With all the recent hubbub about signup promotions offered by online brokers Tiger Brokers and Moomoo, these brokers have gained sizeable attention.

Almost anyone who invests would’ve heard about these brokers and be inclined to use them because of these promotions and their low fees.

However, it doesn’t mean that these brokers are the best for investors.

Interactive Brokers (IBKR) is a well-known broker in the financial community, but not quite as well-known to others as compared to Tiger Brokers and Moomoo due to the lack of mainstream media advertisements.

With the recent removal of their monthly activity fee, IBKR is now, in my opinion, the king of brokers in Singapore, ie the best broker that every investor should use.

Here are 3 reasons why.

1: Low Commission Fees

Fees are an important aspect of investing.

To investors, lower fees generally result in higher overall returns, so it is in our best interest to aim to minimise fees whenever possible.

While Moomoo and Tiger have considerably low commission fees, IBKR offers even lower fees for almost every market with the exception of SG, which is on par with Moomoo.

|

|

|

|

|

| SG | 0.08%, min 2.50 SGD | 0.06%, min 2.49 SGD | 0.08%, min 2.88 SGD |

| HK | 0.05%, min 12 HKD | 0.03%, min 3 HKD + 15 HKD |

0.06%, min 15 HKD |

| US | 0.0035 USD/share, min 0.35 USD |

0.0099 USD/share, min 1.99 USD |

0.01 USD/share, min 1.99 USD |

| CN | via HK | N/A | 0.06%, min 15 CNH |

| AU | 0.08%, min 5 AUD | N/A | 0.10%, min 8 AUD |

| UK | 0.05%, min 1 GBP | N/A | N/A |

The most notable savings on commissions come from US markets – 0.35 USD VS 1.99 USD per trade.

That translates to an 80% savings on commission fees!

If you trade often, or even if you simply dollar-cost-average (DCA) into your investments every month, this will result in considerable savings throughout your investing journey.

2: Spot FX Rates

On the note of minimising costs, IBKR also offers the most competitive forex (FX ) rates for currency conversion.

When it comes to FX conversion, there are 2 things to take note of.

The first is any applicable fees for processing the conversion, and the second is the actual conversion rate that you are getting.

While banks and some brokers (like Tiger and Moomoo) tend to offer free FX conversion, you lose out when it comes to the conversion rate.

On the other hand, IBKR charges a flat conversion fee of 2 USD but offers a more competitive conversion rate.

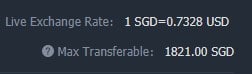

To give you an idea of the spread of this conversion, I took snapshots of the conversion rate from SGD to USD using DBS, Tiger, Moomoo, and IBKR, which were all taken at approximately the same time.

DBS:

Tiger Brokers:

Moomoo:

IBKR:

As you can see, IBKR has the best conversion rate among the 3, followed by Tiger/Moomoo, then DBS, which has the worst rate.

The reason for this is that IBKR offers the conversion rate that exists in the forex market, ie the spot rate.

Meanwhile, Tiger and DBS offer a poorer rate than the spot rate, which allows them to pocket the difference as profits from us.

Naturally, profits for them translate into losses for us.

The table below shows these losses in terms of % when compared against IBKR’s rate.

| IBKR | Tiger | DBS | |

| 1 SGD to USD | 0.7351 | 0.7328 | 0.73 |

| % loss | – | 0.31% | 0.69% |

Tiger’s and Moomoo’s rates are about the same, so I only included 1 of them in this table.

These losses may appear to be small, but if you convert large sums of money, they add up to a considerable amount.

For example, a 0.31% loss on $10k results in a loss of $31.

Remember that the price you pay for spot FX rates with IBKR is a 2 USD processing fee.

So this means that for every conversion you make, as long as the losses you would incur due to the FX spread from free conversions exceeds 2 USD, IBKR becomes the better option.

2 USD is equivalent to approximately 2.70 SGD, though, in a recent conversion, I was charged 2.90 SGD.

Tiger offers the next best conversion rate, which results in ~0.3% loss.

This means that whenever you convert 2.70 SGD/0.3% = 900 SGD worth of currency, IBKR will result in cost savings over Tiger.

But what if you DCA every month, and your DCA amount doesn’t quite hit 900 SGD? Does this mean that using Tiger is actually better than using IBKR?

Well, not quite.

