I’ve talked a lot about Interactive Brokers (IBKR) on my blog and how they’re the best broker for do-it-yourself (DIY) investing in Singapore.

However, the biggest downside to it is that it’s not intuitive to navigate as a platform, especially for beginners.

With that in mind, I figured it would be helpful for people who are just starting out with IBKR to have a guide that describes the step-by-step process of buying their first share.

Note that this guide is written for IBKR SG accounts.

Step 1: Open An IBKR Account

The first step is to open an IBKR account.

You can do this via their website directly.

Or, if you want to support me and help me maintain this blog, you can use my referral link.

As a referral reward, you will receive US$1’s worth of IBKR shares for every US$100 of value you add to your account, up to a maximum of US$1000’s worth of IBKR shares.

If you’d like to use my referral link, drop me an email and I’ll get back to you ASAP!

Step 2: Change Pricing Structure

Next, you want to make sure that your account is on the tiered pricing structure to enjoy the low commission fees that IBKR is known for.

By default, IBKR accounts are opened under the fixed pricing structure, which charges higher commission fees.

For reference, below is a table summarising the fees for both fixed and tiered pricing.

| Tiered | Fixed | |

| SG | 0.08%, min 2.50 SGD | 0.08%, min 2.50 SGD |

| HK | 0.05%, min 12 HKD | 0.08%, min 18 HKD |

| US | 0.0035 USD/share, min 0.35 USD |

0.005 USD/share, min 1 USD |

| AU | 0.08%, min 5 AUD | 0.08%, min 6 AUD |

| UK | 0.05%, min 1 GBP | 0.10%, min 4 GBP |

Step 2.1

Login to the IBKR online portal, click on the user icon in the top right corner, then click on “Manage Account“.

Step 2.2

Scroll down to “Configuration“. You will see whether you are under the fixed or tiered plan under “IBKR Pricing Plan“.

If you want to change this, click on the Settings icon.

Step 2.3

In the table, choose Tiered pricing and click “Continue“.

Your pricing plan is now successfully changed!

Note: It will take up to 1 working day for this change to be implemented in your account.

To check whether this change has taken effect, when placing a trade, make sure you preview the costs and see that you’re not being charged the fixed pricing for commissions.

Step 3: Decide What To Invest In & How Much

After configuring your account, it’s time to decide what you want to invest in and how much you want to invest.

This will tell you how much cash you need to fund your account and in what currency you’ll need to have cash in.

If you’re thinking of investing in an S&P 500 ETF or world ETF, check out these posts on the best S&P 500 ETF and the best world ETF.

When deciding how much to invest, it can be helpful to also consider the share price of the stock/ETF you want to invest in.

Since IBKR only supports fractional shares for US-listed shares, you’ll have to buy shares in whole numbers from every other exchange.

Let’s say you want to invest S$1000 into CSPX (S&P 500 ETF), which is traded on the London Stock Exchange (LSE) and denominated in USD.

At the current trading price of US$476, this is equivalent to S$650.

By investing S$1000, it’s only enough to buy 1 share of CSPX, leaving S$350 of idle cash.

If I want to minimise having any idle cash, I can consider either reducing my investment sum to S$650 to buy 1 share or increasing it to S$1300 to buy 2 shares.

However, if you’re planning to invest in a US-listed share, this is not a concern since fractional shares are supported.

So you’ll be able to invest a specific amount of money and leave no idle cash.

Step 4: Fund Your Account

Next, you need to fund your account with the necessary cash.

You have the choice of funding your account with SGD or with foreign currencies (FX).

The former is free, and the latter is also free if you use a DBS multi-currency account like the Multiplier account.

Using other bank accounts may incur a fee for FX transfers.

Regardless of whether you choose to deposit SGD or FX, the steps are similar, with the exception of specifying the currency of the transfer.

I already have a guide on how to fund your IBKR account in FX, so you can refer to that post.

If you want to fund your account with SGD instead of FX, just change the currency specification accordingly.

