Disclaimer: All information in this post is accurate as of 30/4/21.

Recently, I made the decision to cash out of my Saxo account and switched to Tiger Brokers.

While there were pull factors in attractive sign-up rewards for the new brokers, there were also several push factors on Saxo’s end that ultimately led me to make this decision.

Believe it or not, when I first started investing in 2019, Saxo was actually one of the better brokers to use for investing in US/UK markets.

Although, my opinion may also have been influenced by the several investing and personal finance blogs in Singapore that talked about how good Saxo was as a broker.

Regardless, I ended up starting my investing journey with Saxo.

The Good

Through my 1.5 years of experience using Saxo, I can’t say that I didn’t enjoy it.

The thing I appreciated the most about it was its excellent UI. In fact, it’s probably the only thing I appreciated, really.

Both the online trading platform and mobile app are extremely easy to use and navigate even as a beginner who had just started getting into investing.

You don’t get overwhelmed with technical information relating to trading and the information isn’t too cluttered – which I feel new brokers like Moomoo and Tiger are guilty of.

I think the fact that it’s so beginner-friendly made me feel more comfortable with investing.

The Bad

Unfortunately, while Saxo was one of the better brokers out there back in the day, the same can’t be said about it anymore.

Fees, fees, fees

For one, Saxo is one of the few online brokers that still charge a custodian fee of 0.12% pa.

This is a fee charged by Saxo for holding your investments on your behalf.

Many other online brokers like IBKR, Moomoo, Tiger, and SC Online don’t charge this fee – so that immediately makes Saxo less appealing.

Next, Saxo’s commission fees are also pretty high as compared to other online brokers.

|

|

|

|

|

|

| SG | 0.08%, min 2.88 SGD | 0.08%, min 2.50 SGD | 0.08%, min 5 SGD | 0.20%, min 10 SGD |

| HK | 0.06%, min 15 HKD | 0.08%, min 12 HKD | 0.15%, min 90 HKD | 0.25%, min 100 HKD |

| US | 0.01 USD/share, min 1.99 USD |

0.0035 USD/share, min 0.35 USD |

0.06%, min 4 USD | 0.25%, min 10 USD |

| CN | 0.06%, min 15 CNH | via HK | 0.15%, min 40 CNH | via HK |

| AU | 0.10%, min 8 AUD | 0.08%, min 5 AUD | 0.10%, min 8 AUD | 0.25%, min 10 AUD |

| UK | N/A | 0.05%, min 1 GBP | 0.10%, min 8 GBP | 0.25%, min 10 GBP |

As you can see, Saxo’s commission fees are generally more expensive or equally as expensive as compared to other brokers.

When coupled with Saxo’s custodian fee, Saxo becomes more expensive almost indefinitely.

Another fee that Saxo charges is a currency conversion fee.

All currency conversions applied on buy/sell orders are subject to a fee of 0.75%, while currency conversions as a result of sub-account cash transfers are subject to a fee of 0.3%.

I’ll touch more on the topic of sub-accounts later, but for now, the bottom line is that Saxo charges you a fee for converting currencies.

Meanwhile, other brokers like SC Online, Moomoo, and Tiger don’t charge such fees at all.

And while IBKR does charge a commission fee on currency conversions, it’s worth it because they have much better conversion rates than any other broker – so you actually save money because of the better rates, especially when converting large sums.

With all that’s been said, Saxo’s fees are considerably high in today’s context.

Sub-account Headache

Your main Saxo account is a single-currency account only and cannot hold foreign currencies.

If you try to make any trades in foreign currencies, you will be forced to convert your money at the spot FX rate + a 0.75% conversion fee.

In order to be able to hold other currencies in your account, you need to request to open a sub-account for each of the currencies (ie 1 sub-account for USD, another for GBP, another for EUR).

For sub-account currency conversions, you will enjoy a preferential fee of 0.3% instead of 0.75%.

So Saxo adopts an “opt-in” approach to holding multiple currencies.

This is fine if you’re aware of such an option on Saxo.

But if you’re a beginner and are not aware of sub-accounts, that’s too bad because you don’t get prompted to open a sub-account when you try to make a trade in a foreign currency – so you pay 0.75% in conversion fees instead of 0.3%.

In comparison to brokers like Moomoo/Tiger, they come as multi-currency accounts by default where you can convert and hold money in different currencies with 0 fees.

Also, investments in Saxo are strictly tied to the account in which they were bought.

So if you bought a USD-denominated investment on your SGD account, it will only be available in your SGD account – you can’t sell it on your USD account to try and get USD directly.