Don’t forget that IBKR also offers lower commission fees than Tiger.

If we were to take that into account, then the “tipping point” for which IBKR becomes better than Tiger would be lower than 900 SGD.

Assuming that we want to convert SGD to USD to invest in the US market, the savings from commissions is 1.99 – 0.35 = 1.64 USD.

Subtracting this from the FX fee of 2 USD results in a net fee of 0.36 USD, which is equivalent to approximately 0.50 SGD.

So the tipping point, in this case, is 0.50 SGD / 0.3% = 167 SGD.

Of course, if you are converting currencies to invest in other markets where the cost savings from commission fees aren’t as huge, this tipping point would be higher.

But at least this provides the framework of how to go about deciding which is the broker that will result in more cost savings for you on a case-by-case basis.

3: Fractional Shares

Another reason to use IBKR is that they support fractional shares.

This means that instead of restricting your investment amount to a whole number of shares, you can own fractions of shares.

This is a benefit because it allows you to invest all of the money you intend for investing without leaving any cash idle, which makes investing more efficient.

The benefit lies in the fact that markets tend to trend upwards – so the sooner you have more money invested, the higher your long-term returns are likely to be.

Let me illustrate this with an example.

Say you’re currently using Tiger Brokers.

Every month, you set aside $500 to DCA into VOO.

At the time of writing this post, VOO is trading at ~403 USD/share.

You convert your $500 into ~370 USD, and you realise that you can’t even afford to buy 1 share of VOO.

Now, you have 2 options – set aside a larger sum to invest or wait until the next month to have enough money to buy 1 share of VOO.

The first option is preferred, but sometimes it’s just not possible to set aside more money.

That leaves you with the second option, where even though you have money that is ready to be invested every month, it’s not able to get invested until the next month.

This means that your money spends less time being invested in the market, which in the long run, often translates into lower returns because you miss out on monthly gains.

On the other hand, if you were able to buy a fraction of VOO, as IBKR permits, you wouldn’t have this problem.

You’d be able to invest your full $500 (370 USD) into ~0.9 shares of VOO every month and have your money sitting in the market ASAP, ready to produce returns.

I’m not going to dive into the analysis of the historical performance of both of these scenarios in this post, but if you’d be interested in reading that, let me know and I’ll consider dedicating a post to it.

However, the caveat here is that fractional shares are only supported for US-listed stocks/ETFs. This means that Ireland-domiciled ETFs like CSPX aren’t available for fractional shares.

Bonus Points

These are some bonus features about IBKR that are nice, though not exclusive enough that you should use IBKR just for these features.

Access Many Markets

While Tiger/Moomoo only allows you to trade in US, SG, HK, China, and AU markets, IBKR allows you to trade in many more markets.

The most notable of these markets is the UK market, ie the LSE, which allows you to invest in Ireland-domiciled ETFs that offer tax advantages to SG investors over their US-domiciled ETF counterparts.

Other markets include Japan, India, Germany, France, Russia, and many others.

While many investors may not need to access these markets, if there are very specific companies that you want to invest in, this feature may help you make it a possibility.

Free FX Transfers

In order to minimise losses due to FX conversion, you may want to deposit/withdraw FX into/from your brokerage account.

While it’s possible to make such a transfer, it will often incur bank charges.

However, since IBKR SG uses a corporate multi-currency account (MCA) with DBS, they are able to facilitate FX transfers to/from other DBS MCAs for free.

This means that if you have your own MCA with DBS like a Multiplier account, you will be able to transfer FX to and from your IBKR account with 0 fees.

If this wasn’t possible, to fund your account with FX, you’d either have to pay the fee for transferring FX or make the conversion from the FX to SGD, fund your account with SGD, then convert it back to the desired FX, all while incurring FX spread losses.

This isn’t something that’s exclusive to IBKR (Tiger Brokers also supports this function), but it’s definitely a nice feature that you can take advantage of to minimise back and forth FX conversion.

Note: This only applies to DBS MCAs – if you use an MCA with other banks, applicable fees will be charged.

To summarise,

I believe that IBKR is the best broker for investors in Singapore because of the following reasons:

- low commission fees

- spot FX rates

- fractional shares support

- access to many markets

- free FX transfers

All of these features allow investors to potentially save a lot of money throughout their investing journey and maximise their investment returns.