When specifying how much cash you want to transfer into your IBKR account based on how much you want to invest, you’ll want to include a small cash buffer of 5 – 10%.

This is to account for the fees that you’ll incur later on such as FX conversion and commission fees.

This also helps you make sure that you’ll have enough cash to buy the shares you want if the share price increases during this time.

Finally, take note that it can take 1 working day to receive the cash in your account.

Step 5: Convert Currency

This step is only necessary if the currency you funded your account with is not the currency you need to buy the shares you want.

For example, if you fund your account with SGD but want to trade in USD.

An FX conversion fee of 0.002% of trade value or a 2 USD minimum is applicable.

This is charged in your base currency which should be SGD by default, and comes up to ~2.80 SGD.

When you’re converting currencies, make sure to leave a sufficient SGD balance to pay for this fee.

Note that after placing an order to convert currencies, you may not receive the FX in your account immediately.

It can take 2 working days for the FX conversion to settle.

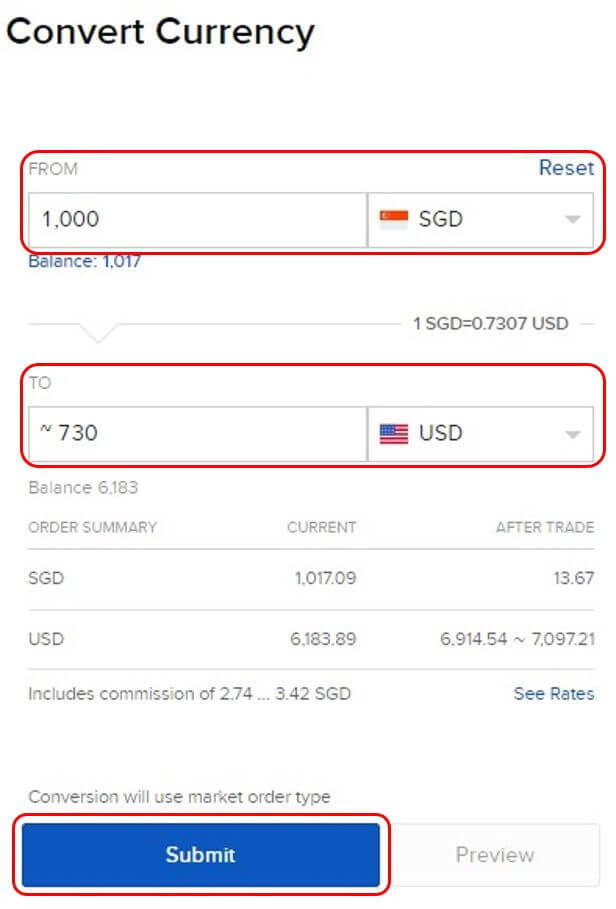

Step 5.1

Login to the IBKR online portal and navigate to “Trade” > “Convert Currency“.

Step 5.2

Under “Convert Currency“, select the currency pair that you wish to convert from and to, and enter the amount you wish to convert.

You can specify the amount to convert in terms of the currency to be converted (ie SGD) or the currency to receive (ie USD).

You can also click on “Preview” to view the estimated commission fee and the post-trade balances of each currency.

Then, click “Submit“.

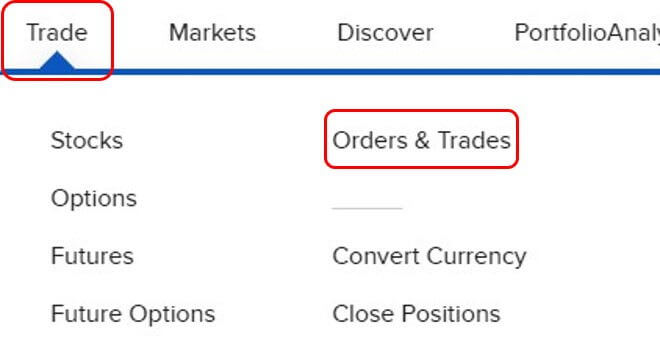

Step 5.3

After placing the order, you can view the trade details by navigating to “Trade” > “Orders & Trades“.