And if you try to sell it in your SGD account thinking you’ll get USD since you have an active USD sub-account, well, you end up paying 0.75% for having Saxo convert the USD into SGD for you and the proceeds end up in your SGD account.

Thankfully, there’s a workaround for this. More on this later.

Not-So-Transparent Fees

Next, even though Saxo advertises that they are very transparent with their fees on their website, I personally don’t think that’s the case.

Don’t get me wrong, Saxo fully discloses all the fees that they charge.

And for the most part, you will be shown where fees have been deducted from your account.

The one fee that is kind of “hidden” among all of this is the currency conversion fee for sub-account transfers.

This is because this fee is not deducted from your balance and is not visible on the trade ticket.

Instead, it is factored into the currency conversion pair that you are converting, so you basically lose money to the conversion equal to the fee that is due.

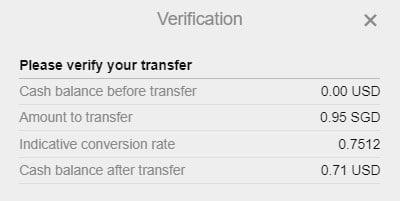

Here is what the trade ticket looks like.

As you can see, there is no indication of how much you pay in fees – only the exchange rate used.

As you can see, there is no indication of how much you pay in fees – only the exchange rate used.

Even though the poor exchange rate may serve as a sign to seasoned investors that the fee has already been factored in, that’s not the case for beginners.

That leaves them wondering whether they were actually charged the 0.3% conversion fee, and if so, where they can see how much they actually paid in fees.

And even if, as a seasoned investor, you know you have paid fees to the poor exchange rate, there’s really no way to tell how much you actually paid in fees.

Since we don’t know the actual conversion rate that was applied before any fees, we simply have to trust that Saxo is only charging 0.3% in fees and not more.

The only reason I know all of this is because I asked Saxo about it – it wasn’t explained anywhere on their website.

Cashing Out

When I decided I wanted to change my broker, I tried looking for the best way to exit my USD positions in Saxo and re-enter them in Tiger, and I believe this is the best way to go about it.

1. Open A USD Sub-account

When I started investing with Saxo, I didn’t know about sub-accounts.

And back then, you could only open sub-accounts if you had total assets of $10k SGD in your account, which I didn’t.

So I was forced to buy USD-denominated investments in my SGD account, which was also my main account.

Fast forward to 2021, Saxo now allows customers to open sub-accounts freely, so I went ahead and opened a USD account.

You can find out how to open a sub-account here.

2. Transfer Positions From SGD To USD Account

Since my USD positions were tied to my SGD account, if I had sold them directly in my SGD account, I would incur a 0.75% conversion fee instead of only 0.3%.

Remember, only sub-account cash transfers are eligible for the 0.3% conversion fee.

Fortunately, Saxo allows customers to transfer their positions between sub-accounts for free, so you can effectively avoid having to pay the 0.75% fee a second time.

The process is slightly antiquated – you have to download an Excel sheet from their website, fill it up with the relevant details, then submit a request to them.

They certainly didn’t make it convenient, but at least it’s free and will allow you to save 0.45% in fees.

The process took a couple of hours, which I thought was pretty fast.

You can find more details about sub-account position transfers here.

3. Sell Positions In USD Account

After successfully transferring my USD positions from my SGD account to my USD account, I sold them.

No fees are paid for currency conversion yet, and I’m able to hold my cash in USD for now.

4a. Convert Cash To SGD + Withdraw

There are 2 ways to withdraw your cash after selling your positions.

The first way is simply to convert this cash into SGD and withdraw it into your bank account.

The downside to this is that you will incur a 0.3% fee for this conversion, imposed by Saxo.

The upside is that if your cash amount is relatively small, as in my case, 0.3% works out to be a small fee to pay.

So this is what I decided to do.

4b. Withdraw USD Via Telegraphic Transfer

The second way to withdraw your cash is to do so directly in the foreign currency via a telegraphic transfer (TT) to your bank account.

The good thing about this method is that you avoid paying the 0.3% conversion fee that Saxo charges.

However, local transfers of foreign currencies in SG often incur a fee imposed by banks.

The fees incurred are fixed, depending on both the outgoing and incoming banks.

In the case of Saxo, the outgoing bank is HSBC. The incoming bank is the bank you are withdrawing the money to.

If you’re withdrawing a large sum of money, it probably makes more sense to withdraw via TT because the fees incurred will work out to be less than 0.3% – which is what Saxo charges for converting it to SGD.

Conversely, if you’re withdrawing a small sum of money like I did, this method becomes more expensive and no longer makes sense.

Also, note that if you’re not withdrawing into a multi-currency account, you may also be charged a fee for withdrawing a foreign currency into your SGD account.

