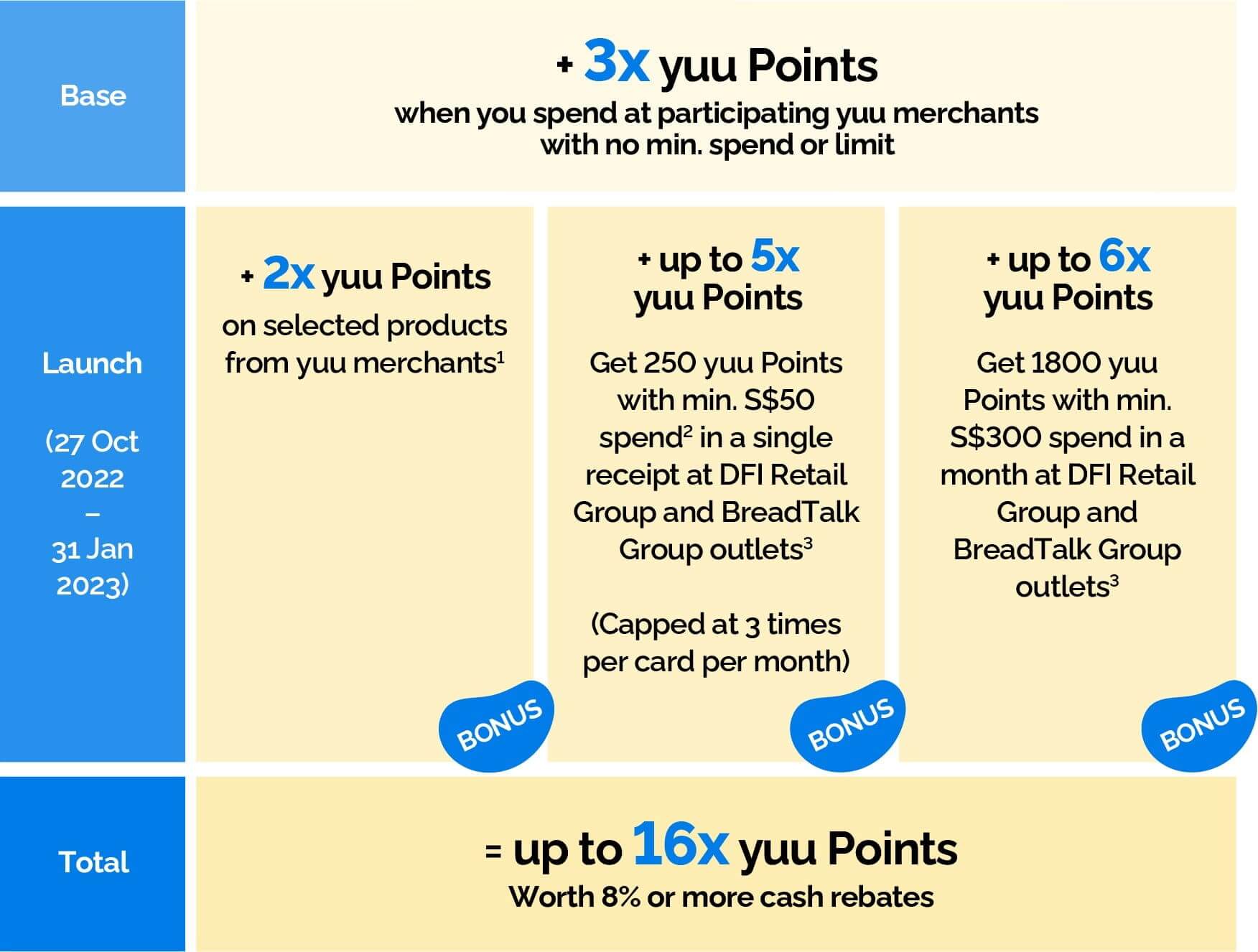

With the PAssion POSB card, you can earn up to 16x yuu Points / S$1 spending, equivalent to 8% cash rebate.

Here’s how it can be achieved.

Base Rate

The PAssion POSB debit card has an earn rate of 3 yuu Points / S$1 spent at yuu partner merchants with no minimum spending requirement or earn cap.

This is equivalent to a cash rebate of 1.5%.

Bonus Rate – Buy Selected Products

If you buy selected offer products from yuu merchants, you’ll earn a bonus of 2 yuu Points / S$1 spent (see point 1 above).

This brings your Points earning rate to 5 yuu Points / S$1 spent so far, or a 2.5% cash rebate.

Note that this is a limited-time offer, valid only from 27 Oct 2022 – 31 Jan 2023.

Bonus Rate – Spend S$50 In A Single Receipt

Next, if you spend S$50 in a single receipt at DFI Retail Group or BreadTalk Group merchants, you’ll earn a bonus of 250 yuu Points.

Note that this bonus can only be received 3x per card per calendar month.

If you spend exactly S$50, this is equivalent to a bonus of 5 yuu Points / S$1 spent, which brings the earning rate up to 10 yuu Points / S$1 spent, or a 5% cash rebate.

Note that this is a limited-time offer, valid only from 27 Oct 2022 – 31 Jan 2023.

Bonus Rate – Spend S$300 In A Calendar Month

Finally, if you spend S$300 or more at DFI Retail Group or BreadTalk Group merchants in a month, you’ll earn a bonus of 1800 yuu Points.