You will see the exact rate that your conversion was executed at and the actual commission fee incurred.

Step 6: Execute Trade

After converting and receiving the desired currency in your account, you’re finally ready to buy your first share on IBKR.

Step 6.1

From the IBKR web portal, locate the search bar at the top of the page and search for the share you want to buy either via ticker symbol or name.

Then, click the relevant result and click “Stock”.

Step 6.2

On the stock details page, click “Buy”.

An order ticket will appear for you to specify your order details below.

Step 6.3

Before you enter the order details, let me briefly explain the various fields that you’re presented with.

Quantity

This is where you enter the quantity you want to buy, either in terms of the number of shares or the US dollar amount.

You can toggle between the 2 options using the buttons beside the field.

Note that if you choose “USD” as the metric for quantity but are not buying a US-listed share, the number of shares you actually buy will be rounded down to the nearest whole number.

Order Type

This is where you define the type of order you wish to execute.

There are a number of different options, but I’ll only explain the 2 basic order types – limit and market orders.

Limit Order

This is the default selection for order types.

A limit order requires you to specify a price at which you want the trade to be executed.

The order will only be active if the specified price is met, so it is often used to set the maximum or minimum price you’re willing to buy or sell the share respectively.

For example, if CSPX is currently trading at 478 USD and I set the limit price on my buy order at 475 USD, I will only buy shares of CSPX if the price drops to 475 USD or less.

Market Order

A market order is simply an order that will execute at the current market price.

You do not need to enter any price.

From the above example, executing a market order will result in me buying CSPX at the current price of 478 USD.

There are more complex order types available that can be useful in various situations.

But if you’re a beginner, I’d recommend only using either limit or market orders first.

You can learn more about different order types here.

Time-In-Force

This is the time or duration that you want your order to be active for.

There are 3 options available, and I’ll go through them briefly below.

Day

A day order is the default selection and is an order that is only valid for the trading day on which it was placed.

If the order is not successfully executed by the end of the trading day, it will be automatically cancelled.

Good Till Cancel

This type of order will remain active until the trade is successfully executed or until you choose to cancel it.

At the Opening

This order will be executed immediately when the market opens for the day at the opening price.

You can read more about different time-in-force orders here.

Outside RTH

RTH stands for regular trading hours.

This field is only displayed on order tickets for US-listed shares.

Checking this option will allow your trade to be executed outside of the market’s RTH, ie during pre-market and post-market trading.

As a reference, here are the trading hours for the US market.

| US Time | SG Time* | |

| Pre-Market | 0400 – 0930 | 1700 – 2230 |

| Regular | 0930 – 1600 | 2230 – 0500 |

| Post-Market | 1600 – 2000 | 0500 – 0900 |

*: time difference may vary depending on daylight saving time

Now that you have a better understanding of the terminology, fill up the order ticket with the necessary details and click “Submit Buy Order” to place your trade.

Step 6.4

To check the status of your order, navigate to “Trade” > “Orders & Trades”.

Pending orders will be displayed under “Orders” and will be displayed under “Trades” if they’ve been executed.

Congratulations! You’ve successfully bought your first share with IBKR.

Closing Thoughts

IBKR is a great broker to use for DIY investors due to their low fees and spot FX rates but can be challenging to navigate for beginners.

Hopefully, this guide has been able to help you navigate IBKR’s platform and familiarise yourself with the process of buying shares.

If you found this guide helpful, share it to help another investor get started with IBKR!

What other challenges did you experience when using IBKR? Let me know in the comments below!

12 replies on “Interactive Brokers: Step-by-step Guide To Buying Your First Share”

does executing a limit order have lower fees than market order ?

Hey Su,

Thanks for checking out my blog and leaving a comment!