5. Fund Tiger Account

I funded my Tiger Brokers account directly in SGD.

Not only did I withdraw my cash from Saxo in SGD, but Tiger charges no fees for converting SGD to USD within the account.

Since there may be fees incurred for funding my account in USD (via TT), there’s no reason to do so.

Tiger also has a more competitive exchange rate than DBS.

After funding my account, I converted my SGD to USD and re-entered my positions.

If you have positions in other foreign currencies in Saxo, you can just apply these same steps with the appropriate currency.

To summarise,

Saxo may have been a prime broker to use a couple of years ago, but I believe the online broker scene has shifted away from its favour.

While Saxo has a beginner-friendly UI, it’s not enough to justify the high fees that it charges and the unintuitive mechanics of its sub-accounts.

I think the majority of people would be better off using low-cost brokers like Tiger Brokers and Moomoo.

Do you use Saxo as your broker? Are you planning to continue investing with them or to change brokers? Let me know in the comments below!

9 replies on “Why I Stopped Using Saxo And The Best Way To Cash Out”

I also have one account in Saxo in AUD (Australian Account). I am also forced to trade US currency stocks (shares) in this account. The conversion costs are a problem. To open a sub-account in USDs do I need additional funds? Whats the minimum deposit Or can I use the existing funds from my original AUD account

Regards,

Sani Stefanovski

Hi Sani,

Thanks for checking out the blog and leaving a comment! I definitely feel your pain haha. I’ve dropped you a reply to your email! 🙂

Great post!

I have SAXO account AUD as main and had X * 100 shares INTEL stock I purchased in USD from my AUD account. Because AUD/USD was very volatile I have also used margin to purchase AUD/USD FOREX of the same value so I have hedged the currency so stock was making money purely based on performance and currency AUD/USD has not affected it. This has two drawbacks:

– Margin annual loan fees 2.97%

– If you sold stock back and you used ending too late not straight away you could loose AUD while USD is positive

So I have opened USD subaccount then used excel to transfer stocks to USD subaccount, sold stocks with USD profits and closed FOREX back to AUD account with AUD profits.

So now using FOREX for currency hedging is for the whole subaccount sum instead of each stock individually. Saxo allows using margin based on balance in both accounts.

Hey Petkus,

Thanks for checking out my blog and leaving a comment! I’m glad you enjoyed the post.

Great that you managed to figure out a way to take profits while minimising fees!

I have used Saxo for a couple of years.

Yes the user interface is easy to use.

The customer service is truly appalling. I have spent the best part of four months trying to get my money out of Saxo. At best it is chaos, at worst downright fraud. Email exchanges are a mixture of lies, damn lies and obfuscation.

And if I have I learned one thing from the Russia/Ukraine war, things can change pretty quickly. Saxo is not a pristine no corruption Nordic bank. Its majority Chinese owned, so when/if China invades Taiwan expect to have your account frozen. Faster than you van get our money out.

And don’t think the shares are in your name so it doesn’t matter. Many brokers hold your shares in their name, and just record your share in their holding. Legally all you have is a claim on their shares. You do not own the shares.

Good summary on the FX conversion fees, but Saxo has a lot of other hidden techniques to charge you. E.g. if you have a sub account they charge interest even if you have enough margin on another account.

What makes Saxo the worst choice is customer service (Account Services). They answer weeks later with a standard text, without taking the effort to reading your question properly.

I have been using Saxo for FX trades only as I have not found the alternative to trade FX forwards and FX swaps in a customized way (futures are liquid in IB only for USD pairs and they are standardized). I appreciate if you have experience with other broker that offers FX forwards and swaps with reasonable conditions.

Hi Agnes,

Thanks for checking out my blog and leaving a comment!

Unfortunately, I don’t take part in FX trading, so I’m not able to give you any useful tips regarding this. You can check out Investopedia’s recommended brokers for FX trading and see if the other options there are better than Saxo for you!

I’m also having trouble withdrawing money from saxo , is there any tips you can give I am new to this and was told what to do most of the time now saxo is saying I need to deposit more in order to take out the assets I currently have

Hey there,

Thanks for checking out my blog and leaving a comment!

Unfortunately, I’m not too familiar with Saxo and their policies anymore. However, it does sound suspicious that they are asking you to deposit more money in order to withdraw the money in your account.

Is it possible that you have incurred some fees in your Saxo account that are outstanding and cannot be paid with the balance in your account now? If so, they might be preventing you from withdrawing your assets before settling such fees.

In any case, it’s probably better to contact Saxo’s customer support to find out what’s the deal.

Sorry I couldn’t be more helpful, but all the best with getting it resolved!