I’d definitely recommend you to start using IBKR if you’re not already doing so.

If you’re looking to open a new IBKR account and need a referral link, feel free to drop me an email – you’ll receive IBKR shares as a reward, and it goes a long way in supporting me to maintain this blog!

I’ll also have another post up soon to serve as a basic guide about some things you should know about IBKR’s platform, so keep a lookout for that.

Do you plan to start using IBKR? Why or why not? Let me know in the comments below!

8 replies on “The Best Broker In SG: 3 Reasons Why You Should Use Interactive Brokers”

Hi, thanks for the informational post.

Is there a difference between opening IBKR Singapore account vs IBKR LLC account? I am Singaporean looking to invest long term in US market.

Hi Alice,

Thanks for checking out my blog and leaving a comment!

As far as I’m aware, there are several differences between IBKR SG and LLC:

– IBKR SG allows investing on SGX, LLC doesn’t

– IBKR SG uses a DBS MCA, so funding is more straightforward (wire transfer)

– IBKR LLC uses a US bank, so funding must be done via overseas remit

These aren’t major differences IMO, but I also believe that by default, SG users will be signed up for IBKR SG. I think you need a referral link from an IBKR LLC user in order to open an IBKR LLC account, though I’m not 100% certain about this.

Either way, if your goal is just to invest in the US market, IBKR SG will work just fine.

Hope this helps!

Hi TFS!

First of all, thank you for all the investment articles you have churned out on your website – I personally find them very helpful as an investment noob!

I noticed you wrote quite extensive about Interactive Broker, and was wondering if it is possible for you to touch on the security of this platform? For one, i understand the IB SG account is not SIPC protected – what does this mean for our funds and assets in the (unlikely) event that IB-SG and/or IB-LLC closes down? Are our assets safe, and will we be forced to liquidate, or?

If you have insights to this, would be most grateful if you can share 🙂

Hey SKK,

Thanks for checking out my blog and the kind words!

You’re right that IBKR SG isn’t protected under SIPC, only IBKR LLC is. However, IBKR SG does have its own set of regulations in place.

In the event that IBKR SG goes bankrupt, your securities will be returned to you as long as:

1. The holdings are owned by you

2. You don’t borrow stocks/cash (ie margin)

3. You don’t invest in futures

The above was referenced from this Seedly article which you can check out: https://bit.ly/3qS0ydg

I believe both assets and cash should be covered, though I’m not sure if there’s a cap to the total amount that will be covered as there is under SIPC.

I’ll admit that I’m not too familiar with regards to security of brokers, so I’m not able to provide in depth analysis about this.

Hope this helps!

Hi Frugal Student,

Great blog.

Are you able to make international wire transfers for free with IBKR? (Not just back to your local DBS account)

Say I want to transfer USD to my own US account or EURO to my own EU account?

I’m trying to understand if it’s a possible alternative to Wise.

Hi Arnaud,

Thanks for checking out my blog and leaving a comment!

I haven’t tried withdrawing fiat from IBKR into international bank accounts because I don’t have any, but I’d think that they wouldn’t be free.

Sorry I’m not able to provide more advice on this!

Hi there,

I have general question on Investing with IBKR, For Major companies I’m seeing stock listed both in Company’s home country like LSE-London vs same company stock listed NYSE, NASDAQ as ADR(American Depository Receipt). Which Ticker shall we prefer ?! to in order to benefit in long run. As USD will remain the World’s Reserve Currency in future as well!.

For example : Which ticker shall we accumulate in case of FMCG behemoth “UNILEVER” – Unilever(UL)ADR in USD or Unilever (ULVR) in GBX.

Hey Vivek,

Thanks for checking out my blog and for leaving a comment!

Sorry for the delayed response, but I did some research on the question you left on my blog about why some MNCs have their stock listed on multiple stock exchanges. I ended up finding the topic quite interesting and wrote an entire post about it, you can check it out here!

https://thefrugalstudent.com/dual-listing-why-mncs-trade-on-multiple-stock-exchanges/

To answer your question, this phenomenon is known as dual listing, which is a common practice among MNCs to increase the international exposure of their stock while also improving liquidity.

While I don’t dare to say for sure in every scenario, I believe it’s usually better to just go with the original listing of the stock on the company’s home market – in the case of Unilever, it is ULVR listed on LSE and traded in GBX.

Hope this helps!