I don’t believe that the fees are different for market and limit orders, at least on IBKR.

Hope this helps!

Hi saw your comment “ This also helps you make sure that you’ll have enough cash to buy the shares you want if the share price increases during this time.” Do you mean to say “if the share price decreases during this time”?

Hi Abdul,

Thanks for checking out my blog and leaving a comment!

No, I actually mean “if the share price increases during this time”.

Let’s say you plan to buy 1000 shares of ABC that is currently trading at $1/share. You’d set aside a sum of $1000, plus a bit extra to account for any fees, say $1020.

But if the share price of ABC increases to $1.10/share by the time you’re ready to buy, you’ll need $1100 instead of $1000. If you didn’t fund your account with enough cash, you’ll need to make another top up to ensure your account has enough cash to still buy 1000 shares, assuming that you’re still willing to buy in at this price.

Hope this clears things up!

Ohh hello there! Been reading your blog quite awhile now. Very informative indeed! Reliable information for beginners.

Just a question, are there any other ways to buy fractional shares from LSE? I’ve been wanting to buy Ireland domiciled ETF’s. Looking forward to your reply, thanks!

Hi Ian,

Thanks for checking out my blog and for the kind words! I’m glad you’ve found my blog helpful 🙂

To my knowledge, there are no brokers that offer fractional shares for LSE. The only way I can think of to get fractional shares on LSE is via Syfe Select, given that the ETF you want to invest in is available on Syfe. But the price you pay for this is the %-based management fees charged by Syfe.

Hope this helps! Happy New Year!

I wanted to purchase VWRA in USD but I’ve tried and very much confused with the fees:

Order type: Market

I’ve tried both shares and USD for the quantity but they differ too much.

USD: 639 (Turns to ~5.4831 shares)

Price with fees: 645.39

—

Shares: 5.4831 shares (Costs 639 USD)

Price with fees: 677.58

Am I missing something on this? I’ve tried to search regarding fees and they seem very straightforward but this got me confused.

Hey Feline,

Thanks for checking out my blog and for leaving a comment!

The fees you are reporting seem to be higher than expected, which might be the case if your account is using Fixed pricing (default setting) instead of Tiered pricing.

I have a post where I show how to change this: https://www.thefrugalstudent.com/interactive-brokers-guide-how-to-fund-account-with-foreign-currency-more/

Hope this helps!

I think Fixed pricing will help if the amount invested per month is a bit high, isn’t it? If so, until which investment value fixed ins suitable? Thanks

Hey Ram,

Thanks for checking out my blog and for leaving a comment!

Actually, the commission fee appears to always be cheaper for Tiered pricing than Fixed pricing, according to IBKR’s website, for USD-denominated ETFs in LSE.

However, it’s interesting that for Fixed pricing, 3rd party fees seem to be waived, so there could be some cases where Fixed pricing becomes cheaper than Tiered pricing. This will depend on how much the 3rd party fees amount to in a trade. Based on the minimum commission fee for Fixed pricing at 4 USD, it’s also reasonable to assume that such cases would only be when 0.05% of the trade value is close to 4 USD (such that the commission fee for Tiered pricing is close to the commission fee for Fixed pricing), which is at ~8000 USD, or ~10800 SGD.

Hope this helps!

Hi, I noticed that there is this line in my statement called: Cash FX Translation Gain/Loss, showing a negative number.

My account is in SGD, and I am holding US stocks & etfs in USD e.g. VOO.

Does it mean I am charged a FX fee due to this FX translation?

Thanks very much for your insight, and great blog!

Hey Vic,

Thanks for checking out my blog and for leaving a comment! I’m writing this email to give my response.

No, you are not being charged any fee. The Cash FX Translation Gain/Loss is like an indication of the FX risk of your portfolio. A negative number in this line probably indicates that your FX assets have depreciated against your base currency.

In your example of USD/SGD, it means that your USD has weakened against SGD or SGD has strengthened against USD.

Hope this helps!