If you spend exactly S$300, this is equivalent to a bonus of 6 yuu Points / S$1 spent, bringing the total earning rate up to 16 yuu Points / S$1 spent, or 8% cash rebate.

Note that this is a limited-time offer, valid only from 27 Oct 2022 – 31 Jan 2023.

What Rewards Are Available?

With yuu Points, you can redeem rewards from yuu partner merchants.

Rewards include specific items that can be redeemed or cash vouchers for selected yuu partner merchants.

The full catalogue can be found in the yuu app.

Link Your PAssion Card

If you have an existing non-debit PAssion card, ie it only works as a PAssion card but cannot be used to make payments, you can and should link it to your yuu account.

The reason is that you can no longer use your PAssion card to earn Tap For More (TFM) points – it is being replaced by yuu Rewards Club.

By linking your PAssion card to your yuu account, your existing TFM points will be converted into yuu points which you can use to redeem for rewards.

Is The yuu Rewards Club Worth Using?

Now that we know all about the yuu Rewards Club, is it actually worth using?

Well, considering that it’s free to sign up, the answer is yes – but even if you don’t you won’t be missing out on much.

On one hand, it’s a free and simple way to earn an extra 0.5% cash rebate whenever you make payments at yuu partner merchants.

It’s not much, but it costs you nothing, so you might as well take it.

On the other hand, because the cash rebate is reasonably low, if you can’t be bothered to use it, I’d say you won’t lose out on much unless you spend a lot on yuu partner merchants.

For example, if you usually buy your groceries from Giant/Cold Storage, or usually eat at Food Junction/Food Republic, etc.

A Deeper Analysis Of The yuu Rewards Club

Considering that the only reason I think it’s worth using the yuu Rewards Club is that it’s free, I definitely don’t think that it’s as good as it’s being made out to be in advertisements and promotions.

It is advertised that you can earn up to 15% cash rebate (30 yuu Points / S$1 spent) with the DBS yuu card, and while that’s true, things aren’t as good as they seem.

For starters, it’s only possible to earn 30 yuu Points / S$1 spent because of the launch promotion that is ongoing from now until 31 Jan 2023.

This means that once the promotion is over, your maximum rewards rate will only be 5 yuu Points / S$1 (2.5% rebate) – and only on spending made at yuu partner merchants.

Furthermore, it’s extremely unlikely that you will truly earn 30 yuu Points / S$1 spent.

Most of the bonus yuu Points are earned by either making a single transaction of at least S$80 or spending at least S$400 in 1 month on DFI and BreadTalk Group merchants.

While it’s possible to do both of these, the average person isn’t likely to.

Also, you will only earn the maximum rate of 30 yuu Points / S$1 spent if your single transaction is exactly S$80 and your monthly spending is exactly S$400.

This is because the bonus yuu Points awarded for these criteria are fixed at 800 and 5200 Points respectively.

So, if your single transaction spending exceeds S$80, your bonus yuu Points earn rate will be lesser than 10 yuu Points / S$1 spent.

Similarly, if your monthly spending exceeds S$400, your bonus yuu Points earn rate will be lesser than 13 yuu Points / S$1 spent.

Naturally, this lowers your overall yuu Points earning rate, making it hard to achieve the maximum earn rate of 30 yuu Points / S$1.

Don’t forget also that the bonus 800 yuu Points for spending S$80 in a single transaction is capped at 3x per card per month.

This means that if you want to hit the monthly spending of S$400, even getting the aforementioned bonus 3x only brings your monthly spending up to S$240, leaving you short of S$160.

You will have to rack up the remaining S$160 of spending without the 10 yuu Points bonus / S$1 spending.

In other words, it’s impossible that you will earn 30 yuu Points / S$1 spent on your entire S$400 of spending.

The same can be said for the PAssion POSB debit card, considering that the mechanics of the promotions are all similar.

To summarise,

The yuu Rewards Club is free to join, so if you want to maximise your rewards earning potential, you might as well sign up for it and use it whenever you can.

But unless you spend a lot at the partner merchants, you probably won’t be missing out on much even if you don’t want to use it.

They are running seemingly attractive promotions for their launch, but unsurprisingly, it’s a lot less attractive than they make it out to be.

Nevertheless, this will definitely be a good rewards program for some people out there, and there isn’t much to complain about when it comes to free rewards.

Personally, I’ll be using my yuu account to earn Points when I shop at the relevant merchants, but I’ll definitely still be using my preferred miles cards to make payments and rack up miles.

Will yuu use yuu? Let me know in the comments below!

2 replies on “What You Need To Know About The yuu Rewards Club”

For the $250 cash back promotion, do online transactions (actual purchases and hotel/flight bookings) or purchase of gift vouchers (eg Cold Storage) count towards the $500 min spend?

I’m not entirely clear even after reading the terms and conditions.

Not sure if “retail” transactions include only in-person transactions, or extend to online transactions.

Hey Russ,

Thanks for checking out my blog and leaving a comment!

Generally, retail transactions include offline and online transactions. As for the purchase of gift vouchers, I can’t say for certain because I’ve never used it to hit the minimum spending except for voucher purchases made on ShopBack. The general consensus I’ve seen online is that buying vouchers directly from merchants is eligible as well, but again, I can’t confirm it personally.

Hope this helps!